FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

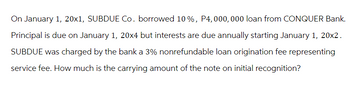

Transcribed Image Text:On January 1, 20x1, SUBDUE Co. borrowed 10%, P4, 000, 000 loan from CONQUER Bank.

Principal is due on January 1, 20x4 but interests are due annually starting January 1, 20x2.

SUBDUE was charged by the bank a 3% nonrefundable loan origination fee representing

service fee. How much is the carrying amount of the note on initial recognition?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1, Felton Company borrows $90,000 from Ottawa State Bank by signing a 6-month, 8%, interest-bearing note. Instructions Prepare the necessary entries below associated with the note payable on the books of Felton Company. (a) Prepare the entry on March 1 when the note was issued. (b) Prepare the entry to record payment of the note at maturity. Essay Toolbar navigation B I U S E E = v Aarrow_forwardOn June 5 Glover Co. issued a $60,000, 6%, 120-day note payable to Jones Co. How much will Glover Co. have to pay at maturity? a. $63,600. b. $58,800. c. $60,000. d. $61,200.arrow_forwardDold Acrobats lent $16,529 to Donaldson, Inc., accepting Donaldson's 2-year, $20,000, zero interest bearing note. The implied interest rate is 10% Prepare Dold's Journal entry for the recognition of interest for the first year of the note. Cash 3,471arrow_forward

- harrow_forwardOn August 1, Taylor Company lent $80,000 to L. King on a 90-day, 5% note. 14. Journalize for Taylor Company the lending of the money on August 1. 15. Journalize the collection of the principal and interest at maturity. Specify the date. Round interest to the nearest dollar. 14. Journalize for Taylor Company the lending of the money on August 1. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. For notes stated in days, use a 365-day year.) Date Aug. 1 Accounts and Explanation Debit Creditarrow_forwardProceeds from Notes Payable On May 15, Franklin Co. borrowed cash from Dakota Bank by issuing a 30-day note with a face amount of $96,000. Assume a 360-day year. Required: a. Determine the proceeds of the note, assuming that the note carries an interest rate of 6%. $ b. Determine the proceeds of the note, assuming that the note is discounted at 6%.arrow_forward

- On May 22, Jarrett Company borrows $8,800, signing a 90-day, 8%, $8,800 note. What is the journal entry made by Jarrett Company to record the transaction? Multiple Choice Debit Cash $8,800; credit Accounts Payable $8,800. Debit Accounts Payable $8,800; credit Notes Payable $8,800. Debit Cash $8,976; credit Notes Payable $8,976. Debit Cash $8,800; credit Notes Payable $8,800. Debit Notes Receivable $8,800; credit Cash $8,800.arrow_forwardanswer in text form please (without image)arrow_forwardBBY Company loaned $66,116 to Orwell, Inc, accepting Orwell's 2-year, $80,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare BBY's journal entries for the initial transaction, recognition of interest each year, and the collection of $80,000 at maturity. Debit - Notes Receivable $80,000 Credit - Credit - Cash Debit - Credit - Debit - Credit - Interest Revenue 6.026 DEC 16 618 10arrow_forward

- 4. AB company receives $10,000 for a 6 month, 8% note on 11/1/20. Prepare the journal entry for the receipt. Account Debit Credit 5. Prepare the journal entry to accrue interest on the above note at 12/31/20. Account Debit Credit 6. Prepare the entry to record payment of the above note in full on it's due date of 5/1/21. Account Debit Credit 7. AB Company purchases a truck in the amount of $15,000. Additional costs include sales tax of $1500, painting of $2500, license of $150 and a 1 year auto insurance policy of $1200. Complete the journal entry for the auto purchase. Account Debit Creditarrow_forwardA business issued a 45-day, 6% note for $210,000 to a creditor. Principal and interest are payable at maturity. How is maturity value calculated in this case? What is the maturity value of the note?arrow_forwardntries for Discounted Note Payable A business issued a 60-day note for $36,000 to a creditor on account. The note was discounted at 6%. Assume a 360-day year. a. Journalize the entry to record the issuance of the note. For a compound transaction, if an amount box does not require an entry, leave it blank. If necessary, round to one decimal place. a. b. Journalize the entry to record the payment of the note at maturity. b.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education