FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

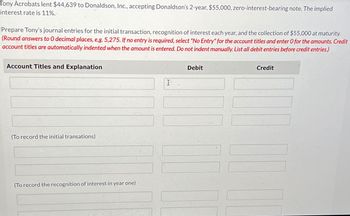

Transcribed Image Text:Tony Acrobats lent $44,639 to Donaldson, Inc., accepting Donaldson's 2-year, $55,000, zero-interest-bearing note. The implied

interest rate is 11%.

Prepare Tony's journal entries for the initial transaction, recognition of interest each year, and the collection of $55,000 at maturity.

(Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit

account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)

Account Titles and Explanation

(To record the initial transations)

(To record the recognition of interest in year one)

Debit

I

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Haresharrow_forwardAkbar Associates issued 120-day note for $50,000 to a creditor on a account. The note was discounted at 6%. Assuming a 360-day year: a. What cash proceeds would Akbar receive from the note? b. How much would Akbar repay the creditor at the note's maturity? =arrow_forward(c) Pearl Inc. loans money to John Kruk Corporation in the amount of $832,000. Pearl accepts an 8% note due in 7 years with interest payable semiannually. After 2 years (and receipt of interest for 2 years), Pearl needs money and therefore sells the note to Chicago National Bank, which demands interest on the note of 10% compounded semiannually. What is the Amount received on sale of note LINK TO TEXT LINK TO TEXT LINK TO TEXTarrow_forward

- BBY Company loaned $66,116 to Orwell, Inc, accepting Orwell's 2-year, $80,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare BBY's journal entries for the initial transaction, recognition of interest each year, and the collection of $80,000 at maturity. Debit - Notes Receivable $80,000 Credit - Credit - Cash Debit - Credit - Debit - Credit - Interest Revenue 6.026 DEC 16 618 10arrow_forwardCullumber Company borrowed $313,000 on January 1, 2022, by issuing a $313,000, 10% mortgage note payable. The terms call for annual installment payments of $54,000 on December 31. (a) Prepare the journal entries to record the mortgage loan and the first two installment payments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit ILOR Credarrow_forwardCrane Taco Company receives a $94,500, 6-year note bearing interest of 8 % (paid annually) from a customer at a time when the discount rate is 10%. Click here to view the factor table. What is the present value of the note received by Crane? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Present value of note received e Textbook and Media Save for Later $ Attempts: unlimited Submit Answerarrow_forward

- Doid Acrobats lent $16,529 to Donaldson, Inc., accepting Donaldson's 2-year, $20,000, zero interest bearing note. The implied interest rate is 10% Prepare Dold's journal entries for the initial transaction. Notes Receivable 20.000 Cash 20,000arrow_forwardDave borrowed $550 on January 1, 2022, and paid it all back at once on December 31, 2022. The bank charged him a $3.50 service charge, and interest was $40.70. What was the APR? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Annual percentage rate %arrow_forwardChang took out a loan for 146 days and was charged simple interest at an annual rate of 12.5%. The total interest he paid on the loan was $245. How much money did Chang borrow? Assume that there are 365 days in a year, and do not round any intermediate computations. If necessary, refer to the list of financial formulas. $0 Explanation 50°F Partly sunny A Check X 4 Ś ? T a 1 Ⓒ2022 McGraw Hill LLC. All Rights Reserved. Terms of U 27 W X PDF/arrow_forward

- Lucky company borrowed an amount of money from ZER Finance Co. In return, ZER Finance Co received a $ 200,000, 4 year, 6% note from Lucky. On the date of the transaction, the market rate on interest was 8% for a similar note. Instructions: Calculate the net carrying value of the notes receivable on the books of ZER Finance, at the end of year one assuming that Zer is using effective interest method to amortize discount or premium on note receivable The following information might help you: Present value of a future sum factor, 6%, 4 years= 0.7921 Present value of a future sum factor, 8%, 4 years= 0.7350 Present value of an ordinary annuity factor, 6%, 4 years= 3.5 Present value of an ordinary annuity factor, 8%, 4 years= 3.3 (When writing your answer do not use commas or sign of the dollar. For example, if your answer is $1,500, write it as 1500) Answer:arrow_forwardLeon Acrobats lent $12,174 to Donaldson, Inc., accepting Donaldson's 2-year, $15,000, zero-interest-bearing note. The implied interest rate is 11%. Prepare Leon's journal entries for the initial transaction, recognition of interest each year, and the collection of $15,000 at maturity. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation (To record the initial transations) (To record the recognition of interest in year one) (To recognize the interest in year 2) Debit Credit [] |||||arrow_forwardPlease answer the question correctly. Thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education