FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

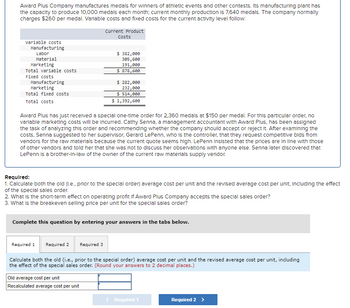

Transcribed Image Text:Award Plus Company manufactures medals for winners of athletic events and other contests. Its manufacturing plant has

the capacity to produce 10,000 medals each month; current monthly production is 7,640 medals. The company normally

charges $260 per medal. Variable costs and fixed costs for the current activity level follow:

Current Product

Costs

Variable costs

Manufacturing

Labor

Material

Marketing

Total variable costs

Fixed costs

Manufacturing

Marketing

Total fixed costs

Total costs

$ 382,000

305,600

191,000

$ 878,600

$ 282,000

232,000

$ 514,000

$ 1,392,600

Award Plus has just received a special one-time order for 2,360 medals at $150 per medal. For this particular order, no

variable marketing costs will be incurred. Cathy Senna, a management accountant with Award Plus, has been assigned

the task of analyzing this order and recommending whether the company should accept or reject it. After examining the

costs, Senna suggested to her supervisor, Gerard LePenn, who is the controller, that they request competitive bids from

vendors for the raw materials because the current quote seems high. LePenn insisted that the prices are in line with those

of other vendors and told her that she was not to discuss her observations with anyone else. Senna later discovered that

LePenn is a brother-in-law of the owner of the current raw materials supply vendor.

Required:

1. Calculate both the old (I.e., prior to the special order) average cost per unit and the revised average cost per unit, including the effect

of the special sales order.

2. What is the short-term effect on operating profit if Award Plus Company accepts the special sales order?

3. What is the breakeven selling price per unit for the special sales order?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Calculate both the old (i.e., prior to the special order) average cost per unit and the revised average cost per unit, including

the effect of the special sales order. (Round your answers to 2 decimal places.)

Old average cost per unit

Recalculated average cost per unit

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Let's say that ABC company manufactures and sells 20,000 units of its product yearly. A single product includes these costs: Direct materials: $3 per unit Direct labor: $5 per unit Variable manufacturing overhead: $2 per unit Fixed manufacturing overhead: $35,000 per year, which computes to a $1.75 per unit cost ($35,000/20,000 annual units) Can you explain what the per unit cost of the product would be under the Absorption and Variable costing methods?arrow_forwardVikramarrow_forwardCordova manufactures three types of stained glass windows, cleverly named Products A, B, and C. Information about these products follows: Fixed costs per unit Sales price Variable costs per unit Required number of labor hours Product A $ 49.00 Product B $ 59.00 Product C $ 104.00 15.80 5.00 2.00 23.80 5.00 23.80 2.50 5.00 4.00 Cordova currently is limited to 60,000 labor hours per month. Required: 1-a. Assuming an infinite demand for each of Cordova's products, determine contribution margin per direct labor hour for each product. 1-b. Which product would be Cordova's first choice to produce?arrow_forward

- Schopp Corporation makes a mechanical stuffed alligator that sings the Martian national anthem. The following information is available for Schopp Corporation's anticipated annual volume of 501,000 units. Per Unit $8 $13 $16 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses $13 Fixed selling and administrative expenses Total $3,507,000 Absorption-cost pricing markup percentage $1,503,000 The company has a desired ROI of 25%, It has invested assets of $30,060,000, Using absorption-cost pricing, compute the markup percentage. (Round answer to 2 decimal places, e.g. 10.50%.) %arrow_forwardWerner Company produces and sells disposable foil baking pans to retailers for $2.65 per pan. The variable cost per pan is as follows: Direct materials Direct labor Variable factory overhead Variable selling expense Fixed manufacturing cost totals $143,704 per year. Administrative cost (all fixed) totals $19,596. Required: $0.27 0.51 0.69 0.18 Compute the number of pans that must be sold for Werner to break even. pans Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent. Unit variable cost Unit variable manufacturing cost Which is used in cost-volume-profit analysis? Unit variable cost ✓ How many pans must be sold for Werner to earn operating income of $7,000? pans How much sales revenue must Werner have to earn operating income of $7,000?arrow_forwardSubject: acountingarrow_forward

- The machining division of Cullumber International has a capacity of 2,000 units. Its sales and cost data are: Selling price per unit $80 Variable manufacturing costs per unit 25 Variable selling costs per unit 3 Total fixed manufacturing overhead 183,200 The machining division is currently selling 1,800 units to outside customers, and the assembly division of Cullumber International wants to purchase 400 units from machining. If the transaction takes place, the variable selling costs per unit on the units transferred to assembly will be $0/unit, and not $3/unit. If Cullumber's assembly division is currently buying from an outside supplier at $75 per unit, what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer price? The company profits would by $arrow_forwardWinner’s Circle, Inc., manufactures medals for winners of athletic events and other contests. Its manufacturing plant has the capacity to produce 10,000 medals each month. Current monthly production is 7,500 medals. The company normally charges $175 per medal. Variable costs and fixed costs for the current activity level of 75 percent of capacity are as follows: Production Costs Variable costs: Manufacturing: Direct labor………………………………………………….$ 375,000 Direct material………………………………………………….262,500 Marketing……………………………………………………………….187,500 Total variable costs……………………………………………………………$ 825,000 Fixed costs: Manufacturing………………………………………………………..$ 275,000 Marketing……………………………………………………………….175,000 Total fixed costs……………………………………………………………...$ 450,000 Total costs……………………………………………………………………$1,275,000 Variable cost per unit………………………………………………………..$ 110 Fixed cost per unit…………………………………………………………………….60 Average unit cost……………………………………………………………$ 170 Winner’s Circle has just received a…arrow_forwardBaird Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between 9,000 and 15,000 trophies per year. The following cost data apply to various activity levels:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education