Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

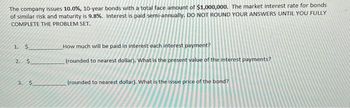

Transcribed Image Text:The company issues 10.0%, 10-year bonds with a total face amount of $1,000,000. The market interest rate for bonds

of similar risk and maturity is 9.8%. Interest is paid semi-annually. DO NOT ROUND YOUR ANSWERS UNTIL YOU FULLY

COMPLETE THE PROBLEM SET.

1.

$

2. $

3. $

How much will be paid in interest each interest payment?

(rounded to nearest dollar). What is the present value of the interest payments?

(rounded to nearest dollar). What is the issue price of the bond?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Interest rates determine the present value of future amounts. (Round to the nearest dollar.) Read the requirements. View the Present Value of $1 table. View the Future Value of $1 table. View the Present Value of Ordinary Annuity of $1 table. View the Future Value of Ordinary Annuity of $1 table. Requirement 1. Determine the present value of seven-year bonds payable with face value of $91,000 and stated interest rate of 14%, paid semiannually. The market rate of interest is 14% at issuance. (Round intermediary calculations and final answer to the nearest whole dollar.) Present Value 91000 When market rate of interest is 12% annually C When market rate of interest is 14% annually Requirement 2. Same bonds payable as in requirement 1, but the market interest rate is 16%. (Round intermediary calculations and final answer to the nearest whole dollar.) Present Value When market rate of interest is 16% annually Requirement 3. Same bonds payable as in requirement 1, but the market interest…arrow_forwardPearson Co issue its $140,000 at a price of 94, the stated rate is 6%, the bond term is 4 years, and the market rate is 9%. Assume the term of the bonds is 4 years. The annual interest payment on the bond will be $_______arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Hoyden Co.'s bonds mature in 13 years and pay 8 percent interest annually. If you purchase the bonds for $700, what is their yield to maturity? Question content area bottom Part 1 The yield to maturity on the Hoyden bonds is enter your response here%. (Round to two decimal places.)arrow_forward

- Kilgore Natural Gas has a $1,000 par value bond outstanding that pays 19 percent annual interest. The current yield to maturity on such bonds in the market is 11 percent. Compute the price of the bonds for these maturity dates: (Do not round intermediate calculations. Round your final answers to 2 decimal places. Assume interest payments are annual.) a. 25 years b. 19 years c. 5 yeararrow_forwardA bond with a face value of $5,000 pays quarterly interest of 1.5 percent each period. Twenty-two interest payments remain before the bond matures. How much would you be willing to pay for this bond today if the next interest payment is due now and you want to earn 8 percent compounded quarterly on your money? Click the icon to view the table of compound interest factors for discrete compounding periods when i= 2%. You should pay $ (Round to the nearest cent as needed.)arrow_forwardA company issues bonds with a par value of $370,000. The bonds mature in 5 years and pay 8% annual interest in semiannual payments. The annual market rate for the bonds is 6%. Compute the price of the bonds on their issue date. The following information is taken from present value tables: Present value of an annuity (series of payments) for 10 periods at 3% Present value of an annuity (series of payments) for 10 periods at 4% Present value of 1 (single sum) due in 10 periods at 3% Present value of 1 (single sum) due in 10 periods at 4% Table Values are Based on: n = i = Cash Flow Par (maturity) value Interest (annuity) Price of bonds Table Value Amount Present Value 8.5302 8.1109 0.7441 0.6756arrow_forward

- Calculate the effective annual interest rate for the following: Required: a. A 3-month T-bill selling at $97,600 with par value $100,000. b. A 11% coupon bond selling at par and paying coupons semiannually. Complete this question by entering your answers in the tabs below. Required A Required B A 3-month T-bill selling at $97,600 with par value $100,000. Note: Round your answer to 2 decimal places. Effective annual rate %arrow_forwardDangerarrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 19 years and pay 13 percent interest annually. If you purchase the bonds for $1,225, what is your yield to maturity? Question content area bottom Part 1 Your yield to maturity on the Abner bonds is enter your response here%. (Round to two decimal places.)arrow_forward

- Ray Co.’s bonds, maturing in 3 years, pay 8 percent interest on a $1,000 face value. Interest is paid once per year. If your required rate of return is 8 percent, what is the value of the bond? Now assume that the required rate of return increased to 9%. Would you recommend investors to buy the bond? What can you conclude about the relationship between bond prices and interest rates? Assume that the modified duration of this bond is 2.60 years. If the market yield changes by 2%, how much change will there be in the bond's price in %arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 22 years and pay 9 percent interest annually. If you purchase the bonds for $1,300, what is your yield to maturity? Your yield to maturity on the Abner bonds is nothing%. (Round to two decimal places.)arrow_forwardEf 420.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education