Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

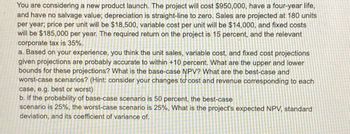

Transcribed Image Text:You are considering a new product launch. The project will cost $950,000, have a four-year life,

and have no salvage value; depreciation is straight-line to zero. Sales are projected at 180 units

per year; price per unit will be $18,500, variable cost per unit will be $14,000, and fixed costs

will be $185,000 per year. The required return on the project is 15 percent, and the relevant

corporate tax is 35%.

a. Based on your experience, you think the unit sales, variable cost, and fixed cost projections

given projections are probably accurate to within +10 percent. What are the upper and lower

bounds for these projections? What is the base-case NPV? What are the best-case and

worst-case scenarios? (Hint: consider your changes to cost and revenue corresponding to each

case, e.g. best or worst)

b. If the probability of base-case scenario is 50 percent, the best-case

scenario is 25%, the worst-case scenario is 25%, What is the project's expected NPV, standard

deviation, and its coefficient of variance of.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1730000 million in annual sales, with costs of $640,000. The tax rate is 24 percent. If the required return is 13 percent, what is the project's NPV? please answer fast i give upvotearrow_forwardH. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.15 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2.23 million in annual sales, with costs of $1.25 million. Assume the tax rate is 23 percent and the required return on the project is 14 percent. What is the project's NPV? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net present valuearrow_forwardYou are considering a new product launch. The project will cost $2,350,000, have a fouryear life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 330 units per year; price per unit will be $19,600, variable cost per unit will be $14,000, and fixed costs will be $720,000 per year. The required return on the project is 10 percent, and the relevant tax rate is 21 percent. a. Based on your experience, you think the unit sales, variable cost, and fixed cost projections given here are probably accurate to within +-10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your NPV answers to 2 decimal places, e.g., 32.16. Round your other answers to the nearest whole number, e.g. 32.) \table[[Scenario,Unit Sales,Variable Cost,Fixed…arrow_forward

- Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,350,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,830,000 in annual sales, with costs of $1,850,000. Assume the tax rate is 25 percent and the required return on the project is 11 percent. What is the project’s NPV?arrow_forwardWilson, Inc., is considering a new four-year expansion project that requires an initial fixed asset investment of $1,875,000. The fixed asset will be depreciated straight-line to zero over its four-year tax life, after which time it will be worthless. The project is estimated to generate $2,040,000 in annual sales, with costs of $1,235,000. If the tax rate is 35 %, and the required return on the project is 12%, what is the project's NPV?arrow_forwardNikularrow_forward

- Vijayarrow_forwardYour firm is considering investing in a new capital project that requires an initial investment of $8,000,000. This equipment will be depreciated by the straight-line over four years down to a value of zero. The machinery also has an operation life of four years. At the end of that life, you estimate it will have a salvage value of $120,000. Any gain or loss on the resell will be taxed at the firm's marginal tax rate. During the four-year life, the project should generate annual cash flows of $225,000 per year. The firm has a marginal tax rate of 22%, and it requires a return of 8.50% on projects of such risk. What is the Net Present Value of this project?arrow_forwardYou are considering a new product launch. The project will cost $960,000, have a 5-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 350 units per year; price per unit will be $15,955, variable cost per unit will be $12,000, and fixed costs will be $625,000 per year. The required return on the project is 10 percent, and the relevant tax rate is 23 percent. Based on your experience, you think the unit sales, variable cost, and fixed cost projections given here are probably accurate to within +10 percent. a. What are the best-case and worst-case NPVs with these projections? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. What is the base-case NPV? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What is the sensitivity of your base-case NPV to changes in fixed costs? Note: A…arrow_forward

- Cochrane, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.1 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,150,000 in annual sales, with costs of $1,311,236. Required: If the tax rate is 35 percent, what is the OCF for this project? (Do not include the dollar sign ($). Enter your answer in dollars(e.g., 1,234,567), not millions of dollars.)arrow_forwardA corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when /- 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay thousand for this machine. (Round to one decimal place.)arrow_forwardConcose Park Department is considering a new capital investment. The cost of the machine is $280,000. The annual cost savings if the new machine is acquired will be $165,000. The machine will have a 3−year life and the terminal disposal value is expected to be $35,000. There are no tax consequences related to this decision. If Concose Park Department has a required rate of return of 14%, which of the following is closest to the present value of the project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education