Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

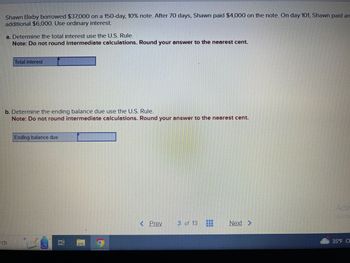

Transcribed Image Text:Shawn Bixby borrowed $37,000 on a 150-day, 10% note. After 70 days, Shawn paid $4,000 on the note. On day 101, Shawn paid an

additional $6,000. Use ordinary interest.

a. Determine the total interest use the U.S. Rule.

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Total interest

b. Determine the ending balance due use the U.S. Rule.

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

rch

Ending balance due

BM

< Prev

3 of 13

Next >

men

*********

Go to

35°F Cl

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The amount of simple interest on a deposit varies jointly with the principal and the time in days. If $17.85 is earned on a deposit of $3500 for 12 days, how much interest would be earned on a deposit of $3700 for 20 days? ... The deposit would earn S in interest. (Simplify your answer. Round to the nearest cent as needed.)arrow_forwardOn March 24, 2014, Brendan and Madison borrow $18,000 each at a simple interest rate r = 12%. Brendan’s bank calculates interest using exact interest, while Madison's bank uses the Banker's Rule (ordinary interest). Let X = amount Brendan pays back on September 24, 2014, and Y = amount Madison pays back on September 24, 2014. What is the value of X - Y?arrow_forward2. On 30 December 2020, Salina received a 90-day promissory note with a simple interest rate of 4.5%. She discounted the note after 32 days with a bank discount rate of 2.33%. The proceeds received was RM10,784.36. Using Banker's Rule. No use excel. Find: a) the maturity date of the note. b) the maturity value of the note.arrow_forward

- nt Shawn Bixby borrowed $25,000 on a 120-day, 15% note. After 60 days, Shawn paid $2,800 on the note. On day 96, Shawn paid an additional $4,800. Use ordinary interest. a. Determine the total interest use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Total interest b. Determine the ending balance due use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Ending balance duearrow_forwardShawn Bixby borrowed $29,000 on a 120-day, 8% note. After 55 days, Shawn paid $3,200 on the note. On day 95, Shawn paid an additional $5,200. Use ordinary interest. a. Determine the total interest use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Total interest b. Determine the ending balance due use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Ending balance duearrow_forward78.arrow_forward

- plz solve!!!arrow_forwardOn March 24, 2014, Brendan and Madison borrow $18,000 each at a simple interest rate r = Brendan's bank calculates interest using exact 12%. interest, while Madison's bank uses the Banker's Rule (ordinary interest). Let X = amount Brendan pays back on September 24, 2014, and Y = amount Madison pays back on September 24, 2014. What is the value of X - Y?arrow_forwardKhamis deposited RO. 12,000 each in two different banks ,bank A and bank B at a rate of 3.1 % per annum for (55+1) years. If Bank A follows simple interest method and Bank B follows compound interest method, calculate and compare the simple interest and the compound interest that Khamis receives on his deposits. please solve manuallyarrow_forward

- Navy Bank requires borrowers to keep a 13 percent compensating balance. Gorman Jewels borrow $380,000 at a 6 percent stated APR. What is the effective interest rate on the loan? (Round answer to 2 decimal places, e.g. 12.25%.) Effective interest rate ________ %arrow_forwardSlingerland borrowed $7,000 on July 20 at 11% interest. If the loan was due on October 15, what was the amount of interest on the loan using the exact interest method? options are: a. 120.25 b. 166.85 c. 183.53 d. 256.67arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education