FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

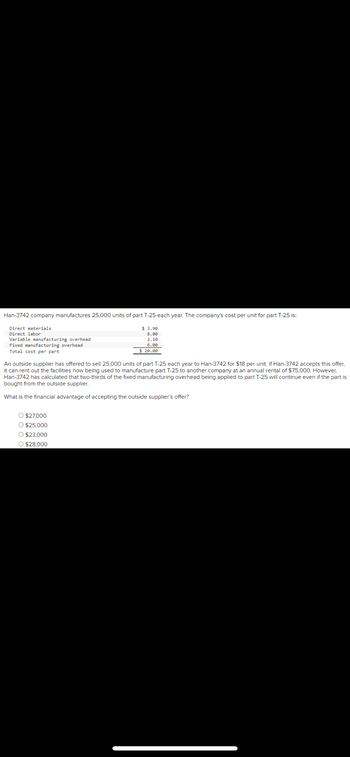

Transcribed Image Text:Han-3742 company manufactures 25,000 units of part T-25 each year. The company's cost per unit for part T-25 is:

Direct materials

$3.90

8.00

Direct labor

Variable manufacturing overhead

2.10

Fixed manufacturing overhead

Total cost per part

6.00

$ 20.00

An outside supplier has offered to sell 25,000 units of part T-25 each year to Han-3742 for $18 per unit. If Han-3742 accepts this offer,

it can rent out the facilities now being used to manufacture part T-25 to another company at an annual rental of $75,000. However,

Han-3742 has calculated that two-thirds of the fixed manufacturing overhead being applied to part T-25 will continue even if the part is

bought from the outside supplier.

What is the financial advantage of accepting the outside supplier's offer?

O $27,000

O $25,000

O $23,000

O $28,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- San Clemente Inc. incurs the following costs to produce 10,000 units of a subcomponent: Direct materials $8,400 Direct labor 11,250 Variable overhead 12,600 Fixed overhead 16,200 An outside supplier has offered to sell San Clemente the subcomponent for $2.85 a unit. If San Clemente accepts the offer, by how much will net income increase (decrease)?arrow_forwardYour Company has the capacity to produce 80,000 units. It produces and sells 70,000 units of a product each year. At this level of activity, Clark Company incurs the following unit costs: Direct materials $18 Direct labor 25 Variable overhead 9 Fixed overhead 10 Variable S&A 7 Fixed S&A 12 A special order for 9,000 units under consideration would require the one-time rental of a special machine. The rental is for $36,000. If the order is accepted, $5 of the variable S&A can be avoided. What is the least amount the company can charge per unit in this special pricing decision? (Think breakeven.) O $61 O $56 O $58 O $59 O $57arrow_forwardChip Jones ahoy manufactures the cloth for sails. The company has the capacity to produce 36,000 sails per year and is currently producing and selling 25,000 sails per year. The following information relates to current production: $175 Sales price per unit Variable costs per unit: Manufacturing Selling and administrative Total fixed costs: Manufacturing Selling and administrative LEFE $62 $20 $700,000 $250,000 Assume that a special pricing order is accepted for 5600 sails at a sales price of $150 per unit. This special order requires both variable manufacturing and variable selling and administrative costs, as well as incremental fixed costs of $400,000. What will be the impact on operating income? Operating income decreases by $380,800.arrow_forward

- Adams Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $5,900 6,200 3,500 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Adams for $2.60 each. Required X Answer is complete but not entirely correct. $ 19,300 Yes $ 24,180 X No 11,100 26,900 a. Calculate the total relevant cost. Should Adams continue to make the containers? b. Adams could lease the space it currently uses in the manufacturing process. If leasing would produce $11,800 per month, calculate the total avoidable costs. Should Adams continue to make the containers? a. Total relevant cost a. Should Adams continue to make the containers? b. Total avoidable cost b. Should Adams continue to make the containers?arrow_forwardHan Products manufactures 23,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 Is Direct materials Direct labor- Variable manufacturing overhead $13.70 11.00 2130 Fixed manufacturing overhead Total cost per part 19.00 $ 26.00 An outside supplier has offered to sell 23,000 units of part S-6 each year to Han Products for $22 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company for $73.000 per year However, Han Products determined two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part $-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer? Financial advantagearrow_forwardEvery year Riverbed Industries manufactures 7,300 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials $ 5.00 Direct labor 11.00 Variable manufacturing overhead 6.00 Fixed manufacturing overhead 10.00 Total $32.00 Ivanhoe, Inc., has offered to sell 7,300 units of part 231 to Riverbed for $34 per unit. If Riverbed accepts Ivanhoe’s offer, its freed-up facilities could be used to earn $10,500 in contribution margin by manufacturing part 240. In addition, Riverbed would eliminate 40% of the fixed overhead applied to part 231.(a) Calculate total relevant cost to make and net cost to buy. Total relevant cost to make $enter a dollar amount Net relevant cost to buy $enter a dollar amount (b) Should Riverbed accept Ivanhoe’s offer?arrow_forward

- The Rodgers Company makes 27,000 units of a certain component each year for use in one of its products. The cost per unit for the component at this level of activity is as follows: Direct materials. $4.20 Direct labor. $12.00 $5.80 Variable manufacturing overhead. Fixed manufacturing overhead $6.50 ****** Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier. Assume that there is no other use for the capacity now being used to produce the component and the total fixed manufacturing overhead of the company would be unaffected by this decision. If Rodgers Company purchases the components rather than making them internally, what would be the impact on the company's annual net operating income? Select one: a. $94,500 increase b.…arrow_forwardHan Products manufactures 40,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per uni for part S-6 is: Direct materials Direct labor Variable manufacturing overhead $ 3.30 12.00 2.70 Fixed manufacturing overhead Total cost per part 6.00 $ 24.00 An outside supplier has offered to sell 40,000 units of part S-6 each year to Han Products for $22 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company at an annual rental of $90,000. However, Han Products has determined that two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part S-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer? Answer is complete but not entirely correct. Financial advantage $ 8,000 ×arrow_forwardHan Products manufactures 38,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per part $ 3.10 10.00 2.90 9.00 $ 25.00 An outside supplier has offered to sell 38,000 units of part S-6 each year to Han Products for $21 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company for $88,000 per year. However, Han Products determined two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part S-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer? > Answer is complete but not entirely correct. Financial advantage $ 126,000arrow_forward

- Damon Industries manufactures 16,000 components per year. The manufacturing costs of the components were determined as follows: Direct materials $ 134,000 Direct labor 21,500 Variable manufacturing overhead 61,000 Fixed manufacturing overhead 81,000 An outside supplier has offered to sell the component for $15. If Damon purchases the component from the outside supplier, the manufacturing facilities would be unused and could be rented out for $11,700. If Damon purchases the component from the supplier instead of manufacturing it, the effect on operating profits would be a:arrow_forwardEvery year Marigold Industries manufactures 6,100 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total (a) Total relevant cost to make $ $4.00 Net relevant cost to buy 10.00 Carla Vista, Inc., has offered to sell 6,100 units of part 231 to Marigold for $34 per unit. If Marigold accepts Carla Vista's offer, its freed-up facilities could be used to earn $10,700 in contribution margin by manufacturing part 240. In addition, Marigold would eliminate 40% of the fixed overhead applied to part 231. $ 6.00 10.00 Calculate total relevant cost to make and net cost to buy. $30.00arrow_forwardDown Home Jeans Co. has an annual plant capacity of 65,300 units, and current production is 45,000 units. Monthly fixed costs are $39,300, and variable costs are $25 per unit. The present selling price is $36 per unit. On November 12 of the current year, the company received an offer from Fields Company for 13,200 units of the product at $28 each. Fields Company will market the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of sales of Down Home Jeans Co. a. Prepare a differential analysis dated November 12 on whether to reject (Alternative 1) or accept (Alternative 2) the Fields order. If an amount is zero, enter zero "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) November 12 RejectOrder(Alternative 1) AcceptOrder(Alternative 2) DifferentialEffecton…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education