FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

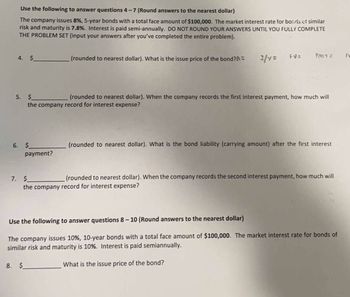

Transcribed Image Text:Use the following to answer questions 4-7 (Round answers to the nearest dollar)

The company issues 8%, 5-year bonds with a total face amount of $100,000. The market interest rate for bo:ds cf similar

risk and maturity is 7.8%. Interest is paid semi-annually. DO NOT ROUND YOUR ANSWERS UNTIL YOU FULLY COMPLETE

THE PROBLEM SET (input your answers after you've completed the entire problem).

4. $

(rounded to nearest dollar). What is the issue price of the bond?=

1/Y=

FV=

PMT=

5. $

(rounded to nearest dollar). When the company records the first interest payment, how much will

the company record for interest expense?

6. $

payment?

(rounded to nearest dollar). What is the bond liability (carrying amount) after the first interest

7. $

(rounded to nearest dollar). When the company records the second interest payment, how much will

the company record for interest expense?

FE

Use the following to answer questions 8-10 (Round answers to the nearest dollar)

The company issues 10%, 10-year bonds with a total face amount of $100,000. The market interest rate for bonds of

similar risk and maturity is 10%. Interest is paid semiannually.

8. $

What is the issue price of the bond?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please do stepwise and correct please ill like.. and use excel given formulas only.arrow_forwardBlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forwardPlease do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.arrow_forward

- Please help me. Thankyou.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardGive me correct answer with explanation.jarrow_forward

- Please type the answer very fast i ll upvote , Thank You On January 1, 2024, Twister Enterprises, a manufacturer of a variety of transportable spin rides, issues $560,000 of 7% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year. 1. If the market interest rate is 7%, the bonds will issue at $560,000. Record the bond issue on January 1, 2024, and the first two semiannual interest payments on June 30, 2024, and December 31, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) 1a. Record the bond issue. 1b. Record the first semiannual interest payment. 1c. Record the second semiannual interest payment. 2. If the market interest rate is 8%, the bonds will issue at $511,582. Record the bond issue on January 1, 2024, and the first two semiannual interest payments on June 30, 2024, and December 31, 2024. (If no entry is required for a particular transaction/event, select…arrow_forwardPlease answer all questions and show all calculations. Thank you.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education