Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

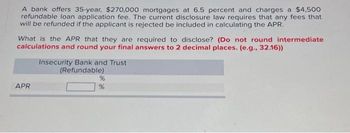

Transcribed Image Text:A bank offers 35-year, $270,000 mortgages at 6.5 percent and charges a $4,500

refundable loan application fee. The current disclosure law requires that any fees that

will be refunded if the applicant is rejected be included in calculating the APR.

What is the APR that they are required to disclose? (Do not round intermediate

calculations and round your final answers to 2 decimal places. (e.g., 32.16))

APR

Insecurity Bank and Trust

(Refundable)

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A mortgage applicant who has a monthly gross income of $4,285.00 applies for a mortgage with monthly PITI of $1,542.60. The applicant's other financial obligations total $231.39 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would the applicant qualify for?arrow_forwardOn April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $277,500. The interest rate charged by the bank was 4.50%. The bank made the loan on a discount basis. Exercise 7-5 (Algo) Part a Required: a-1. Calculate the loan proceeds made available to Powell. Loan proceedsarrow_forwardPlease provide correct solutionarrow_forward

- A mortgage applicant who has a monthly gross income of $4,705.00 applies for a mortgage with monthly PITI of $1,411.50. The applicant's other financial obligations total $282.30 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would the applicant qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% O FHA only O Conventional only O FHA and Conventional O None of the abovearrow_forwardI can purchase a 1-year Certificate of Deposit at a bank. The bank uses that deposit money to fund a 30-year mortgage loan. This is an example of (2 words)arrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forward

- On 2019-03-23, xeniya deposits $814.22 in an account paying a simple interest rate 5.540%. Calculate the force of interest δ(t) on 2019-10-22. Use the daycount convention ACT/365.arrow_forwardA bank offers 35-year, $175,000 mortgages at 4.6 percent and charges a $3,600 refundable loan application fee. The current disclosure law requires that any fees that will be refunded if the applicant is rejected be included in calculating the APR What is the APR that they are required to disclose? (Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) APR Insecurity Bank and trust (Refundable) % %arrow_forwardA loan of $10,000 is taken out on November 7, 2020 at a simple interest rate of r = 9%. The loan will be paid back on May 11, 2021. If the bank uses ordinary interest (the Banker's Rule), how much interest is charged? a $450.00 b $456.16 c $443.84 d $462.50arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education