FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

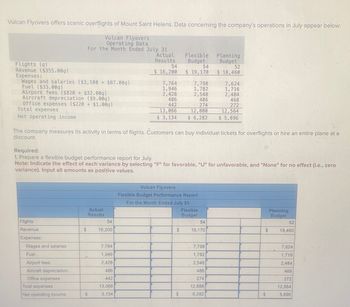

Transcribed Image Text:Vulcan Flyovers offers scenic overflights of Mount Saint Helens. Data concerning the company's operations in July appear below:

Vulcan Flyovers

Operating Data

For the Month Ended July 31

Flights (q)

Revenue ($355.00q)

Expenses:

Wages and salaries ($3,100 + $87.00q)

Fuel ($33.009)

Airport fees ($820 + $32.00q)

Aircraft depreciation ($9.00q)

Office expenses ($220 + $1.00q)

Total expenses

Net operating income

Actual

Results

Flexible

Budget

Planning

Budget

54

54

52

$ 16,200

$ 19,170

$ 18,460

7,764

7,798

7,624

1,946

1,782

1,716

2,428

2,548

2,484

486

486

468

442

274

272

13,066

12,888

12,564

$ 3,134

$ 6,282

$ 5,896

The company measures its activity in terms of flights. Customers can buy individual tickets for overflights or hire an entire plane at a

discount.

Required:

1. Prepare a flexible budget performance report for July.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance). Input all amounts as positive values.

Vulcan Flyovers

Flights

Flexible Budget Performance Report

For the Month Ended July 31

Actual

Results

54

$

16,200

Flexible

Budget

Planning

Budget

54

52

$

19,170

$

18,460

Revenue

Expenses:

Wages and salaries

7,764

7,798

7,624

Fuel

1,946

1,782

1,716

Airport fees

2,428

2,548

2,484

Aircraft depreciation

486

486

468

Office expenses

442

274

272

Total expenses

13,066

12,888

12,564

Net operating income

$

3,134

$

6,282

$

5,896

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- 1arrow_forwardGoldenrod Company makes artificial flowers and reports the following data for the month: Purchases of materials, on account $ 51,000Materials requisitions: Direct materials 42,300 Indirect materials 500Labor incurred (not yet paid): Direct labor 20,300 Indirect labor 1,340Journalize the entries relating to materials and labor.arrow_forward[The following information applies to the questions displayed below.]Information on Kwon Manufacturing’s activities for its first month of operations follows: Purchased $101,700 of raw materials on credit. Materials requisitions show the following materials used for the month. Job 201 $ 49,900 Job 202 25,300 Total direct materials 75,200 Indirect materials 10,320 Total materials used $ 85,520 Time tickets show the following labor used for the month. Job 201 $ 40,900 Job 202 14,300 Total direct labor 55,200 Indirect labor 25,900 Total labor used $ 81,100 Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. Transferred Job 201 to Finished Goods Inventory. (1) Sold Job 201 for $168,860 on credit. (2) Record cost of goods sold for Job 201. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment $ 33,700 Rent on factory building (payable)…arrow_forward

- Jake’s Roof Repair has provided the following data concerning its costs: Fixed Costper Month Cost perRepair-Hour Wages and salaries $ 20,900 $ 15.00 Parts and supplies $ 7.60 Equipment depreciation $ 2,730 $ 0.55 Truck operating expenses $ 5,750 $ 1.60 Rent $ 4,650 Administrative expenses $ 3,870 $ 0.70 For example, wages and salaries should be $20,900 plus $15.00 per repair-hour. The company expected to work 2,900 repair-hours in May, but actually worked 2,800 repair-hours. The company expects its sales to be $48.00 per repair-hour. Required: Compute the company’s activity variances for May.arrow_forwardJake's Roof Repair has provided the following data concerning its costs: Cost per Repair-Hour Fixed Cost per Month $ Wages and salaries Parts and supplies Equipment depreciation $ Truck operating expenses $ Rent $ Administrative expenses $ 21,100 2,750 5,780 4,660 3,840 $ 16.00 $ 7.20 $ 0.55 $ 1.70 $ 0.40 For example, wages and salaries should be $21,100 plus $16.00 per repair-hour. The company expected to work 2,600 repair-hours in May, but actually worked 2,500 repair-hours. The company expects its sales to be $48.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Need to make sure my notes coincide with this example problem from video. please include how you calculated each part. Thank youarrow_forwardWalter Company has the following information for the month of March: Cash balance, March 1 Collections from customers Paid to suppliers Manufacturing overhead Direct labor Selling and administrative expenses $ 17,220 39,450 22,900 6,700 8,550 4,800 Walter pays wages and other cash expenses in the month incurred. Manufacturing overhead includes $1,500 for machinery depreciation, but the amount for selling and administrative expenses is exclusive of depreciation. Additionally, Walter also expects to buy a piece of property for $7,600 during March. Walter can borrow in increments of $1,000 and would like to maintain a minimum cash balance of $11,000. Required: Prepare Walter's cash budget for the month of March. Beginning Cash Balance Budgeted Cash Receipts Budgeted Cash Payments Preliminary Cash Balance Cash Borrowed Ending cash balancearrow_forward

- At the beginning of 2012, Conway Manufacturing Company had the following account balances: WIP Inventory 2,000 During the year, the following transactions took place: Direct materials placed in production: Direct labor incurred: FG Inventory 8,000 Select one: Oa. debit of $67,000 $80,000 $190,000 Manufacturing overhead incurred $300,000 Manufacturing overhead allocated to production: $295,000 Cost of Jobs Completed $500,000 Selling Price of Jobs Sold $750,000 Cost of Jobs Sold $440,000 After these transactions have been recorded, the balance in the Work in process account is a: O b. credit of $63,000 O c. debit of $72,000 O d. debit of $70,000* Manufacturing O/H 0arrow_forwardAelan Products Company, a small manufacturer, has submitted the items below concerning last year's operations. The president's secretary, trying to be helpful, has alphabetized the list. Administrative salaries $4,800 Advertising expense 2,400 Depreciation—factory building 1,600 Depreciation—factory equipment 3,200 Depreciation—office equipment 360 Direct labour cost 43,800 Raw materials inventory, beginning 4,200 Raw materials inventory, ending 6,400 Finished goods inventory, beginning 93,960 Finished goods inventory, ending 88,820 General liability insurance expense 480 Indirect labour cost 23,600 Insurance on factory 2,800 Purchases of raw materials 29,200 Repairs and maintenance of factory 1,800 Sales salaries 4,000 Taxes on factory 900 Travel and entertainment expense 2,820 Work in process inventory, beginning 3,340 Work in process inventory, ending 2,220…arrow_forwardAll products at Luke Corp. are allocated a portion of corporate overhead costs, which is computed as a percent of product revenue. The percentage rate is based on the level of corporate costs as a percentage of revenues. Data on corporate costs and revenues for the past two years were stated as: Corporate Revenue Corporate Overhead Costs Most recent year $ 112,750,000 $ 10,237,500 Previous year $ 76,200,000 $ 7,921,000 Using the data in the table apply the high low method (based on revenues) to determine the variable corporate overhead costs per sales dollar. Round to the nearest 0.001.arrow_forward

- Munoz Air is a large airline company that pays a customer relations representative $15,975 per month. The representative, who processed 1,120 customer complaints in January and 1,460 complaints in February, is expected to process 21,300 customer complaints during the year. Required a. Determine the total cost of processing customer complaints in January and in February. Month Allocated Cost January Februaryarrow_forwardA. Prepare the January income statement for a Sorensen manufacturing companyarrow_forwardMarks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments using different allocation bases. The following information is available for the current period: Office Expenses Total Allocation Basis Salaries $40,000 Number of employees Depreciation Advertising 26,000 Cost of goods sold 60,000 Net sales Item Drilling Grinding Total Number of employees 1,800 2,700 4,500 Net sales $352,000 $528,000 $880,000 Cost of goods sold $110,200 $179,800 $290,000 The amount of depreciation that should be allocated to Grinding for the current period is: Multiple Choice $37,200. $26,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education