ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

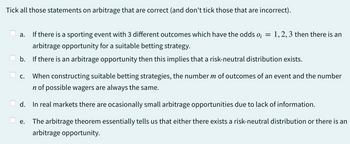

Transcribed Image Text:Tick all those statements on arbitrage that are correct (and don't tick those that are incorrect).

a. If there is a sporting event with 3 different outcomes which have the odds o¡ = 1, 2, 3 then there is an

arbitrage opportunity for a suitable betting strategy.

b. If there is an arbitrage opportunity then this implies that a risk-neutral distribution exists.

C. When constructing suitable betting strategies, the number m of outcomes of an event and the number

n of possible wagers are always the same.

d. In real markets there are ocasionally small arbitrage opportunities due to lack of information.

e. The arbitrage theorem essentially tells us that either there exists a risk-neutral distribution or there is an

arbitrage opportunity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A firm's board of directors wants to maximize its profits. If the firm's manager puts in a high effort, the firm gets a high profit of 9 with probability 80%, but if the manager puts in a low effort, the firm gets a low profit of 4 with probability 80%. The utility functions of both the board of directors and the manager are identical and are simply u(b)-b. High effort for the manager costs 2. The manaаger has an outside wage of 1. Calculate the optimal wage schedule under high and low realized profits.arrow_forwardChoice under uncertainty. Consider a coin-toss game in which the player gets $30 if they win, and $5 if they lose. The probability of winning is 50%. (a) Alan is (just) willing to pay $15 to play this game. What is Alan’s attitude to risk? Show your work.(b) Assume a market with many identical Alans, who are all forced to pay $15 to play this coin-toss game. An insurer offers an insurance policy to protect the Alans from the risk. What would be the fair (zero profit) premium on this policy? i need help with question B please.arrow_forwardFirms A and B are contemplating whether or not to invest in R&D. Each has two options: “Invest” and “Abstain.” A firm that invests will invent product X with a probability of 0.5, whereas a firm that abstains is incapable of invention. Investment costs $6. If a firm doesn’t invent X, it makes $0 in revenue. If a firm invests and is the only one to invent X, it becomes a monopolist and generates $20 in revenue. If both firms invent X, each firm becomes a duopolist, and generates $8 in revenue. Revenues are gross figures (i.e. they are not net of investment costs), and there are no costs besides investments costs (i.e. no variable cost of production etc.). The firms are risk-neutral entities, and are uninformed of each other’s investment decisions. The “research and development” game is best analyzed as a simultaneous move game, because the parties lack information about each other’s investment decisions. Find the Nash Equilibria (or Equilibrium) of the “research and development”…arrow_forward

- Give new answer with proper explanationarrow_forwardIn the signaling game represented below, there are two types of Player 1, smart and dumb, the probabilities of which are 0.4 and 0.6, respectively. Player 1 is in college and can either ((Q)uit or (G)raduate. Player 2 is a prospective employer and can either (N)ot hire or (H)ire Player 1. Player 2's payoff does not depend upon l's education, only her intelligence. Player 1's payoff depends partly on her education: both types benefit from completing their education, but the smart type gets more out of it. Player l's payoff also depends on 2's hiring decision: the smart type wants a job but the weak type does not. 0,0 1, 1 2, 1 0,0 N H N H 2 Q Q .4 C .6 18 G G N H H 2,0 3,1 3, 1 1,0 (a) Find a separating PBE. (b) Find a pooling PBE. (c) , Find an equilibrium in which one type of player 1 mixes, playing both Q and G with positive probability.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education