FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

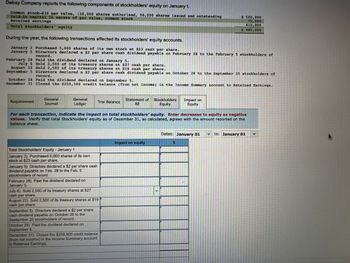

Transcribed Image Text:**Delray Company Stockholders' Equity Overview**

Delray Company reports the following components of stockholders' equity on January 1:

- **Common Stock ($10 par value, 120,000 shares authorized, 50,000 shares issued and outstanding):** $500,000

- **Paid-in Capital in Excess of Par Value, Common Stock:** $75,000

- **Retained Earnings:** $410,000

**Total Stockholders' Equity:** $985,000

**Yearly Transactions Affecting Stockholders' Equity:**

1. **January 2:** Purchased 5,000 shares of its own stock at $23 each.

2. **January 5:** Directors declared a $2 per share cash dividend, payable on February 28 to February 5 stockholders of record.

3. **February 28:** Paid the dividend declared on January 5.

4. **July 6:** Sold 2,500 of its treasury shares at $27 per share.

5. **August 22:** Sold 2,500 of its treasury shares at $19 per share.

6. **September 5:** Directors declared a $2 per share cash dividend, payable on October 28 to September 25 stockholders of record.

7. **October 28:** Paid the dividend declared on September 5.

8. **December 31:** Closed the $259,500 credit balance (net income) in the Income Summary account to Retained Earnings.

**Requirements:**

- Use the following accounting components:

- **General Journal**

- **General Ledger**

- **Trial Balance**

- **Statement of Retained Earnings**

- **Stockholders’ Equity Retained**

- **Impact on Equity**

**Instructions for Equity Impact Tracking:**

For each transaction, indicate the effect on total stockholders' equity. Note that decreases in equity should be entered as negative values. Verify that the calculated total Stockholders' Equity as of December 31 matches the amount reported on the balance sheet.

**Table Format:**

- The table tracks the impact on equity for each transaction, allowing users to fill in details about how stockholders' equity is affected throughout the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please fill in the blanks with blue arrows to the table above, the one you submitted back to me in response does not look like the same one I submitted

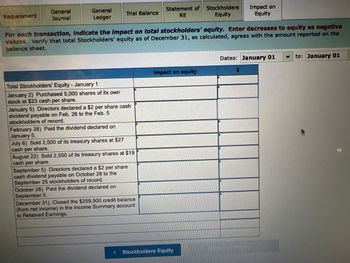

Transcribed Image Text:**Understanding the Impact of Transactions on Stockholders’ Equity**

This educational resource illustrates how different transactions affect the total stockholders' equity. Below is a summary table highlighting each transaction and its subsequent impact:

| Date | Transaction Details | Impact on Equity | $ |

|-----------------|------------------------------------------------------------------------------------------------------|---------------------|-------------|

| January 1 | Total Stockholders' Equity - Beginning balance | | |

| January 2 | Purchased 5,000 shares of its own stock at $23 cash per share | | |

| January 5 | Directors declared a $2 per share cash dividend payable on Feb. 28 to the Feb. 5 stockholders of record | | |

| February 28 | Paid the dividend declared on January 5 | | |

| July 6 | Sold 2,500 of its treasury shares at $27 cash per share | | |

| August 22 | Sold 2,500 of its treasury shares at $19 cash per share | | |

| September 5 | Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record | | |

| October 28 | Paid the dividend declared on September 5 | | |

| December 31 | Closed the $259,500 credit balance (from net income) in the Income Summary account to Retained Earnings | | |

### **Explanation of Key Concepts:**

- **Treasury Stock Transactions**: These occur when a company buys back its own shares (e.g., January 2 purchase) or sells previously repurchased shares (e.g., July 6 and August 22 sales).

- **Dividends**: Regular payments made to shareholders, impacting the cash or retained earnings (e.g., dividends declared on January 5 and September 5).

- **Net Income and Retained Earnings**: The closing of the net income into retained earnings on December 31 reflects the company’s profitability over the period.

Understanding these transactions helps comprehensively grasp how operational and financial decisions influence stockholders’ equity on a balance sheet.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please fill in the blanks with blue arrows to the table above, the one you submitted back to me in response does not look like the same one I submitted

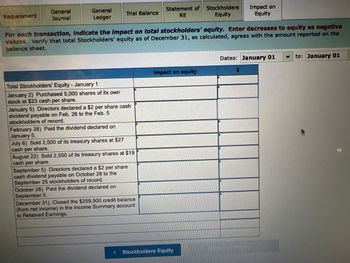

Transcribed Image Text:**Understanding the Impact of Transactions on Stockholders’ Equity**

This educational resource illustrates how different transactions affect the total stockholders' equity. Below is a summary table highlighting each transaction and its subsequent impact:

| Date | Transaction Details | Impact on Equity | $ |

|-----------------|------------------------------------------------------------------------------------------------------|---------------------|-------------|

| January 1 | Total Stockholders' Equity - Beginning balance | | |

| January 2 | Purchased 5,000 shares of its own stock at $23 cash per share | | |

| January 5 | Directors declared a $2 per share cash dividend payable on Feb. 28 to the Feb. 5 stockholders of record | | |

| February 28 | Paid the dividend declared on January 5 | | |

| July 6 | Sold 2,500 of its treasury shares at $27 cash per share | | |

| August 22 | Sold 2,500 of its treasury shares at $19 cash per share | | |

| September 5 | Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record | | |

| October 28 | Paid the dividend declared on September 5 | | |

| December 31 | Closed the $259,500 credit balance (from net income) in the Income Summary account to Retained Earnings | | |

### **Explanation of Key Concepts:**

- **Treasury Stock Transactions**: These occur when a company buys back its own shares (e.g., January 2 purchase) or sells previously repurchased shares (e.g., July 6 and August 22 sales).

- **Dividends**: Regular payments made to shareholders, impacting the cash or retained earnings (e.g., dividends declared on January 5 and September 5).

- **Net Income and Retained Earnings**: The closing of the net income into retained earnings on December 31 reflects the company’s profitability over the period.

Understanding these transactions helps comprehensively grasp how operational and financial decisions influence stockholders’ equity on a balance sheet.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company's board of directors declared a $0.50 per share cash dividend on its $3 par common stock. On the date of declaration, there were 44,000 shares authorized, 18,000 shares issued, and 5,000 shares held as treasury stock.What is the entry when the dividends are declared? A. Dividends 6,500 Dividends Payable 6,500 B. Dividends 6,500 Cash 6,500 C. Dividends 22,000 Dividends Payable 22,000 D. Dividends 9,000 Cash 9,000arrow_forwardThe following shareholders' equity accounts are reported by Branch Inc on January 1 Common shares (unlimited authorized, 150,000 issued) $2.400.000 Preferred shares ($4 cumulative, convertible, 100,000 authorized, 5,000 issued) 375,000 Contributed surplus-reacquisition of common shares 30.000 Retained earnings 1.275.000 The following selected transactions occurred during the year: Feb. 11 Issued 50,000 common shares at $20 per share. Mar. 2. Reacquired 20,000 common shares at $22 per share. Split the common shares 2 for 1 when the common shares were trading at $30 per share. June 14 July 25 Reacquired 500 preferred shares at $70 per share. Sept. 16 Reacquired 50,000 common shares for $17 per share. Declared a 5% common stock dividend distributable on December. 13 to shareholders of record on November 24. The fair value of the common shares on October 27 was $19 per share. Oct 27 Distributed the stock dividend declared on October 27. The fair value of the common shares on December 13…arrow_forwardUpperchurch Company reports the following components of stockholders' equity on January 1. Common stock-$10 par value, 130,e00 shares authorized, 50,0e0 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings $ 500,000 75,000 410,e00 Total stockholders' equity $ 985,000 During the year, the following transactions affected its stockholders' equity accounts. 2 Purchased 5,eee shares of its own stock at $23 cash per share. 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. 28 Paid the dividend declared on January 5. 6 Sold 1,98e of its treasury shares at $27 cash per share. 22 Sold 3,100e of its treasury shares at $20 cash per share. 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. Jan. Jan. Feb. July Aug. Sept. 28 Paid the dividend declared on September 5. 31 Closed the $214, eee credit balance (from net income) in…arrow_forward

- In Draco Corporation's first year of business, the following transactions affected its equity accounts. • Issued 7,400 shares of $2 par value common stock for $52. It authorized 20,000 shares. • Issued 1,850 shares of 12%, $10 par value preferred stock for $57. It authorized 3,000 shares. Reacquired 370 shares of common stock for $64 each. ● • Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31. (Amounts to be deducted should be indicated by a minus sign.) DRACO CORPORATION Stockholders' Equity Section of the Balance Sheet December 31 Total stockholders' equityarrow_forwardsharadarrow_forwardKohler Corporation reports the following components of stockholders’ equity at December 31 of the prior year. Common stock—$25 par value, 100,000 shares authorized, 60,000 shares issued and outstanding $ 1,500,000 Paid-in capital in excess of par value, common stock 80,000 Retained earnings 460,000 Total stockholders' equity $ 2,040,000 During the current year, the following transactions affected its stockholders’ equity accounts. January 2 Purchased 6,000 shares of its own stock at $15 cash per share. January 5 Directors declared a $4 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 3,000 of its treasury shares at $19 cash per share. August 22 Sold 3,000 of its treasury shares at $11 cash per share. September 5 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend…arrow_forward

- Kohler Corporation reports the following components of stockholders' equity at December 31 of the prior year. Common stock-$15 par value, 100,000 shares authorized, 60,000 shares issued and outstanding Paid-in capital in excess of par value, cormon stock Retained earnings Total stockholders' equity During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 4,000 shares of its own stock at $20 cash per share. January 5 February 28 July 6 August 22 September 5 Directora declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. Paid the dividend declared on January 5. Sold 2,000 of its treasury shares at $24 cash per share. Sold 2,000 of its treasury shares at $16 cash per share. Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend declared on September 5. December 31 Closed the $408,000 credit…arrow_forwardIf Common Stock is $10 par value , 140,000 shares are authorized, and 60,000 shares , if the directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record , what is the debit and credit ?arrow_forwardJournalize the following selected transactions completed during the current fiscal year: Jan. 3 The board of directors reduced the par of common shares from $100 to $20. This action increased the number of outstanding shares to 400,000. 22 Declared a dividend of $2.00 per share on the outstanding shares of common stock. Feb. 8 Paid the dividend declared on January 22. Sep. 1 Declared a 5% stock dividend on the common stock outstanding (the fair market value of the stock to be issued is $30). Oct. 1 Issued the certificates for the common stock dividend declared on September 1. (for each Journal Entry, omit the step of providing a brief explanation) JOURNAL Date Post. DR CR Jan 3 Jan 22 Feb 8…arrow_forward

- MH Corp. was organized on January 1, 20X7. The firm was authorized to issue 100,000 shares of $5 par value common stock. During 20X7, MH had the following transactions relating to stockholders' equity: Issued 15,000 shares of common stock at $7 per share. Issued 10,000 shares of common stock at $9 per share. Reported a net income of $270,000. Paid dividends of $60,000. Purchased 3,000 shares of treasury stock at $10 (part of the 10,000 shares issued at $9). What is the total stockholders' equity of MH at the end of 20X7? Select one: a. $355,000 b. $375,000 c. $498,000 d. $378,000 e. $495,000arrow_forwardDwight Corporation in its first year of operations had the following stock transactions. Record each transaction in the journal provided. Mar 3 Issued 10,000 shares of common stock, $1 par value, for cash of $50,000. Apr 12 Issued 500 shares of preferred stock, $10 par value, for cash of $12,500. Jul 8 Issued 2,000 shares of preferred stock, $10 par value, in exchange for land valued at $60,000.arrow_forwardKohler Corporation reports the following components of stockholders' equity at December 31 of the prior year. Common stock-$25 par value, 100,000 shares authorized, 60,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 6,000 shares of its own stock at $20 cash per share. January 5 Directors declared a $6 per share cash dividend payable on February 28 to the February 5 stockholders of record. Paid the dividend declared on January 5. February 28 Sold 3,000 of its treasury shares at $24 cash per share. Sold 3,000 of its treasury shares at $16 cash per share. July 6 August 22 September 5 October 28 December 31 Directors declared a $6 per share cash dividend payable on October 28 to the September 25 stockholders of record. Paid the dividend declared on September 5. Closed the $408,000 credit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education