Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

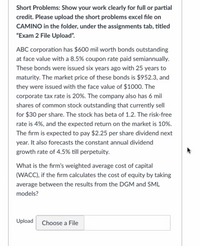

Transcribed Image Text:Short Problems: Show your work clearly for full or partial

credit. Please upload the short problems excel file on

CAMINO in the folder, under the assignments tab, titled

"Exam 2 File Upload".

ABC corporation has $600 mil worth bonds outstanding

at face value with a 8.5% coupon rate paid semiannually.

These bonds were issued six years ago with 25 years to

maturity. The market price of these bonds is $952.3, and

they were issued with the face value of $1000. The

corporate tax rate is 20%. The company also has 6 mil

shares of common stock outstanding that currently sell

for $30 per share. The stock has beta of 1.2. The risk-free

rate is 4%, and the expected return on the market is 10%.

The firm is expected to pay $2.25 per share dividend next

year. It also forecasts the constant annual dividend

growth rate of 4.5% till perpetuity.

What is the firm's weighted average cost of capital

(WACC), if the firm calculates the cost of equity by taking

average between the results from the DGM and SML

models?

Upload

Choose a File

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Similar questions

- BlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardplease dont provide image based answers thank youarrow_forward

- Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $37,000,000 of three-year, 11% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. The amount of the bond interest expense for the first year. Do not round intermediate calculations. Round your final answer to the nearest dollar.arrow_forwardDon't give solution in image format..arrow_forwardPlease help me. Thankyou.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education