FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

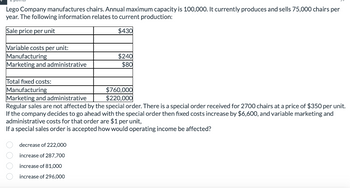

Transcribed Image Text:Lego Company manufactures chairs. Annual maximum capacity is 100,000. It currently produces and sells 75,000 chairs per

year. The following information relates to current production:

Sale price per unit

$430

Variable costs per unit:

Manufacturing

Marketing and administrative

Total fixed costs:

Manufacturing

$240

$80

$760,000

$220,000

Marketing and administrative

Regular sales are not affected by the special order. There is a special order received for 2700 chairs at a price of $350 per unit.

If the company decides to go ahead with the special order then fixed costs increase by $6,600, and variable marketing and

administrative costs for that order are $1 per unit,

If a special sales order is accepted how would operating income be affected?

decrease of 222,000

increase of 287,700

increase of 81,000

increase of 296,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Division A manufactures electronic circuit boards that can be sold to Division B of the same company or to outside customers. Last year, the following activity occurred in Division A: Selling price per circuit board Variable cost per circuit board Number of circuit boards: Produced during the year Sold to outside customers Sold to Division B $ 178 $ 120 21,000 15,600 5,400 Sales to Division B were at the same price as sales to outside customers. The circuit boards purchased by Division B were used in an electronic instrument manufactured by that division (one board per instrument). Division B incurred $210 in additional variable cost per instrument and then sold the instruments for $620 each. Required: 1. Calculate the net operating incomes earned by Division A, Division B, and the company as a whole. 2. Assume Division A's manufacturing capacity is 21,000 circuit boards. Next year, Division B wants to purchase 6,400 circuit boards from Division A rather than 5,400. (Circuit boards of…arrow_forwardComer Company produces and sells strings of colorful indoor/outdoor lights for holiday display to retailers for $16.13 per string. The variable costs per string are as follows: Direct materials $1.87 Direct labor 1.70 Variable factory overhead 0.57 Variable selling expense 0.42 Fixed manufacturing cost totals $805,272 per year. Administrative cost (all fixed) totals $614,367. Comer expects to sell 253,600 strings of light next year. Required: 1. Calculate the break-even point in units.fill in the blank 1 units 2. Calculate the margin of safety in units.fill in the blank 2 units 3. Calculate the margin of safety in dollars.$fill in the blank 3 4. Conceptual Connection: Suppose Comer actually experiences a price decrease next year while all other costs and the number of units sold remain the same. Would this increase or decrease risk for the company? (Hint: Consider what would happen to the number of break-even units and to the margin of safety.) IncreaseDecrease Please…arrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost Information relating to the products follow: Selling price per unit Variable expenses per unit Product Weedban $ 6.00 $ 2.40 $ 45,000 Greengrow $ 7.50 $ 5.25 $ 21,000 Traceable fixed expenses per year Last year the company produced and sold 15,000 units of Weedban and 28,000 units of Greengrow. Its annual common fixed expenses are $33,000. Required: Prepare a contribution format Income statement segmented by product lines. × Answer is not complete. Product Line Total Company Weedban Sales Variable expenses Contribution margin $ 300,000 $ 90,000 183,000 → 38,000 ✔ Greengrow $ 210,000 147,000 117,000 54,000 63,000 Traceable fixed expenses Gross margin 66,000 45,000 63,000 x x 51,000 $ 9,000 $ 0 33,000 Net operating income S 18,000arrow_forward

- Markham Farms reports the following contribution margin income statement for the month of August. The company has the opportunity to purchase new machinery that will reduce its variable cost per unit by $2 but will increase fixed costs by 10%. MARKHAM FARMS Contribution Margin Income Statement Sales (1,500 Units @ $70 per unit) $105,000 Variable Costs (1,500 Units @ $15 per Unit) 22,500 Contribution Margin $82,500 Fixed Cost 40,000 Net Income (Loss) $42,500 Prepare a projected contribution margin income statement for Markham Farm assuming it purchases the new equipment. Assume sales level remains unchanged. blankMARKHAM FARMSContribution Margin Income Statement $Sales Variable Costs $Contribution Margin Fixed Cost $Net Income (Loss)arrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban $ 10.00 $ 3.00 $ 133,000 Greengrow $31.00 $11.00 $ 35,000 Last year the company produced and sold 41,500 units of Weedban and 24,500 units of Greengrow. Its annual common fixed expenses are $105,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forwardFranz began business at the start of this year and had the following costs: variable manufacturing cost per unit, $9; fixed manufacturing costs, $60,000; variable selling and administrative costs per unit, $2; and fixed selling and administrative costs, $220,000. The company sells its units for $45 each. Additional data follow. Planned production in units 10,000 Actual production in units 10,000 Number of units sold 8,500 - The net income (loss) under absorption costing is: A. $(7,500) B. $9,000 C. $15,000 D. $18,000 - The net income (loss) under variable costing is: A. $(7,500) B. $9,000 C. $15,000 D. $18,000arrow_forward

- Flying Cloud Co. has the following operating data for its manufacturing operations: Unit selling price $239 Unit variable cost $108 Total fixed costs $842,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be Oa. increased by 858 units Ob, decreased by 858 units Oc. increased by 686 units Od. increased by 1,029 unitsarrow_forwardsarrow_forwardWhat is another way of saying "Interest earned on interest"?arrow_forward

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban $ 10.00 $2.40 $ 131,000 Greengrow $ 34.00 $14.00 $ 31,000 Last year the company produced and sold 42,000 units of Weedban and 16,500 units of Greengrow. Its annual common fixed expenses are $111,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forwardJayleen Company makes two products: Carpet Kleen and Floor Deodorizer. Operating information from the previous year follows. Carpet Kleen Units produced and sold Machine hours used Sales price per unit Variable cost per unit 4,000 4,000 $ 6 $4 Floor Deodorizer 3,000 1,500 $ 12 $ 10 Fixed costs of $39,000 per year are presently allocated equally between both products. If the product mix were to change, total fixed costs would remain the same. The contribution margin per machine hour for Floor Deodorizer is:arrow_forward! Required information [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $76 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 58,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $ 23 $ 15 $3 $ 3 $ 1,160,000 $ 640,000 The company sold 40,000 units in the East region and 14,000 units in the West region. It determined that $320,000 of its fixed selling and administrative expense is traceable to the West region, $270,000 is traceable to the East region, and the remaining $50,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education