FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

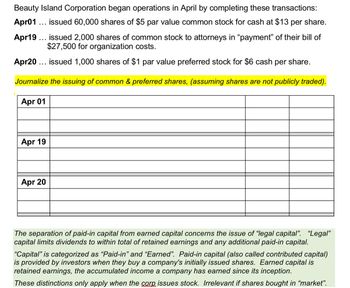

Transcribed Image Text:Beauty Island Corporation began operations in April by completing these transactions:

Apr01... issued 60,000 shares of $5 par value common stock for cash at $13 per share.

Apr19... issued 2,000 shares of common stock to attorneys in "payment" of their bill of

$27,500 for organization costs.

Apr20... issued 1,000 shares of $1 par value preferred stock for $6 cash per share.

Journalize the issuing of common & preferred shares, (assuming shares are not publicly traded).

Apr 01

Apr 19

Apr 20

The separation of paid-in capital from earned capital concerns the issue of “legal capital". "Legal"

capital limits dividends to within total of retained earnings and any additional paid-in capital.

"Capital" is categorized as "Paid-in" and "Earned". Paid-in capital (also called contributed capital)

is provided by investors when they buy a company's initially issued shares. Earned capital is

retained earnings, the accumulated income a company has earned since its inception.

These distinctions only apply when the corp issues stock. Irrelevant if shares bought in “market”.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- During its first year of operations, Concord Corporation had the following transactions pertaining to its common stock. Jan. 10 Issued 82,500 shares for cash at $6 per share. Mar. 1 Issued 5,000 shares to attorneys in payment of a bill for $37,700 for services rendered in helping the company to incorporate. Issued 31,700 shares for cash at $8 per share. July 1 Sept. 1 Issued 63,600 shares for cash at $10 per share. (a) Prepare the journal entries for these transactions, assuming that the common stock has a par value of $5 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record entries in the order displayed in the problem statement.) Date Account Titles and Explanation Debit Creditarrow_forwardRequired information The following information applies to the questions displayed below] Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $1 par value. During its first year, the following selected transactions were completed: a. Issued 5,400 shares of common stock for cash at $24 per share. b. Issued 1,400 shares of common stock for cash at $27 per share. 3. Prepare the stockholders' equity section as it should be reported on the year-end balance sheet. At year-end, the accounts reflected net income of $200. INCENTIVE CORPORATION Balance Sheet (Partial) At December 31 Stockholders' Equity Contributed Capital: Total Contributed Capital Total Stockholders' Equityarrow_forwardWhen Wisconsin Corporation was formed on January 1, the corporate charter provided for 95,400 shares of $10 par value common stock. During its first month of operation, the corporation issued 8,990 shares of stock at a price of $21 per share. The journal entry for this transaction would include a a. debit to Common Stock for $95,400 b. debit to Cash for $89,900 c. credit to Paid-In Capital in Excess of Par—Common Stock for $98,890 d. credit to Common Stock for $188,790arrow_forward

- During its first year of operations, Collin Raye Corporation had the following transactions pertaining to its common stock. Jan. 10 Mar. 1 Issued 80,000 shares for cash at $6 per share. Issued 5,000 shares to attorneys in payment of a bill for $35,000 for services rendered in helping the company to incorporate. July 1 Issued 30,000 shares for cash at $8 per share. Sept. 1 Issued 60,000 shares for cash at $10 per share. (a) Prepare the journal entries for these transactions, assuming that the common stock has a par value of $5 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record entries in the order displayed in the problem statement.)arrow_forwardPart A During its first year of operations, the A. Clem Corporation entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 103 million common shares, $1 par per share. Required: Prepare the appropriate journal entries to record each transaction. January 9 Issued 30 million common shares for $14 per share. March 11 Issued 4,200 shares in exchange for custom-made equipment. A. Clem shares have traded recently on the stock exchange at $14 per share. Part B A new staff accountant for the A. Clem Corporation recorded the following journal entries during the second year of operations. A. Clem retires shares that it reacquires (restores their status to that of authorized but unissued shares). Date General Journal ($ in millions) Debit Credit September 1 Common stock 4 Retained earnings 72 Cash 76 December 1 Cash 40 Common stock 2 Gain on sale of previously issued shares 38 Required:…arrow_forwardRequired information [The following information applies to the questions displayed below.] Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $1 par value. During its first year, the following selected transactions were completed: a. Issued 5,400 shares of common stock for cash at $24 per share. b. Issued 1,400 shares of common stock for cash at $27 per share. Required: 1. Complete the table below, indicating the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) Assets Liabilities Stockholders' Equityarrow_forward

- Work Place Products Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 50,000 shares of 3% preferred stock, $40 par and 600,000 shares of $10 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. July. 1. Issued 90,000 shares of common stock at par for cash. July. 1 Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Aug. 7. Issued 16,500 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $30,000, $164,000, and $37,000, respectively. For a compound transaction, if an amount box does not require an entry, leave it blank. Sept. 20. Issued 30,000 shares of preferred stock at $49 for cash. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forwardBased on the following information from Castle Keys Corporation, prepare the appropriate journal entries. Apr. 10 Incurred organization costs totaling $4,200. 12 Issued 9,000 shares of $10 par common stock for $110,000. 25 Issued 3,500 shares of 7%, $30 par preferred stock for $115,000. 30 Issued 6,000 shares of $10 par common stock for $65,000. May 15 Issued 3,000 shares of 7%, $30 par preferred stock for equipment with a fair market value of $90,000.arrow_forwardOM, Inc. was organized on January 1, 20X5. The firm was authorized to issue 1,000,000 shares of $3 par value common stock. During 20X5, OM had the following transactions relating to stockholders' equity: Issued 50,000 shares of common stock at $7 per share. Issued 30,000 shares of common stock at $8 per share. Reported a net income of $100,000. Paid dividends of $50,000. What is the total amount recorded in the Common Stock account at the end of 20X5? Select one: a. $240,000 b. $160,000 c. $80,000 d. $-0- e. $590,000arrow_forward

- Spring Company is authorized to issue 500,000 shares of $2 par value common stock. In its first year, the company has the following transactions: Mar. 1 Issued 40,000 shares of stock at $9.75 per share Apr. 10 Issued 1,000 shares of stock for legal services valued at $10,000 Oct. 3 Purchased 1,000 shares of treasury stock at $9 per share Journalize the 3 transactions and calculate how many shares of stock are outstanding on August 3. Required: 3 journal entries and the number of outstanding shares of stockarrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y8, were as follows: Record on journal page 10: Jan. 3 Issued 15,000 shares of $20 par common stock at $30, receiving cash. Feb. 15 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. May 1 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. 16 Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. 26 Paid the cash dividends declared on May 16. Jun. 8 Purchased 8,000 shares of treasury common stock at $33 per share. 30 Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. Jul. 11 Paid the cash dividends to the preferred…arrow_forward55arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education