ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

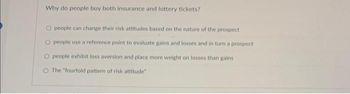

Transcribed Image Text:Why do people buy both insurance and lottery tickets?

O people can change their risk attitudes based on the nature of the prospect

people use a reference point to evaluate gains and losses and in turn a prospect

people exhibit loss aversion and place more weight on losses than gains

O The "fourfold pattern of risk attitude"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- not use ai pleasearrow_forwardAnne has $138.40 and is thinking about buying a lottery ticket. The lottery pays $4.00 with probability 0.20 and $172.00 with probability 0.80. To buy the ticket, Anne would need to spend all her money. Suppose we observe Anne buying the ticket. What can we infer about Anne? Choose one: O A. We cannot infer that Anne is risk neutral. O B. We can infer that Anne is not risk averse. O C. We cannot infer anything. O D. We can infer that Anne is risk averse.arrow_forwardJanet's broad attitude to risk (risk averse, risk neutral, or risk loving) is independent of her wealth. She has initial wealth w and is offered the opportunity to buy a lottery ticket. If she buys it, her final wealth will be either w + 4 or w – 2, each equally likely. She is indifferent between buying the ticket and not buying it. Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally. Sam has another idea: They buy two tickets (that have independent outcomes) and share the costs and proceeds equally. Which of the following statements is true? O a. There are risk averse expected utility maximisers who would prefer Janet's idea to Sam's idea. O b. Any expected utility maximiser whose utility is a strictly increasing function of wealth would prefer Sam's idea to Janet's idea. O c. Any risk averse expected utility maximiser would prefer Sam's idea to Janet's idea. O…arrow_forward

- I need 4,5,6 answeredarrow_forward3. In the second example, we will consider the case where the insurance contract involves a deductible this is an amount which is deducted from the final pay-out of the insurance firm in the case of a loss. In other words, the consumer bears this part of the loss herself. For this problem, assume a risk-averse, expected utility maximizing consumer with initial wealth wo who faces a potential loss of size L which will occur with probability p. Her utility-of-final-wealth function is denoted by u(.). Suppose that the consumer can purchase insurance coverage of C > 0 units of wealth from a perfectly competitive insurance firm at a premium of 7 per unit of coverage, but that the firm charges an additive deductible: if C units of insurance is purchased, the insurance firm pays out (C – d) if the loss occurs, where d 20 is a fixed amount independent of C. (a). For this problem, state the consumer's expected utility function. (b). Set up the consumer's utility maximization problem and find…arrow_forwardSuppose that Natasha's utility function is given by u(I) = √/10/, where I represents annual income in thousands of dollars. Is Natasha risk loving, risk neutral, or risk averse? Explain. A. She is risk averse because her utility function exhibits diminishing marginal utility. OB. She is risk loving because her utility function exhibits increasing marginal utility. OC. She is risk neutral because her utility function exhibits constant marginal utility. Suppose that Natasha is currently earning an income of $40,000 (1 = 40) and can earn that income next year with certainty. She is offered a chance to take a new job that offers a 0.6 probability of earning $44,000 and a 0.4 probability of earning $33,000. Should she take the new job? Natasha should not take the new job because her expected utility of 19.85 is less than her current utility. (Round expected utility to three decimal places.)arrow_forward

- Joey has utility function 1+√x where x is the amount of money he has. He is... A) Cannot tell from the information provided B) Risk averse C) Risk Netutral D) Risk Lovingarrow_forwardJanet's broad attitude to risk (risk averse, risk neutral, or risk loving) is independent of her wealth. She has initial wealth w and is offered the opportunity to buy a lottery ticket. If she buys it, her final wealth will be either w + 4 or w – 2, each equally likely. She is indifferent between buying the ticket and not buying it. Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally. Sam has another idea: They buy two tickets (that have independent outcomes) and share the costs and proceeds equally. Suppose that Janet's and Sam's utility of income is given by u(x) = In x and the initla wealth of each one of them is equal to w = 4. Which of the following statements is true? O a. Both agents prefer Sam's solutions to Janet's solution. b. Both agents prefer Janet's solutions to Sam's solution. The agents are indifferent between Janet's solutions to Sam's solution.…arrow_forwardJanet's broad attitude to risk (risk averse, risk neutral, or risk loving) is independent of her wealth. She has initial wealth w and is offered the opportunity to buy a lottery ticket. If she buys it, her final wealth will be either w + 4 or w – 2, each equally likely. She is indifferent between buying the ticket and not buying it. Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally. Should Sam accept the offer? O a. Yes, Sam should accept the offer. O b. No, Sam should reject the offer. O c. Sam would be indifferent between accepting an rejecting the offer. O d. There is not enough information to determine if Sam should accept or reject the offer.arrow_forward

- Question a .Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardExercise 4: Insurance Fiona has von Neumann-Morgenstern utility function u(x) = VT and initial wealth 640, 000. She faces a 25% chance of losing L = 280, 000. 1. Is Fiona risk averse? 2. What is Fiona's utility if no loss occurs, what is her utility if the loss occurs? What is Fiona's expected utility? 3. What is the cost of fair insurance against the possible loss? Suppose Fiona is able to choose insurance with any coverage z E [0, 1] (i.e. 0 0 C(z) = if z = 0 4. Suppose co = 0 and c1 = 70,000. Is insurance at coverage level z > 0 fair insurance? What coverage level z* would Fiona choose? Explain. 5. Suppose co = 100 and c1 = 70,000. Is insurance at coverage level z > 0 fair insurance? What coverage level z** would Fiona choose? Explain. (Note that co = 100 is an "avoidable fixed cost" which is only paid if she chooses strictly positive insurance coverage. However, the "marginal cost" of additional insurance, c1 = 70,000, is the same as in the previous part.) 6. Suppose co = 100 and…arrow_forwardPlease answer question on screenshot (which of the folowing statements....) q1) Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education