Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

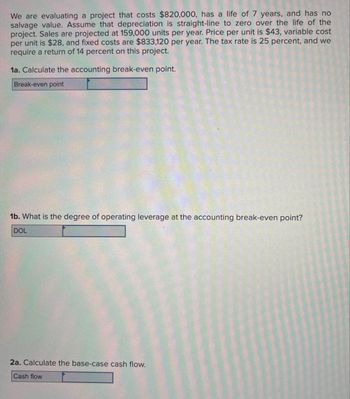

Transcribed Image Text:We are evaluating a project that costs $820,000, has a life of 7 years, and has no

salvage value. Assume that depreciation is straight-line to zero over the life of the

project. Sales are projected at 159,000 units per year. Price per unit is $43, variable cost

per unit is $28, and fixed costs are $833,120 per year. The tax rate is 25 percent, and we

require a return of 14 percent on this project.

1a. Calculate the accounting break-even point.

Break-even point

1b. What is the degree of operating leverage at the accounting break-even point?

DOL

2a. Calculate the base-case cash flow.

Cash flow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- We are evaluating a project that costs $1,100,000, has a ten-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 42,000 units per year. Price per unit is $50, variable cost per unit is $25, and fixed costs are $820,000 per year. The tax rate is 35 percent, and we require a 10 percent return on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) Best-case Worst-case NPV $ LA LAarrow_forwardGateway Communications is considering a project with an initial fixed assets cost of $1.63 million that will be depreciated straight-line to a zero book value over the 10-year life of the project. At the end of the project the equipment will be sold for an estimated $233,000. The project will not change sales but will reduce operating costs by $384,000 per year. The tax rate is 24 percent and the required return is 10.8 percent. The project will require $48,500 in net working capital, which will be recouped when the project ends. What is the project's NPV? Multiple Choice $399,054 $367,946 $428,850 $415,017 $351,948arrow_forwardA 7-year project is expected to provide annual sales of $221,000 with costs of $97,500. The equipment necessary for the project will cost $360,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 35 percent. What is the annual operating cash flow for the worst-case scenario?arrow_forward

- Gateway Communications is considering a project with an initial fixed assets cost of $1.58 million that will be depreciated straight-line to a zero book value over the 9-year life of the project. At the end of the project the equipment will be sold for an estimated $237,000. The project will not change sales but will reduce operating costs by $393,000 per year. The tax rate is 34 percent and the required return is 11.2 percent. The project will require $50,500 in net working capital, which will be recouped when the project ends. What is the project's NPV? Multiple Choice $242,544 $202,140 $250,629 $233,215 $193,351arrow_forwardYou are evaluating a new project that costs $15 million over its 5-year life. Depreciation is straight-line to zero over the life of the project and the salvage value is zero. The project is expected to have the following base case estimates: Unit sales/year: 250,000; Price/unit: $40; VC/unit: $15; FC/year: $900,000. The required return is 14 % and the corporate tax rate is 30%. The firm has no debt. The base case NPV is $946,661.1003. Calculate the sensitivity of the NPV to changes to changes in variable costs/unitarrow_forwardGateway Communications is considering a project with an initial fixed assets cost of $1.47 million that will be depreciated straight-line to a zero book value over the 9-year life of the project. At the end of the project the equipment will be sold for an estimated $248,000. The project will not change sales but will reduce operating costs by $415,000 per year. The tax rate is 21 percent and the required return is 12.3 percent. The project will require $56,000 in net working capital, which will be recouped when the project ends. What is the project's NPV? Multiple Choice O $256,094 $584,027 $193,231 $238,300 $247,833arrow_forward

- Suppose you are considering an investment project that requires $800,000, has a six-year life, and has a salvage value of $100,000. Sales volume is projected to be 65,000 units per year. Price per unit is $63, variable cost per unit is $42, and fixed costs are $532,000 per year. The depreciation method is a five-year MACRS. The tax rate is 35% and you expect a 20% return on this investment.(a) Determine the break-even sales volume.(b) Calculate the cash flows of the base case over six years and its NPW.(c) lf the sales price per unit increases to $400, what is the required break-even volume?(d) Suppose the projections given for price, sales volume, variable costs, and fixed costs are all accurale to wi thin ± 15%. What would be the NPW figures of the best-case and worst-case scenarios?arrow_forwardYou are considering a new product launch. The project will cost $950,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 180 units per year; price per unit will be $18,500, variable cost per unit will be $14,000, and fixed costs will be $185,000 per year. The required return on the project is 15 percent, and the relevant corporate tax is 35%. a. Based on your experience, you think the unit sales, variable cost, and fixed cost projections given projections are probably accurate to within +10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios? (Hint: consider your changes to cost and revenue corresponding to each case, e.g. best or worst) b. If the probability of base-case scenario is 50 percent, the best-case scenario is 25%, the worst-case scenario is 25%, What is the project's expected NPV, standard deviation, and its coefficient…arrow_forwardA project with a life of 9 years is expected to provide annual sales of $ 410,000 and costs of $293,000. The project will require an investment in equipment of $715,000, which will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/- 10 percent. The tax rate is 21 percent. What is the annual operating cash flow for the best-case scenario? Multiple Choice $ 121,745 $93,361 $121,456 $164,650 $58,161arrow_forward

- Nikularrow_forwardA company is considering purchasing a new piece of equipment that costs $100,000 and has an estimated useful life of 5 years. The equipment should increase annual cash receipts by $80,000 per year. Cash expenses to operate the equipment should be $25,000. The company uses straight-line depreciation. If the after-tax cost of capital is 10% and the tax rate is (Round your 30%, the net present value of this project based on the tables in the appendix is $ answer to the nearest whole number.) Need help? Review these concept resources. Read About the Conceptarrow_forwardWe are evaluating a project that costs RM604,000, has an 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 55,000 units per year. Price per unit is RM36, variable cost per unit is RM17, and fixed costs are RM685,000 per year. The tax rate is 21 percent and we require a return of 15 percent on this project. (i) Calculate the base-case cash flow and NPV., (ii) Assume the sales figure increases to 56,000 units per year, calculate the sensitivity of NPV to changes in the sales figure?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education