FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

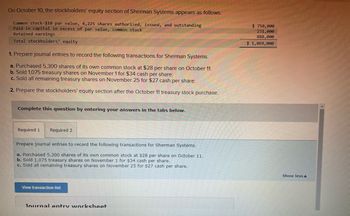

Transcribed Image Text:## Sherman Systems - Stockholders' Equity and Transactions

### Stockholders' Equity Section (as of October 10)

The stockholders' equity section for Sherman Systems appears as follows:

- **Common Stock**: $10 par value, 4,225 shares authorized, issued, and outstanding — **$750,000**

- **Paid-in Capital in Excess of Par Value, Common Stock** — **$231,000**

- **Retained Earnings** — **$888,000**

**Total Stockholders' Equity** — **$1,869,000**

### Transactions to Record

Prepare journal entries for the following transactions of Sherman Systems:

1. **On October 11**: Purchased 5,300 shares of its own common stock at $28 per share.

2. **On November 1**: Sold 1,075 treasury shares at $34 cash per share.

3. **On November 25**: Sold all remaining treasury shares for $27 cash per share.

### Stockholders' Equity Section Update

After the October 11 treasury stock purchase, you'll need to prepare an updated stockholders' equity section reflecting these changes.

#### Steps to Complete:

1. **Prepare Journal Entries**: Record each transaction for Sherman Systems.

2. **Update Equity Section**: Recalculate the stockholders' equity after the October 11 treasury stock purchase.

### Additional Features

- **Transaction List**: You can view a full list of transactions for easier reference.

- **Journal Entry Worksheet**: A tool available to help you draft and organize your journal entries.

**Note**: Navigate the tabs for required sections to input your answers and complete this educational exercise.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Top-Value Corporation has 256,500 shares of $35 par common stock outstanding. On September 2, Top-Value Corporation declared a 3% stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $50 per share on September 2. Required: Journalize the entries required on September 2, October 3, and November 30. If no entry is required, simply skip to the next transaction. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardAlma Corp. issues 1,120 shares of $7 par common stock at $15 per share. When the transaction is journalized, credits are made to a.Common Stock, $7,840 and Paid-In Capital in Excess of Par—Common Stock, $8,960. b.Common Stock, $16,800. c.Common Stock, $8,960 and Paid-In Capital in Excess of Stated Value, $7,840. d.Common Stock, $7,840 and Retained Earnings, $8,960.arrow_forwardOn January 1, Oriole Corporation had 61,400 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following transactions occurred. Issued 11,250 additional shares of common stock for $11 per share. Declared a cash dividend of $1.90 per share to stockholders of record on June 30. Paid the $1.90 cash dividend. Issued 5,000 additional shares of common stock for $12 per share. Dec. 15 Declared a cash dividend on outstanding shares of $2.00 per share to stockholders of record on December 31. Apr. 1 June 15 July 10 Dec. (a) Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to O decimal places, e.g.…arrow_forward

- The stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 20% stock dividend. The stock's per share market value on April 2 is $15 (prior to the dividend). Common stock-$5 par value, 415,000 shares authorized, 220,000 shares issued and outstanding Paid-in capital in excess of par value, common stock. Retained earnings Total stockholders' equity Prepare the stockholders' equity section immediately after the stock dividend is distributed. Total paid-in capital Total stockholders' equity JUN COMPANY Stockholders' Equity April 2 (after stock dividend) $ 0 $ 1,100,000 530,000 853,000 $ 2,483,000 0 4arrow_forwardFollowing is the stockholders' equity section as of June 30. Common stock-$20 par value, 200,000 shares authorized, 80,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity On July 1, the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record. The stock's market value is $50 per share on July 1 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Enter answers in the tabs below. Required 1 Required 2 $ 1,600,000 400,000 750,000 $ 2,750,000 Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Stockholders' Equity Section of the Balance Sheet July 31 Retained earnings Common stock Paid-in capital in excess of par value, common…arrow_forwardOn January 1, Pharoah Company had 87000 shares of $10 par value common stock outstanding. On May 7, the company declared a 5% stock dividend to stockholders of record on May 21. Market value of the stock was $16 on May 7. The stock was distributed on May 24. The entry to record the transaction of May 24 would include aarrow_forward

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, Year 1, were as follows: 1. Journalize the selected transactions. a. Issued 15,000 shares of $20 par common stock at $30, receiving cash. b. Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash c. Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at $40 per share plus a $150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at $33 per share h. Purchased 40,000 shares of Pinkberry Co. stock…arrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y8, were as follows: Record on journal page 10: Jan. 3 Issued 15,000 shares of $20 par common stock at $30, receiving cash. Feb. 15 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. May 1 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. 16 Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. 26 Paid the cash dividends declared on May 16. Jun. 8 Purchased 8,000 shares of treasury common stock at $33 per share. 30 Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. Jul. 11 Paid the cash dividends to the preferred…arrow_forwardPrepare the journal entry to record Zende Company's issuance of 84,000 shares of $8 par value common stock assuming the shares sell for: a. $8 cash per share. b. $9 cash per share. View transaction list Journal entry worksheet 1 Record the issuance of 84,000 shares of $8 par value common stock assuming the shares sell for $8 cash per share. 2 Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journal Saved >arrow_forward

- Nebraska Inc. issues 2,300 shares of common stock for $73,600. The stock has a stated value of $12 per share. The journal entry to record the stock issuance would include a credit to Common Stock for a.$73,600 b.$27,600 c.$2,300 d.$46,000arrow_forwardThe stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10% stock dividend. The stock's per share market value on April 2 is $20 (prior to the dividend). Common stock-$5 par value, 375,000 shares authorized, 200,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Prepare the stockholders' equity section immediately after the stock dividend is distributed. Total paid-in capital JUN COMPANY Stockholders' Equity April 2 (after stock dividend) Total stockholders' equity $ $ 1,000,000 600,000 833,000 $ 2,433,000 0arrow_forwardPrepare the journal entry to record Zende Company's issuance of 79,000 shares of $8 par value common stock assuming the shares sell for: a. $8 cash per share. b. $9 cash per share. View transaction list Journal entry worksheetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education