FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

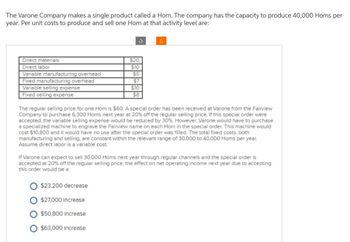

Transcribed Image Text:The Varone Company makes a single product called a Hom. The company has the capacity to produce 40,000 Homs per

year. Per unit costs to produce and sell one Hom at that activity level are:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling expense

Fixed selling expense

S

$20

$10

$5

$7

O $23,200 decrease

$27,000 Increase

$50,800 Increase

O $63,000 Increase

$10

$8

The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview

Company to purchase 6,300 Homs next year at 20% off the regular selling price. If this special order were

accepted, the variable selling expense would be reduced by 30%. However, Varone would have to purchase

a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would

cost $10,800 and it would have no use after the special order was filled. The total fixed costs, both

manufacturing and selling, are constant within the relevant range of 30,000 to 40,000 Homs per year.

Assume direct labor is a variable cost.

If Varone can expect to sell 30,000 Homs next year through regular channels and the special order is

accepted at 20% off the regular selling price, the effect on net operating income next year due to accepting

this order would be a:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Reuben's Deli currently makes rolls for deli sandwiches it produces. It uses 31,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: Materials $0.24 per roll Labor 0.39 per roll Variable overhead 0.16 per roll Fixed overhead 0.20 per roll A potential supplier has offered to sell Reuben the rolls for $0.89 each. If the rolls are purchased, 30% of the fixed overhead could be avoided. If Reuben accepts the offer, what will the effect on profit be? decline in profit if he buys the rolls. Reuben would see a $arrow_forwardMohave Corporation is considering outsourcing production of the umbrella tote bag included with some of its products. The company has received a bid from a supplier in Vietnam to produce 8,700 units per year for $10.00 each. Mohave the following information about the cost of producing tote bags: Direct materials $ 6.00 Direct labor 2.00 Variable manufacturing overhead 1.00 Fixed manufacturing overhead 1.50 Total cost per unit $ 10.50 Mohave determined all variable costs could be eliminated by outsourcing the tote bags, while 70 percent of the fixed overhead cost is unavoidable. At this time, Mohave has no specific use in mind for the space currently dedicated to producing the tote bags. Required: 1) Based on the incremental analysis, should Mohave buy the tote bags or continue making them? 2) Suppose the space Mohave currently uses to make the bags could be utilized by a new product line that would generate $12,000 in annual profits. Recompute the difference in cost…arrow_forwardThe machining division of Cullumber International has a capacity of 2,000 units. Its sales and cost data are: Selling price per unit $80 Variable manufacturing costs per unit 25 Variable selling costs per unit 3 Total fixed manufacturing overhead 183,200 The machining division is currently selling 1,800 units to outside customers, and the assembly division of Cullumber International wants to purchase 400 units from machining. If the transaction takes place, the variable selling costs per unit on the units transferred to assembly will be $0/unit, and not $3/unit. If Cullumber's assembly division is currently buying from an outside supplier at $75 per unit, what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer price? The company profits would by $arrow_forward

- Supler Corporation produces a part used in the manufacture of one of its products. The unit product cost is $21, computed as follows: Direct materials $ 8 Direct labor 7 Variable manufacturing overhead 1 Fixed manufacturing overhead 5 Unit product cost $ 21 An outside supplier has offered to provide the annual requirement of 5,500 of the parts for only $13 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the costs saved by purchasing the units of purchasing the parts from the outside supplier would be: Multiple Choice $1 per unit on average ($8) per unit on average $6 per unit on average ($1) per unit on averagearrow_forwardEvery year Blue Industries manufactures 7,300 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total (a) $3.00 Total relevant cost to make $ 11.00 Net relevant cost to buy $ 8.00 Cullumber, Inc., has offered to sell 7,300 units f part 231 to Blue for $33 per unit. If Blue accepts Cullumber's offer, its freed-up facilities could be used to earn $10,700 in contribution margin by manufacturing part 240. In addition, Blue would eliminate 50% of the fixed overhead applied to part 231. 10.00 $32.00 Calculate total relevant cost to make and net cost to buy.arrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $155 and $115, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 110,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 $ 12 Direct labor 23 26 Variable manufacturing overhead 22 12 Traceable fixed manufacturing overhead 23 25 Variable selling expenses 19 15 Common fixed expenses 22 17 Total cost per unit $ 133 $ 107 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Required: 1. What is the total amount of traceable fixed manufacturing overhead for each of the two products? what is the alpha and betaarrow_forward

- Beach Blanket Bonanza Corporation sells its popular mid-century beach towel for $18 per unit, and the standard cost card for the product shows the following costs: Direct material $1 Direct labor 2 Overhead (80% fixed) 7 Total $10 Beach Blanket Bonanza Corporation received a special order for 1,000 units of the beach towel. The only additional cost to Beach Blanket Bonanza would be foreign import taxes of $1 per unit. If Beach Blanket Bonanza is able to sell all of the current production domestically, what would be the minimum sales price that Beach Blanket Bonanza would consider for this special order? Group of answer choices $11.00 $19.00 $5.40 $18.00arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardNardin Outfitters has a capacity to produce 12,000 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $900 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs $ 440 Fixed manufacturing costs 90 Variable selling and administrative costs 80 Fixed selling and administrative costs 50 Total costs $ 660 The company has received a special order for 500 tents at a price of $600 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $45 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case $ 600 Variable manufacturing costs 440 Fixed manufacturing costs 90 Variable selling and administrative costs 45 Fixed selling and…arrow_forward

- Han Products manufactures 28,000 units of part 5-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 Is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per part $ 3.60 11.00 2.40 6.00 $23.00 An outside supplier has offered to sell 28,000 units of part S-6 each year to Han Products for $21 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company at an annual rental of $78,000. However, Han Products has determined that two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part S-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer?arrow_forwardRain Incorporated currently manufactures part QX100, which is used in several products produced by the company. Monthly production costs for 10,000 units of QX100 are as followarrow_forwardRoyal Company manufactures 10,000 units of Part R-3 each year. At this level of activity, the cost per unit for Part-R-3 follows: Direct materials Direct labour $14.40 21.00 Variable manufacturing overhead Fixed manufacturing overhead 9.60 25.00 $70.00 Total cost per part An outside supplier has offered to sell 10,000 units of Part R-3 each year to Royal Company for $54 per part. If Royal Company accepts this offer, the facilities now being used to manufacture Part R-3 could be rented to another company at an annual rental of $150,000. However, Royal Company has determined that $15 of the fixed manufacturing overhead being applied to Part R-3 would continue even if the part was purchased from the outside supplier. Required: Compute the net dollar advantage or disadvantage of accepting the outside supplier's offer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education