FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

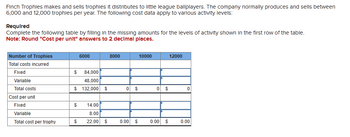

Transcribed Image Text:Finch Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between

6,000 and 12,000 trophies per year. The following cost data apply to various activity levels:

Required

Complete the following table by filling in the missing amounts for the levels of activity shown in the first row of the table.

Note: Round "Cost per unit" answers to 2 decimal places.

Number of Trophies

Total costs incurred

Fixed

Variable

Total costs

Cost per unit

Fixed

Variable

Total cost per trophy

$

84,000

48,000

$ 132,000 $

$

6000

$

14.00

8.00

22.00

$

8000

0 $

0.00 $

10000

0

0.00

$

$

12000

0

0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Benson Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between 5,000 and 11,000 trophies per year. The following cost data apply to various activity levels. Required Complete the preceding table by filling in the missing amounts for the levels of activity shown in the first row of the table. (Round your intermediate calculations and per unit amounts to 2 decimal places.)arrow_forward! Required information [The following information applies to the questions displayed below.] Acacia Manufacturing has compiled the following information from the accounting system for the one product it sells: Sales price Fixed costs (for the month) Marketing and administrative Manufacturing overhead Variable costs (per unit) Marketing and administrative Direct materials Manufacturing overhead Direct labor Units produced and sold (for the month) Required: a. Calculate the product costs per unit. Note: Round your answer to 2 decimal places. b. Calculate the period costs for the period. Product costs per unit b. Period costs $80 per unit $ 23,800 $ 9,100 $9 $20 $ 10 $16 21,000arrow_forwardAnswer all questions and properlyarrow_forward

- A cement manufacturer has supplied the following data: Tons of cement produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income What is the company's unit contribution margin? (Round your intermediate calculations to 2 decimal places.) Multiple Choice $2.00 per unit $0.32 per unit O $4.30 per unit 235,000 $1,010,500 $ 416,000 $ 275,000 $ 54,000 $ 215,000 $ 50,500 $2.30 per unitarrow_forwardMunoz Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between 6,000 and 12,000 trophies per year. The following cost data apply to various activity levels: Required Complete the preceding table by filling in the missing amounts for the levels of activity shown in the first row of the table. (Round "Cost per unit" answers to 2 decimal places.) Number of Trophies 6,000 8,000 10,000 12,000 Total costs incurred Fixed $ 64,000 Variable 42,000 Total costs $ 106,000 $ Cost per unit Fixed 2$ 10.67 Variable 7.00 Total cost per trophy 24 17.67 0.00 0.00 S 0.00arrow_forwardThe following data are from the accounting records of Niles Castings for year 2 Units produced and sold Total revenues and costs Sales revenue Direct materials costs Direct labor costs Variable manufacturing overhead Fixed manufacturing overhead Variable marketing and administrative costs Fixed marketing and administrative costs Required: a. Prepare a gross margin income statement. b. Prepare a contribution margin income statement. Required A Required B 89,000 Complete this question by entering your answers in the tabs below. Prepare a gross margin income statement. $280,000 64,000 40,000 18,000 43,000 11,500 32,000arrow_forward

- Bowl Me Over, Inc (BMO) makes ceramic bowls They have a capacity of 50,000 bowls per period. Below is the selling and cost information for BMO. Sales and cost information Sales Direct Materials Direct labor Variable overhead Fixed overhead Total product cost Variable selling expense (commission of 4% of sales dollars Fixed selling expense BMO sales and cost information Per Unit 30 3.50 10 5 7 25.50 1.20 .50 Dollars 1,200,000 140,000 400,000 200,000 280,000 1,020,000 48,000 20,000 BMO has a defective part rate of 12%. They can sell the defective bowls for $3.00 each. Alternatively, they can rework the bowls and sell them for full price. The cost to rework the bowls is $2 for direct materials, $5 for direct labor and 1.50 for variable overhead. Analyze the incremental income of both options and recommend a course of action for BMO.arrow_forwardNeon Company manufactures widgets. The following data is related to sales and production of the widgets for last year. Selling price per unit Variable manufacturing costs per unit Variable selling and administrative expenses per unit Fixed manufacturing overhead (in total) Fixed selling and administrative expenses (in total) Units produced during the year Units sold during year $ 130.00 $ 62.00 $ 5.00 $ 30,000 $ 8,000 1,500 1,100 Using variable costing, what is the contribution margin for last year? A. $216,700 8. $69,300 C. $143,000 D. $68,200arrow_forwardCheck my work mode: This shows what is correct or incorrect for the work you have completed so far. It d Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $795. Selected data for the company's operations last year follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Required: 0 13,000 10,000 3,000 $ 180 $ 390 $ 51 $ 23 $ 700,000 $ 430,000 1. Assume that the company uses absorption costing. Compute the unit product cost for one gamelan. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 2. Assume that the company uses variable costing. Compute the unit product cost for one gamelan. > Answer is complete but not entirely correct. 1.…arrow_forward

- Aspen Company makes snowboards and uses the total cost approach in setting product prices. Its costs for producing 12,000 units follow. The company targets a profit of $338,400 on this product. Variable Costs per Unit $ 102 Fixed Costs Direct materials Overhead $472,000 107,000 333,000 Direct labor 27 Selling Administrative Overhead 22 Selling 8 1. Compute the total cost per unit. 2. Compute the markup percentage on total cost. (Round your final percentage answer to 1 decimal place.) 3. Compute the product's selling price using the total cost method. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 1. Total cost per unit 2. Markup percentage 3. Selling pricearrow_forwardSandhill Company makes three models of tasers. Information on the three products is given below. Tingler Shocker Stunner Sales $296,000 $504,000 $200,000 Variable expenses 151,700 207,900 138,200 Contribution margin 144,300 296,100 61,800 Fixed expenses 117,800 231,800 95,000 Net income $26,500 $64,300 $(33,200) Fixed expenses consist of $300,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $29,000 (Tingler), $80,600 (Shocker), and $35,000 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. (a) Compute current net income for Sandhill Company. Net income Aarrow_forwardGiven the following cost and activity observations for Bounty Company's utilities, use the high-low method to determine Bounty's variable utilities cost per machine hour. Round your answer to the nearest cent. Cost Machine Hours March $3,002 15,174 April 2,664 9,624 May 2,823 12,276 June 3,621 17,777 a.$1.17 b.$0.70 c.$0.66 d.$0.12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education