FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

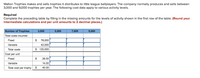

Transcribed Image Text:Walton Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between

3,000 and 9,000 trophies per year. The following cost data apply to various activity levels.

Required

Complete the preceding table by filling in the missing amounts for the levels of activity shown in the first row of the table. (Round your

intermediate calculations and per unit amounts to 2 decimal places.)

Number of Trophies

3,000

5,000

7,000

9,000

Total costs incurred

Fixed

$

78,000

Variable

42,000

Total costs

$ 120,000

Cost per unit

Fixed

$

26.00

Variable

14.00

Total cost per trophy

2$

40.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with show all calculation thankuarrow_forwardC. W. McCall sells a goldplated souvenir mug; McCall expects to sell 1,400 units for $35 each to earn a $15 contribution margin per unit. Janice McCall, president, expects the year’s total market to be 35,000 units. For the year just completed, the local college won the national hockey championship, and as a result, the total actual market was 150,000 units. C. W. McCall sold 3,000 units and calculates sales variances using contribution margin. What is the firm’s sales volume variance?arrow_forwardCan you please give answer?arrow_forward

- Cordova manufactures three types of stained glass window, cleverly named Products A, B, and C. Information about these products follows: Sales price Variable costs per unit Fixed costs per unit Required number of labor hours Product A Product B Product C Cordova currently is limited to 50,000 labor hours per month. Required: Assuming an infinite demand for each of Cordova's products, determine contribution margin per direct labor hour. (Round your answers to 2 decimal places.) Contribution Margin Product B Ⓒ Product C O Product A Product A Product B Product C $46.00 $56.00 $86.00 22.00 12.25 38.00 8.00 8.00 2.50 4.00 $ $ $ 8.00 1.50 14.67 CM per DL hour 13.12 CM per DL hour 15.25 CM per DL hour Which product would be Cordova's first choice to produce?arrow_forwardCan you please show me how to do this problemarrow_forwardStuart Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between 10,000 and 16,000 trophies per year. The following cost data apply to various activity levels: Required Complete the following table by filling in the missing amounts for the levels of activity shown in the first row of the table. Note: Round "Cost per unit" answers to 2 decimal places. Number of Trophies Total costs incurred Fixed Variable Total costs Cost per unit Fixed Variable Total cost per trophy $ 66,000 $ 42,000 $ 108,000 $ $ 10,000 $ 6.60 4.20 10.80 12,000 $' 14,000 4,20 4.20 $ 66,000 $ 66,000 $ 66,000 50,400 58,800 67,200 116,400 $ 124,800 $ 133,200 4.20 4.20 16,000 $ 4.20 4.20arrow_forward

- Paradise Marine Sails manufactures sails for sailboats. The company’s capacity is 29,000 sails per month. They are currently producing 25,000 sails a month. Current production cost can be found in the chart below: Sales Price $200 Variable Cost Manufacturing Cost $100 Administrative Cost $50 Total Fixed Cost Manufacturing $500,000 Administrative $480,000 Should you accept a special order at a price of $170 for 3000 sails? Fixed cost will increase by $9,000 to produce these sails. Give a numerical justification Would your answer be different if the company was currently producing 28,000 sails?arrow_forwardI will provide the question and answer but I need an explanation on how to get the answers. There are 4 answers (below) and the chart should be attached. Solve the problem. Round dollar amounts to the nearest dollar. Westminster Office Machines allocates its overhead of $1,487,304 by the sales of each product. Find the overhead for each department. List your answers if the order of the table. ($423,696, $458,304, $222,684, $382,620)arrow_forwardWinner’s Circle, Inc., manufactures medals for winners of athletic events and other contests. Its manufacturing plant has the capacity to produce 10,000 medals each month. Current monthly production is 7,500 medals. The company normally charges $175 per medal. Variable costs and fixed costs for the current activity level of 75 percent of capacity are as follows: Production Costs Variable costs: Manufacturing: Direct labor………………………………………………….$ 375,000 Direct material………………………………………………….262,500 Marketing……………………………………………………………….187,500 Total variable costs……………………………………………………………$ 825,000 Fixed costs: Manufacturing………………………………………………………..$ 275,000 Marketing……………………………………………………………….175,000 Total fixed costs……………………………………………………………...$ 450,000 Total costs……………………………………………………………………$1,275,000 Variable cost per unit………………………………………………………..$ 110 Fixed cost per unit…………………………………………………………………….60 Average unit cost……………………………………………………………$ 170 Winner’s Circle has just received a…arrow_forward

- Baird Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between 9,000 and 15,000 trophies per year. The following cost data apply to various activity levels:arrow_forwardFill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. (Round the "Average cost per cup of coffee served" to 3 decimal places.) Fixed cost 2,000 Cups of Coffee 2,100 Cups of Coffee 2,200 Cups of Coffee Variable cost Total cost $ 0 $ 0 $ 0 Average cost per cup of coffee servedarrow_forwardDirections Below is information for Blue Company. Using this information, answer the following questions on the "Calculation" tab in the file. Show your work (how you got your answer) and format appropriately. Blue company has prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 to 1,500 units): Sales $ 20,000 Variable expenses 12,000 Contribution margin 8,000 NOTE: Use the amounts in the original fact pattern to the left as your basis for the questions below. Fixed expenses 6,000 Net operating income $ 2,000 Questions:…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education