FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

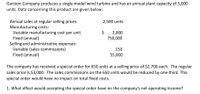

Transcribed Image Text:Garston Company produces a single model wind turbine and has an annual plant capacity of 3,000

units. Data concerning this product are given below:

Annual sales at regular selling prices

Manufacturing costs:

Variable manufacturing cost per unit

Fixed (annual)

2,500 units

$

2,000

750,000

Selling and administrative expenses:

Variable (sales commissions)

Fixed (annual)

150

55,000

The company has received a special order for 650 units at a selling price of $2,700 each. The regular

sales price is $3,000. The sales commissions on the 650 units would be reduced by one-third. This

special order would have no impact on total fixed costs.

1. What effect would accepting the special order have on the company's net operating income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pam-Tees Company plans to sell 11,000 T-shirts at $15 each in the coming year. Product costs include: Direct materials per T-shirt $4.75 Direct labour per T—shirt $2.25 Variable overhead per T- shirt $0.50 Total fixed factory overhead $32,000 Variable selling expense is the redemption of a coupon, which averages $0.70 per T-shirt; fixed selling and administrative expenses total $17,000. Required: Calculate the: 1. Variable product cost per unit 2. Contribution margin ratio (rounded to four significant digits) 3. Total fixed expense for the year 4. Break Even point in quantity (Q) 5. Margin of Safety in Quantity (Q)arrow_forwardNardin Outfitters has a capacity to produce 21,000 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $1,800 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Total costs The company has received a special order for 2,300 tents at a price of $780 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $63 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Net profit (loss) per case Required: a. What is the…arrow_forwardSage Company is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $14.00 per unit. The unit cost for the business to make the part is $22.00, including fixed costs, and $11.00, excluding fixed costs. If 39,879 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it? a.$558,306 cost decrease b.$119,637 cost increase c.$319,032 cost increase d.$119,637 cost decreasearrow_forward

- Burns Industries currently manufactures and sells 30,000 power saws per month, although it has the capacity to produce 45,000 units per month. At the 30,000- unit-per-month level of production, the per-unit cost is $85, consisting of $50 in variable costs and $35 in fixed costs. Burns sells its saws to retail stores for $90 each. Allen Distributors has offered to purchase 6,000 saws per month at a reduced price. Burns can manufacture these additional units with no change in its present level of fixed manufacturing costs. Burns decides to accept the special order for 6,000 units from Allen at a unit sales price that will add $120,000 per month to its operating income. The unit price Burns is charging Allen is: Multiple Choice $85. $50 $90. $70.arrow_forwardA manufacturer of ovens sells them for $1,370.00 each. The variable costs are $1,020.00 per unit. The manufacturer's factory has annual fixed costs of $2,460,000.00. Given the expected sales volume of 3,700 units for this year, what will be this year's net income? Round to two decimal placesarrow_forwardWhispering Winds Inc. has been manufacturing capacity, and variable manufacturing and direct labour costs per unit to make the A supplier offers to make the lampshades per year. variable manufacturing costs will be its own shades for its table lamps. The company is currently operating at 100% of overhead is charged to production at the rate of 50% of direct labour costs. The direct materials lampshades are $4.70 and $5.60, respectively. Normal production is 48,800 table lamps at a price of $13.50 per unit. If Whispering Winds Inc. accepts the supplier's offer all eliminated, but the $41.300 of fixed manufacturing overhead currently being charged to the lampshades will have to be absorbed by other productsarrow_forward

- Western Jeans Co. has an annual plant capacity of 2,000,000 units, and current production is 1,920,000 units. Monthly fixed costs are $400,000, and variable costs are $9 per unit. The present selling price is $15 per unit. On July 6 of the current year, the company received an offer from Childs Company for 50,000 units of the product at $13 each. Childs Company will market the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of sales of Western Jeans Co. Question Content Area a. Prepare a differential analysis dated July 6 on whether to reject (Alternative 1) or accept (Alternative 2) the Childs order. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential AnalysisReject (Alt. 1) or Accept (Alt. 2) OrderJuly 6 Line Item Description Reject Order(Alternative 1) Accept Order(Alternative 2) Differential Effects(Alternative 2) Revenues $Revenues…arrow_forwardGuadalupe Olayo produces grandfather clocks. Each grandfather clock normally sells for $1,500. The following manufacturing cost information per clock is available: Direct materials are $200, labor is $600, variable overhead is $50, and fixed overhead is $40 (based on planned production for the year of 1,200 clocks). Commissions are 10% of selling price, and fixed selling and administrative costs are $70,000. Guadalupe’s tax rate is 25%. A European company has asked Guadalupe to accept a special order for 400 clocks. Due to some minor design changes, the material and labor costs for the special order clocks would increase by 25%. Another production run would have to be scheduled for the special order, since the clocks are different from the regular clocks, at a cost of $2,200. In addition, Guadalupe would have to hire a temporary clerk to process the ISO and export paperwork for shipping to Europe, at a cost of $600. Commissions will be paid at the rate of 5% of the special order…arrow_forwardNardin Outfitters has a capacity to produce 12,000 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $900 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs $ 440 Fixed manufacturing costs 90 Variable selling and administrative costs 80 Fixed selling and administrative costs 50 Total costs $ 660 The company has received a special order for 500 tents at a price of $600 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $45 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case $ 600 Variable manufacturing costs 440 Fixed manufacturing costs 90 Variable selling and administrative costs 45 Fixed selling and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education