FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

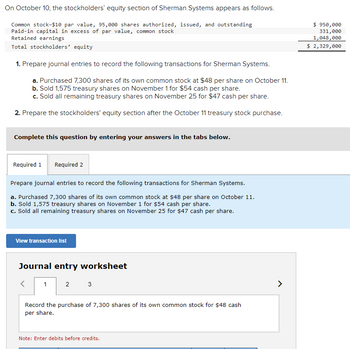

Transcribed Image Text:On October 10, the stockholders' equity section of Sherman Systems appears as follows.

Common stock-$10 par value, 95,000 shares authorized, issued, and outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

1. Prepare journal entries to record the following transactions for Sherman Systems.

a. Purchased 7,300 shares of its own common stock at $48 per share on October 11.

b. Sold 1,575 treasury shares on November 1 for $54 cash per share.

c. Sold all remaining treasury shares on November 25 for $47 cash per share.

2. Prepare the stockholders' equity section after the October 11 treasury stock purchase.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare journal entries to record the following transactions for Sherman Systems.

a. Purchased 7,300 shares of its own common stock at $48 per share on October 11.

b. Sold 1,575 treasury shares on November 1 for $54 cash per share.

c. Sold all remaining treasury shares on November 25 for $47 cash per share.

View transaction list

Journal entry worksheet

1

2

3

Record the purchase of 7,300 shares of its own common stock for $48 cash

per share.

Note: Enter debits before credits.

$ 950,000

331,000

1,048,000

$ 2,329,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 9 images

Knowledge Booster

Similar questions

- Kohler Corporation reports the following components of stockholders' equity at December 31 of the prior year. Common stock-$10 par value, 100,000 shares authorized, 50,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 5,000 shares of its own stock at $20 cash per share. January 5 Directors declared a $4 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 2,500 of its treasury shares at $24 cash per share. August 22 Sold 2,500 of its treasury shares at $16 cash per share. September 5 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend declared on September 5. December 31 Closed the $428,000 credit…arrow_forwardSubject:arrow_forwardDangerarrow_forward

- Stockholders' Equity: Transactions and StatementThe stockholders' equity section of Night Corporation's balance sheet at January 1 follows: Common stock, $6 par value, 300,000 shares authorized, 60,000 shares 360,000 issued, 6,000 shares in treasury Additional paid-in capital In excess of par value 600,000 From treasury stock 37,500 637,500 Retained earnings 435,000 1,432,500 Less: Treasury stock (6,000 shares) at cost 172,500 Total Stockholders’ Equity 1,260,000 The following transactions affecting stockholders’ equity occurred during the year: Jan. 8 Issued 15,000 shares of previously unissued common stock for $26 cash per share. Mar. 12 Sold all of the treasury shares for $35 cash per share. June 30 Declared a five percent stock dividend on all outstanding shares of common stock. The market value of the stock was $31 per share. July 10 Issued the stock dividend declared on June 30. Oct. 7 Acquired 2,500 shares of common…arrow_forwardReporting Stockholders' Equity Using the following accounts and balances, prepare the “Stockholders’ Equity” section of the balance sheet. 70,000 shares of common stock authorized, and 1,000 shares have been reacquired. Common Stock, $80 par $4,480,000 Paid-In Capital from Sale of Treasury Stock 90,000 Paid-In Capital in Excess of Par—Common Stock 784,000 Retained Earnings 2,330,000 Treasury Stock 60,000 Balance Sheet Stockholders' Equity Paid-in capital: $fill in the blank 2 fill in the blank 4 Paid-in capital, common stock $fill in the blank 5 fill in the blank 7 Total paid-in capital $fill in the blank 8 fill in the blank 10 Total $fill in the blank 11 fill in the blank 13 Total stockholders' equity $fill in the blank 14arrow_forwardPrepare the journal entry to record Autumn Company's issuance of 71,000 shares of no-par value common stock assuming the shares: a. Sell for $34 cash per share. b. Are exchanged for land valued at $2,414,000. View transaction list Journal entry worksheet 1 Record the issuance of 71,000 shares of no-par value common stock assuming the shares sell for $34 cash per share. 2 Note: Enter debits before credits. Transaction a. General Journal Debit Credit >arrow_forward

- 3arrow_forwardPrepare the journal entry to record Jevonte Company's issuance of 41,000 shares of its common stock assuming the shares have a: a. $3 par value and sell for $19 cash per share. b. $3 stated value and sell for $19 cash per share. View transaction list Journal entry worksheet < 1 Record the issuance of 41,000 shares of common stock assuming the shares have a $3 par value and sell for $19 cash per share. 2 Note: Enter debits before credits. Transaction a. General Journal Debit Creditarrow_forwardJournalizing issuance of stock for assets other than cash Cedar Corporation issued 36,000 shares of $1 par value common stock in exchange for a building with a market value of $160,000. Record the stock issuance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education