FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

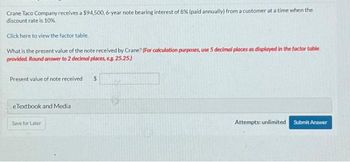

Transcribed Image Text:Crane Taco Company receives a $94,500, 6-year note bearing interest of 8 % (paid annually) from a customer at a time when the

discount rate is 10%.

Click here to view the factor table.

What is the present value of the note received by Crane? (For calculation purposes, use 5 decimal places as displayed in the factor table

provided. Round answer to 2 decimal places, e.g. 25.25.)

Present value of note received

e Textbook and Media

Save for Later

$

Attempts: unlimited Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Answer with in 30 Minutes to get upvotes?arrow_forwardDold Acrobats lent $16,529 to Donaldson, Inc., accepting Donaldson's 2-year, $20,000, zero interest bearing note. The implied interest rate is 10% Prepare Dold's Journal entry for the recognition of interest for the first year of the note. Cash 3,471arrow_forwardAnderson Co. issued a $57,329, 60-day, discounted note to National Bank. The discount rate is 9%. At maturity, assuming a 360-day year, the borrower will payarrow_forward

- JAB Consulting received a promissory note of $18,500 at 8% simple interest for 15 months from one of its customers. After 6 months, Grove Isle Bank discounted the note at a discount rate of 5% Calculate the proceeds that JAB Consulting will receive from the discounted note. Step 1 When a promissory note is sold before maturity, it is said to be discounted. The maturity value represents the total amount of money a promissory note will be worth after interest has accrued. The maturity value is calculated as follows where the rate is expressed as a decimal and the time is a fraction whose numerator is the given amount of time in months and denominator is 12 months. maturity value = principal(1 + rate ✕ time) The rate was given to be 8%. As a decimal, we have 8% = . Find the maturity value (in $) for the promissory note of $18,500 at 8% interest for 15 months. maturity value = principal(1 + rate ✕ time) = 18,500 1 + ✕ 15 12 = $arrow_forwardPlease see below. I need help with the part a2.arrow_forwardAkbar Associates issued 120-day note for $50,000 to a creditor on a account. The note was discounted at 6%. Assuming a 360-day year: a. What cash proceeds would Akbar receive from the note? b. How much would Akbar repay the creditor at the note's maturity? =arrow_forward

- answer in text form please (without image)arrow_forward4. AB company receives $10,000 for a 6 month, 8% note on 11/1/20. Prepare the journal entry for the receipt. Account Debit Credit 5. Prepare the journal entry to accrue interest on the above note at 12/31/20. Account Debit Credit 6. Prepare the entry to record payment of the above note in full on it's due date of 5/1/21. Account Debit Credit 7. AB Company purchases a truck in the amount of $15,000. Additional costs include sales tax of $1500, painting of $2500, license of $150 and a 1 year auto insurance policy of $1200. Complete the journal entry for the auto purchase. Account Debit Creditarrow_forwardNelson Co. issued a $80,000, 90-day, discounted note to Community Bank. The discount rate is 5%. At maturity, assuming a 360-day year, the borrower will pay how much?arrow_forward

- 1. What are all the journal entries? 2. How muh is the interest expense in 20x2? 3. How much is the carrying amount of the note in dec. 31, 20x1?arrow_forwardAssuming a 360-day year, proceeds of $47,444 were received from discounting a $48,147, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was a. 7.59% Ob. 7.08% Oc. 5.84% Od. 3.84%arrow_forwardAssuming a 360-day year, proceeds of $43,722 were received from discounting a $44,958, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was O a. 12.24% b. 11.00% c. 9% Od. 12.75%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education