FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

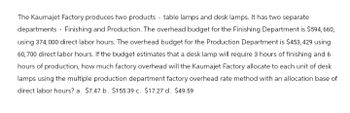

Transcribed Image Text:The Kaumajet Factory produces two products table lamps and desk lamps. It has two separate

departments Finishing and Production. The overhead budget for the Finishing Department is $594,660,

using 374,000 direct labor hours. The overhead budget for the Production Department is $453,429 using

60,700 direct labor hours. If the budget estimates that a desk lamp will require 3 hours of finishing and 6

hours of production, how much factory overhead will the Kaumajet Factory allocate to each unit of desk

lamps using the multiple production department factory overhead rate method with an allocation base of

direct labor hours? a. $7.47 b. $155.39 c. $17.27 d. $49.59

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Gidget Company produces a variety of styles of gidgets, and measures total output as the standard hours allowed for actual output. Gidget Company's manufacturing overhead budget calls for $50,000 of fixed overhead for the year plus $10 per direct labor hour. Last year the Gidget Company produced 11,000 standard hours of output. Actual manufacturing overhead for the year amounted to $53,000 of fixed overhead and the Gidget Company used 8,000 direct labor hours. The Gidget Company uses standard direct labor hours allowed as a basis for allocating overhead and uses 10,000 direct labor hours as its denominator volume. Calculate the production volume variance:arrow_forwardBlackwelder Factory produces two similar products: small table lamps and desk lamps. The total factory overhead budget is $650,000 with 477,000 estimated direct labor hours. It is further estimated that small table lamp production will require 263,000 direct labor hours, and desk lamp production will need 125,000 direct labor hours. Using a single plantwide factory overhead rate with an allocation base of direct labor hours, the factory overhead that Blackwelder Factory will allocate to desk lamp production if actual direct labor hours for the period for desk lamps is 239,000 would be a.$325,040 b.$725,935 c.$715,272 d.$324,960arrow_forwardCrane Inc. manufactures two products, sweaters and jackets. The company has estimated its overhead in the order-processing department to be $193000. The company produces 54000 sweaters and 75000 jackets each year. Sweater production requires 27000 machine hours, jacket production requires 52000 machine hours. The company places raw materials orders 10 times per month, 4 times for raw materials for sweaters and the remainder for raw materials for jackets. How much of the order-processing overhead should be allocated to jackets? O $48250 O $115800 $69250 O $158200arrow_forward

- Sifton Electronics Corporation manufactures and assembles electronic motor drives for video cameras. The company assembles the motor drives for several accounts. The process consists of a lean cell for each customer. The following information relates to only one customer's lean cell for the coming year. For the year, projected labor and overhead was $5,154,500 and materials costs were $34 per unit. Planned production included 5,408 hours to produce 16,900 motor drives. Actual production for August was 1,820 units, and motor drives shipped amounted to 1,400 units. Conversion costs are applied based on units of production From the foregoing information, determine the amount of the conversion costs charged to Raw and In Process Inventory during August. Oa. $555,100 Ob. $556,954 Oc. $235,349 Od. $128,100arrow_forwardGood Eats Inc. manufactures flatware sets. The budgeted production is for 80,000 sets this year. Each set requires 2.5 hours to polish the material. If polishing labor costs $15.00 per hour, determine the direct labor cost budget for polishing for the year.$____arrow_forwardSunland Inc. manufactures two products, sweaters and jackets. The company has estimated its overhead in the order-processing department to be $177000. The company produces 53000 sweaters and 78000 jackets each year. Sweater production requires 23000 machine hours, jacket production requires 49000 machine hours. The company places raw materials orders 12 times per month, 4 times for raw materials for sweaters and the remainder for raw materials for jackets. How much of the order-processing overhead should be allocated to jackets? O $44250 O $69250 O $135000 O $118000arrow_forward

- T-Shirt Co. makes two products: A and B. In the cutting department, budgeted information is as follows: Budgeted manufacturing overhead: $400,000 Budgeted machine hours: 80,000 Budgeted units produced: 50,000 The company allocates overhead based on units produced. The actual number of machine hours spent on product B is 30,000 and 10,000 units of product B are produced. How much is the manufacturing overhead of product B in the cutting department? 80,000 230,000 320,000 150,000arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $30 per unit and $45 is used in direct labor, while the direct material for the double is $45 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 10,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: Activity CostPools Driver EstimatedOverhead Use perTwin Use perDouble Framing Square Feet of Pine $270,000 6,000 3,000 Padding Square Feet of Quilting 230,000 130,000 100,000 Filling Square Feet of Filling 240,000 450,000 350,000 Labeling Number of Boxes 250,000 850,000 400,000 Inspection Number of Inspections 165,000 11,000 4,000 After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Purchasing (per order) $56 Utilities (per square foot) 2 Machine Setups (per machine hour) 7 Supervision (per direct labor hour)…arrow_forwardKata Systems allocates manufacturing overhead based on machine hours. Each connector should require 10 machine hours. According to the static budget, Kata expected to incur the following: 1,000 machine hours per month (100 connectors × 10 machine hours per connector) $8,500 in variable manufacturing overhead costs $9,450 in fixed manufacturing overhead costs During August, Kata actually used 800 machine hours to make 130 connectors and spent $5,200 in variable manufacturing costs and $7,800 in fixed manufacturing overhead costs. Kata's standard variable manufacturing overhead allocation rate is A. $17.95 per machine hour. B. $9.45 per machine hour. C. $10.63 per machine hour. D. $8.50 per machine hour.arrow_forward

- Kaumajet Factory produces two products: table lamps and desk lamps. It has two separate departments: Fabrication and Assembly. The factory overhead budget for the Fabrication Department is $644,490, using 325,500 direct labor hours. The factory overhead budget for the Assembly Department is $596,624, using 76,100 direct labor hours. If a table lamp requires 4 hours of fabrication and 7 hour of assembly, the total amount of factory overhead that Kaumajet Factory will allocate to table lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours if 9,200 units are produced is a.$72,128 b.$312,751 c.$150,035 d.$577,760arrow_forwardPatel and Sons Inc. uses a standard cost system to apply factory overhead costs to units produced. Practical capacity for the plant is defined as 51,600 machine hours per year, which represents 25,800 units of output. Annual budgeted fixed factory overhead costs are $258,000 and the budgeted variable factory overhead cost rate is $2.50 per unit. Factory overhead costs are applied on the basis of standard machine hours allowed for units produced. Budgeted and actual output for the year was 19,500 units, which took 40,600 machine hours. Actual fixed factory overhead costs for the year amounted to $251,600 while the actual variable overhead cost per unit was $2.40. Assume that at the end of the year, management of Patel and Sons decides that the overhead cost variances should be allocated to WIP Inventory, Finished Goods Inventory, and Cost of Goods Sold (CGS) using the following percentages: 10%, 20%, and 70%, respectively. Provide the proper journal entry to close out the…arrow_forwardCompute the predetermined variable overhead rate and the predetermined fixed overhead rate. (Round answers to 2 decimal places, eg. 2.75.) Predetermined Overhead Rate (b) eTextbook and Media Compute the applied overhead for Crane for the year. Overhead Applied Variable $ 2.50 Fixed Attempts: 1 of 3 usedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education