ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:p

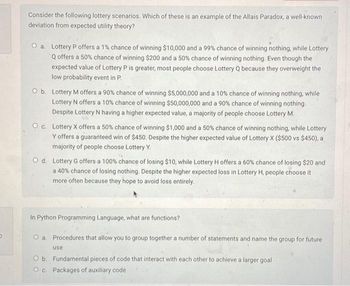

Consider the following lottery scenarios. Which of these is an example of the Allais Paradox, a well-known

deviation from expected utility theory?

O a. Lottery P offers a 1% chance of winning $10,000 and a 99% chance of winning nothing, while Lottery

Q offers a 50% chance of winning $200 and a 50% chance of winning nothing. Even though the

expected value of Lottery P is greater, most people choose Lottery Q because they overweight the

low probability event in P.

O b. Lottery M offers a 90% chance of winning $5,000,000 and a 10% chance of winning nothing, while

Lottery N offers a 10% chance of winning $50,000,000 and a 90% chance of winning nothing.

Despite Lottery N having a higher expected value, a majority of people choose Lottery M.

Oc. Lottery X offers a 50% chance of winning $1,000 and a 50% chance of winning nothing, while Lottery

Y offers a guaranteed win of $450. Despite the higher expected value of Lottery X ($500 vs $450), a

majority of people choose Lottery Y.

O d. Lottery G offers a 100% chance of losing $10, while Lottery H offers a 60% chance of losing $20 and

a 40% chance of losing nothing. Despite the higher expected loss in Lottery H, people choose it

more often because they hope to avoid loss entirely.

In Python Programming Language, what are functions?

O a. Procedures that allow you to group together a number of statements and name the group for future

use

O b. Fundamental pieces of code that interact with each other to achieve a larger goal

O c. Packages of auxiliary code

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Are the following preferences consistent with von Neumann Morgenstern’s axioms to maximize expected utility? Explain. a. You would rather have a sure $200 to a gamble with p=0.7 chance of $200, p=0.1 chance of $50, p=0.2 chance of $300. b. You prefer the gamble of p=2/3 chance of $300 and p=1/3 chance of $50 than a sure $250 win.arrow_forwardYour friend is contemplating buying a local restaurant. He has assessed the lifetime profits, including resale, to be $11 million with 20% chance, $6 million with 60% chance or $3 million with 20% chance. Knowing the most your friend would pay for the restaurant is $6.4 million, what can you infer about the situation? O A. The expected payoff of the restaurant is $6.333 million, the risk-discount being offered by your friend is $77.000 and your friend is risk averse with respect to this purchase. O B. The expected payoff of the restaurant is $6.4 million, the risk-premium being required by your friend $0 and your friend is risk neutral with respect to this purchase. o C. The expected payoff of the restaurant is $6.4 million, the risk-premium being required by your friend $200,000 and your friend is risk seeking with respect to this purchase. O D. The expected payoff of the restaurant is $6.333 million, the risk-premium being required by your friend is $333,000 and your friend is risk…arrow_forward. Explain the interpretation of a utility function and why such a function should be increasing. is said that the utility function of a decision maker is given by Ua(x) = 2ax – x², r € R for some a > 0.For which lotteries with random outcomes X is the above function a utility function? Explain your answer and give an example of a lottery or specify a distibution of the random variable X for which the function mentioned in relation 2 is not a utility function. 3. Consider a decision maker with initial wealth 0 and this decision maker needs to play a lottery L having a random outcome X bounded above by a > 0. This means P(X 0 be given and L a lotery with random outcome X having cumulative distribution function if r a and assume that the utility function of the decision maker having initial wealth w = 0 is given by the function uq listed in relation 2. Compute the expected utility of this lottery and the certainty equivalence of this lottery.arrow_forward

- Find the attached file.arrow_forwardQ5arrow_forwardQuestion 4 Suppose that there is a 10% chance Ja'Marr is sick and earns $10,000, and a 90% chance he is healthy and will earn $70,000. Suppose further that his utility function is the following (utility = square root of income) U (I) = VIncome Ja'Marr's expected income is O $60,000 O $70,000 $40,000 O $64,000arrow_forward

- Please answer question on screenshot (which of the folowing statements....) q1) Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally.arrow_forward5. Understanding risk aversion Suppose your friend Juanita offers you the following bet: She will flip a coin and pay you $1,000 if it lands heads up and collect $1,000 from you if it lands tails up. Currently, your level of wealth is $3,000. The graph shows your utility function from wealth. Use the graph to answer the following questions. UTILITY (Units of utility) 100 90 80 70 60 50 40 30 20 10 0 0 A+ C B WEALTH (Thousands of dollars)arrow_forwardLet vij be bidder i's valuation for object j, where i in {1,2,3} and j in {1,2}. Bidder i knows its valuation vi; but other bidders only know that vi; is drawn uniformly from [0, 100]. If bidder i wins object 1 at price p1 and object 2 at price p2, bidder i's payoff is v;1 If bidder i wins only object j at price p;, his payoff is vij – Pj. If bidder i does not win any object, his payoff is 0. The auction proceeds as follows. The initial prices are zero for both objects. All bidders sit in front of their computers and observe the prices for both items in real-time. Initially, all bidders are invited to enter the bidding race for both items. At any moment in time, each bidder has the option to withdraw from the bidding race for either object or both. If a bidder withdraws from the bidding for one object, he can no longer get back to the bidding for that object, but he can stay in the bidding race for the other object if he hasn't withdrawn from it previously. The price for an object…arrow_forward

- 2. Suppose you have no money of your own but luckily you participate in one contest. You have a utility for money as follows. U=y". You two options: Option 1: You get X liras for sure. Option 2: You get 144 liras 50 percent of the time and nothing 50 perctt of the time. a-) How much X should be in order for you to be indifferent between option 1 and option 2? Please show all your calculations b-) What is your Arrow-Pratt measure of absolute risk aversion? How does it change with y?arrow_forward4.arrow_forwardWhen the second order derivative of a function is greater than zero than the agent is risk lover. question; Asses the risk attitude of an agent represented by the expected utility function u(x)= 2x2-5. However my course material writes that this agent is risk neutral because it is affine. My question is that whys is this so despite the fact that the second order derivative is '4' which is >0. Kindly explain this to me with complete steps.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education