Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

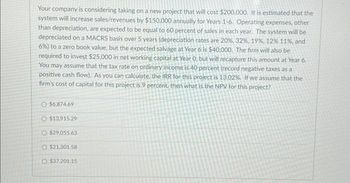

Transcribed Image Text:Your company is considering taking on a new project that will cost $200,000. It is estimated that the

system will increase sales/revenues by $150,000 annually for Years 1-6. Operating expenses, other

than depreciation, are expected to be equal to 60 percent of sales in each year. The system will be

depreciated on a MACRS basis over 5 years (depreciation rates are 20%, 32 %, 19%, 12% 11%, and

6%) to a zero book value, but the expected salvage at Year 6 is $40,000. The firm will also be

required to invest $25,000 in net working capital at Year 0, but will recapture this amount at Year 6.

You may assume that the tax rate on ordinary income is 40 percent (record negative taxes as a

positive cash flow). As you can calculate, the IRR for this project is 13.02%. If we assume that the

firm's cost of capital for this project is 9 percent, then what is the NPV for this project?

$6,874.69

$13,915.29

$29,055.63

$21.301.58

O $37,201.15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- DataPoint Engineering is considering the purchase of a new piece of equipment for $200,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $100,000 in nondepreciable working capital. $25,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Need help with subpart D-1, previously asked question and was a-c were answered. Year Amount 1 $ 173,000 2 152,000 3 108,000 4 103,000 5 89,000 6 71,000 The tax rate is 25 percent. The cost of capital must be computed based on the following: Cost(aftertax) Weights Debt Kd 5.50 % 30 % Preferred stock Kp 9.20 10…arrow_forwardAcompany is evaluating the addition of equipment to its presentoperations. They need to purchase equipment for $160,000. The five year MACRS GDS Recovery Method is appropriate forthe investment and the total tax rate (federal plus state) is 40%. Gross revenue is expected to be $30,000/year while maintenance costs are expected to be $5,000/year. It is expected that the operation will be shut down at the end of the fourth year with a salvage value of $20,000.1-Prepare a table showing your development of the ATCF's.arrow_forwardAcompany is evaluating the addition of equipment to its presentoperations. They need to purchase equipment for $160,000. The five year MACRS GDS Recovery Method is appropriate forthe investment and the total tax rate (federal plus state) is 40%. Gross revenue is expected to be $30,000/year while maintenance costs are expected to be $5,000/year. It is expected that the operation will be shut down at the end of the fourth year with a salvage value of $20,000. 2-Draw a BTCFDarrow_forward

- Argyl Manufacturing is evaluating the possibility of expanding its operations. This expansion will require the purchase of land at a cost of $150,000. A new building will cost $120,000 and will be depreciated on a straight-line basis over 10 years to a salvage value of $0. Actual land salvage at the end of 10 years is expected to be $200,000. The actual building salvage at the end of 10 years is expected to be $190,000. Equipment for the facility is expected to cost $260,000. Installation costs will be an additional $20,000 and shipping costs will be $13,000. This equipment will be depreciated as a 7-year MACRS asset. Actual estimated salvage at the end of 10 years is $0. The project will require net working capital of $75,000 initially (year 0), an additional $40,000 at the end of year 1, and an additional $40,000 at the end of year 2. The project is expected to generate increased EBIT (operating income) for the firm of $110,000 during year 1. Annual EBIT is expected to grow at a rate…arrow_forward1. Batinah Water Desalination project is a 15 year project. The project manager estimated that net initial investment expend in year zero is 100 million rials. The investment will be depreciated on a straight line basis to a 10 million book value by enc the project. During the operating phase revenue per year is 35 million and expense per year is estimated to be 20 million ria per year for 15 years. In year 15 net salvage value is estimated to be 15 million. WACC is estimated to be 10%. Tax Rate 209 1. Calculațe annual depreciation expenses 2. Calculate cash flow after tax CFAT in year 5 3. Calculate net present value. 4. Is it a good project Only final answers are requiredarrow_forwardNational Integrated Systems (NIS), a global provider of heating and air conditioning is planning a project whose data is provided below. The project’s equipment has a 3 year tax life after which its salvage value will be zero. The machinery will be depreciated on a straight line basis over three years. Revenues and other operating costs are expected to be constant over the project’s life. What is the project’s cash flow in Year 1? Equipment Cost = $130,000Depreciation rate = 33.33%Annual Sales Revenue= $120,000Operating Costs (ex Depreciation) = $50,000 Tax Rate = 35%arrow_forward

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck has an after-tax cost of $23,500, and it is expected to generate after-tax cash flows of $7,250 per year. The truck has a 5-year expected life. The expected year-end abandonment values (after-tax salvage values) for the truck are given below. The company's WACC is 8%. After-Tax Year 0 Annual After-Tax Cash Flow Abandonment Value ($23,500) 1 7,250 2 7,250 3 7,250 7,250 $17,500 15,000 13,000 8,000 7,250 4 5 a. What is the truck's optimal economic life? Round your answer to the nearest whole number. year(s) b. Would the introduction of abandonment values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project? -Select- varrow_forwardA 5-year project is expected to generate revenues of $100000, variable costs of $24000, and fixed costs of $16500. The annual depreciation is $12000 and the tax rate is 35 percent. What is the annual operating cash flow? a. $43,275. b. $40,875. c. $43,000. d. $44,500. e. $42,875.arrow_forwardThe lovely company has a new 4-year project that will have annual sales of 9,300 units. The price per unit it $20,80 and the variable cost per unit is $8.55. The project will require fixed assets of $103.000, which will be depreciated on a 3 year MACRS schedule. The annual depreciation percentages are 33.33 percent, 44.45 percent, 14.81 percent, 7.41 percent, respectively. Fixed costs are $43,000 per year and the tax rate is 34 percent. What is the operating cash flow for year 3?arrow_forward

- The cost of the new machine is $127,000. Installation will cost $20,000. $4,000 in net working capital will be needed at the time of installation. The project will increase revenues by $85,000 per year, but operating costs will increase by 35% of the revenue increase. Simplified straight line depreciation is used. Class life is 5 years, and the firm is planning to keep the project for 5 years. Salvage value at the end of year 5 will be $50,000. 14% cost of capital; 34% marginal tax rate. /////// The depreciation is 29400. How do I get this result? Could you please show me how to get depreciation by NOT using excel but calculation?arrow_forwardEsc You consider purchasing a new piece of equipment (7yr MACRS property) for your manufacturing process for $120,000. The equipment has a 6-year useful life and no salvage value. The equipment is expected to generate an additional $40,000 of net income before taxes and depreciation each year by using this upgraded system. The combined federal and state income tax rate= 35%. Annual inflation = 4%. a. Fill in the following table assuming MACRS depreciation rates Year 46°F Rain showers 0 1 F1 2 O 2 3 4 5 Pretax income 6 MACRS Taxable Depreciation income F2 - F3 + F4 Ⓡ b. If your MARR = 12%, should you purchase this system based on your real after-tax income? Why or why not? F5 8 C B Tax owed F6 Q Search G After tax income F7 Ca 7 F8 O Inflation adjustment factor O F9 ala LG F10 Real after tax income 0 A I THE F11 - 0 1 asod F12 + Prt Sc ScrLk Post-it sod Ins Post-it Del Backspace Post-it PgUp Home asod> Post-it Mumi 1-10 PgOn End Pause Break 11-15 11-15 Carrow_forwardBad Company has a new 4-year project that will have annual sales of 8,400 units. The price per unit is $19.90 and the variable cost per unit is $7.65. The project will require fixed assets of $94,000, which will be depreciated on a 3-year MACRS schedule. The annual depreciation percentages are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. Fixed costs are $34,000 per year and the tax rate is 25 percent. What is the operating cash flow for Year 3? $20,705 $80,655 $57,550 $55,155 $60,744arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education