FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

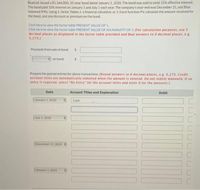

Transcribed Image Text:BlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest.

The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue

followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for

the bond, and any discount or premium on the bond.

Click here to view the tactor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5

decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g.

5,275.)

Proceeds from sale of bond

: on bond

Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit

account titles are automatically indented when the amount is entered. Do not Indent manually. If no

entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Date

Account Titles and Explanation

Debit

January 1,2020

Cash

July 1. 2020

December 31. 2020

January 1. 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The notes to the Thorson Ltd.financial statements reported the following data on December 31, Year 1 (end of the fiscal year): Thorson amortizes bond discounts using the effective-interest method and pays all interestamounts at December 31. Requirements1. Assume the market interest rate is 6% on January 1 of year 1, the date the bonds are issued.a. Using the PV function in Excel, what is the issue price of the bonds?b. What is the maturity value of the bonds?c. What is Thorson’s annual cash interest payment on the bonds?d. What is the carrying amount of the bonds at December 31, year 1?2. Prepare an amortization table through the maturity date for the bonds using Excel. (Roundall amounts to the nearest dollar.) How much is Thorson’s interest expense on the bonds forthe year ended December 31, Year 4?3. Show how Thorson would report these bonds and notes at December 31, Year 4.arrow_forward5 On January 1, Ruiz Company issued bonds as follows: Face Value: Number of Years: Stated Interest Rate: Interest payments per year 7 B 9 0 1 2 AWN IC $500,000 a) Required: 1) Calculate the bond selling price given the two market interest rates below. Use formulas that reference data from this worksheet and from the appropriate future or present value tables (found by clicking the tabs at the botto this worksheet). Note: Rounding is not required. 15 7% 2 Annual Market Rate Semiannual Interest Payment: PV of Face Value: +PV of Interest Payments: Bond Selling Price: Annual Market Rate Semiannual Interest Payment: PV of Face Value: +PV of Interest Payments: = Bond Selling Price: 9% $17,500 133,500.01 285,055.55 418,555.56 6.00% $17,500 205,993.38 5343,007.72 $549,001.10 +arrow_forwardCompute bond proceeds, amortizing premium by interest method, and interest expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $44,000,000 of 5-year, 13% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. d. The amount of the bond interest expense for the first year. Round your…arrow_forward

- On January 1, Year 1, Residence Company issued bonds with a $50,000 face value. The bonds were issued at face value. They had a 20 year term and a stated rate of interest of 7%. Which of the following shows how the payoff of the bond liability will affect Residence's financial statements on December 31, Year 20 (the maturity date)? A. B. C. D. Balance Sheet Assets = Liabilities + ΝΑ = ΝΑ + NA = ΝΑ 50,000 50,000 (50,000) = (50,000) = Multiple Choice Option A Option B Option C Option D + + Equity Revenues ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ NA Income Statement Expenses = ΝΑ ΝΑ ΝΑ ΝΑ ||| || || || || = = = = Net Income ΝΑ ΝΑ ΝΑ ΝΑ Statement of Cash Flows (50,000) IA (50,000) IFA 50,000 IA (50,000) FAarrow_forwardwill thumb up if correct. only need (b). please show the work too (FV-PV)arrow_forward1. On January 1, 2024, Lansing Group issued $1,000,000 of 6% bonds, dated January 1. Interest is payable semiannually on June 30 and December 31. The bonds mature in five years. The market yield for bonds of similar risk and maturity is 8%. INSTRUCTIONS: 1. Determine the price of these bonds that are issued to yield the 8% market rate using the Time Value of Money Tables. Include the table and relevant components for each factor used. 2. Record the issuance of these bonds by Lansing Group. 3. Prepare an amortization schedule that determines interest at the effective rate through the maturity date of the bonds. 4. Prepare the entries to record the interest on June 30, 2024, and December 31, 2024. 5. Assume that Lansing Group retires the bonds on January 1, 2026, paying $1,027,544. Prepare the entry to record the retirement.arrow_forward

- Don't give answer in imagearrow_forwardAnswer full question.arrow_forward< Compute bond proceeds, amortizing premium by interest method, and interest expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $29,000,000 of three-year, 10% bonds at a market (effective) interest rate of 9%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ d. The amount of the bond interest expense for the first year.…arrow_forward

- Hansabenarrow_forwardCompute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $80,000,000 of five-year, 9% bonds at a market (effective) interest rate of 11%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ d. The amount of the bond interest expense for the first…arrow_forwardOn January 1, 2024, Anne Teak Furniture issued $100,000 of 12% bonds, dated January 1. Interest is payable semiannually on June 30 and December 31. The bonds mature in 4 years. The annual market rate for bonds of similar risk and maturity is 14%. What was the issue price of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Multiple Choice $89,460 $120,942 $95,460 $94,029arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education