FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

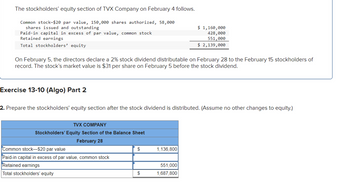

Transcribed Image Text:The stockholders' equity section of TVX Company on February 4 follows.

Common stock-$20 par value, 150,000 shares authorized, 58,000

shares issued and outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

On February 5, the directors declare a 2% stock dividend distributable on February 28 to the February 15 stockholders of

record. The stock's market value is $31 per share on February 5 before the stock dividend.

Exercise 13-10 (Algo) Part 2

2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.)

TVX COMPANY

Stockholders' Equity Section of the Balance Sheet

February 28

Common stock-$20 par value

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

$

$

$ 1,160,000

428,000

551,000

$ 2,139,000

1,136,800

551,000

1,687,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Entries for Stock Dividends Vienna Corporation has 31,000 shares of $40 par common stock outstanding. On August 2, Vienna Corporation declared a 3% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $62 per share on August 2. Journalize the entries required on August 2, September 15, and October 8. If an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required" and leave the amount boxes blank. Aug. 2 Sept. 15 Oct. 8arrow_forwardOn June 30, Sharper Corporation's stockholders' equity section of its balance sheet appears as follows before any stock dividend or split. Sharper declares and immediately distributes a 50% stock dividend. Common stock-$10 par value, 90,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Exercise 11-8 (Algo) Large stock dividend LO P2 (1) Prepare the updated stockholders' equity section after the distribution is made. (2) Compute the number of shares outstanding after the distribution is made. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the updated stockholders' equity section after the distribution is made. SHARPER CORPORATION Stockholders' Equity Section of the Balance Sheet June 30 Total stockholders' equity 69 $ $ 900,000 400,000 760,000 $ 2,060,000 0arrow_forwardCurrent Attempt in Progress On January 1, Ivanhoe Corporation had 91,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $6 per share. During the year, the following occurred. Apr. 1 Issued 21,000 additional shares of common stock for $17 per share. June 15 July 10 Dec. 1 (a) 15 Declared a cash dividend of $1 per share to stockholders of record on June 30. Paid the $1 cash dividend. Issued 2,500 additional shares of common stock for $18 per share. Declared a cash dividend on outstanding shares of $2.30 per share to stockholders of record on December 31. Prepare the entries to record these transactions. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forward

- Stock Dividends Penguin Company has the following information regarding its common stock: $24 par, with 300,000 shares authorized, 132,000 shares issued, and 130,600 shares outstanding. On August 22, Penguin declared and paid a 15% stock dividend when the market price of the common stock was $28 per share. Required: 1. Prepare the journal entries to record declaration and payment of this stock dividend. If an amount box does not require an entry, leave it blank. Aug. 22 Dividends Declared Common Stock Additional Paid-In Capital-Common Stock Feedback 548,520 ✔ Aug. 22 Dividends Declared Common Stock 470,160 Check My Work 1. Small stock dividends are capitalized using the stock's market value, while large stock dividends are capitalized at the stock's par value. 470,160 78,360 2. Prepare the journal entries to record declaration and payment assuming it was a 30% stock dividend. If an amount box does not require an entry, leave it blank.arrow_forwardStockholders' Equity: Transactions and StatementThe stockholders' equity section of Night Corporation's balance sheet at January 1 follows: Common stock, $6 par value, 300,000 shares authorized, 60,000 shares 360,000 issued, 6,000 shares in treasury Additional paid-in capital In excess of par value 600,000 From treasury stock 37,500 637,500 Retained earnings 435,000 1,432,500 Less: Treasury stock (6,000 shares) at cost 172,500 Total Stockholders’ Equity 1,260,000 The following transactions affecting stockholders’ equity occurred during the year: Jan. 8 Issued 15,000 shares of previously unissued common stock for $26 cash per share. Mar. 12 Sold all of the treasury shares for $35 cash per share. June 30 Declared a five percent stock dividend on all outstanding shares of common stock. The market value of the stock was $31 per share. July 10 Issued the stock dividend declared on June 30. Oct. 7 Acquired 2,500 shares of common…arrow_forward3arrow_forward

- 9arrow_forwardEntries for Stock Dividends Paris Corporation has 20,000 shares of $80 par common stock outstanding. On June 8, Paris Corporation declared a 4% stock dividend to be issued August 12 to stockholders of record on July 13. The market price of the stock was $118 per share on June 8. Journalize the entries required on June 8, July 13, and August 12. For a compound transaction, if an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required" and leave the amount boxes blank, Jun. 8 Jul. 13 Aug. 12arrow_forward32arrow_forward

- nit.0arrow_forwardStockholders’ Equity: Transactions and Balance Sheet Presentation Beaker Corporation was organized on July 1, with an authorization of 50,000 shares of $5 no-par value preferred stock ($5 is the annual dividend) and 100,000 shares of $10 par value common stock. During July, the following transactions affecting stockholders’ equity occurred: July 1 Issued 31,000 shares of common stock at $21 cash per share. 12 Issued 3,500 shares of common stock in exchange for equipment with a fair market value of $71,000. 15 Issued 5,000 shares of preferred stock for cash at $40 per share. Required a. Prepare journal entries to record the foregoing transactions. General Journal Date Description Debit Credit Jul.01 Paid-in-Capital in Excess of Par Value - Common Stock Issued shares of common stock. Jul.12 Common Stock Issued common stock for equipment. Jul.15…arrow_forwardEntries for Stock Dividends Madrid Corporation has 22,000 shares of $80 par common stock outstanding. On August 2, Madrid Corporation declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $96 per share on August 2. Journalize the entries required on August 2, September 15, and October 8. If an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required and leave the amount boxes blank. Aug. 2 Sept. 15 Oct. 8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education