FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Hydro Sports budgets

1. Compute the total number of budgeted direct labor hours for the year.

2. Compute the plantwide overhead rate using budgeted direct labor hours.

3. Compute overhead cost per unit for each model using the plantwide overhead rate. Actual direct labor hours per unit are 8 for the standard model and 14 for the deluxe model.

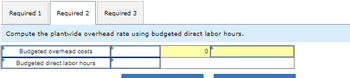

Transcribed Image Text:Required 1 Required 2 Required 3

Compute the plantwide overhead rate using budgeted direct labor hours.

Budgeted overhead costs

Budgeted direct labor hours

0

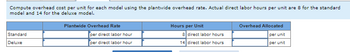

Transcribed Image Text:Compute overhead cost per unit for each model using the plantwide overhead rate. Actual direct labor hours per unit are 8 for the standard

model and 14 for the deluxe model.

Standard

Deluxe

Plantwide Overhead Rate

per direct labor hour

per direct labor hour

Hours per Unit

8 direct labor hours

14 direct labor hours

Overhead Allocated

per unit

per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The total factory overhead for Diva-nation is budgeted for the year at $180,000, divided intofour activities: cutting, $18,000; sewing, $36,000; setup, $96,000; and inspection, $30,000.Diva-nation manufactures two types of men's pants: jeans and khakis. The activity-base usagequantities for each product by each activity are as follows. Determine the a) activity rates foreach activity and b) activity based factory overhead per unit for each product.: Each product is budgeted for 20,000 units of production for the year. Determine (a) theactivity rates for each activity and (b) the activity based factory overhead per unit for eachproduct.arrow_forwardThe total factory overhead for Bardot Marine Company is budgeted for the year at $937,950, divided into four activities: fabrication, $435,000; assembly, $168,000; setup, $182,700; and inspection, $152,250. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 7,250 dlh 21,000 dlh 52 setups 91 inspections Bass boat 21,750 7,000 383 634 29,000 dlh 28,000 dlh 435 setups 725 inspections Each product is budgeted for 4,500 units of production for the year. а. Determine the activity rates for each activity. Fabrication per direct labor hour Assembly 24 per direct labor hour Setup 24 per setup Inspection per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. Speedboat per unit Bass boat per unitarrow_forwardam. 112.arrow_forward

- Tioga Company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information. Units produced Material moves per product line Lenses 30 Mirrors 30 21 11 220 220 Direct-labor hours per unit The total budgeted material-handling cost is $94,200. Required: 1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one mirror would be what amount? 3. Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling…arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $20 per unit and $35 is used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $45 per unit. Box Springs estimates it will make 5,000 twins and 10,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: Activity Cost Pools Driver Square Feet of Pine Square Feet of Quilting Square Feet of Filling Number of Boxes Number of Inspections How much does each unit cost to manufacture? Do not round intermediate computations but round final answers for the fields below to the nearest whole number. Total Cost per Unit Framing Padding Filling Labeling Inspection Direct Material Direct Labor Cost Overhead Total per Unit $ Estimated Use per Use per Overhead Twin Double Twin $245,000 5,000 2,000 230,000 130,000 100,000 240,000 500,000 300,000 240,000 800,000 400,000 160,000 12,000 4,000 Doublearrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $1,204,000. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 11,800 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 12,200 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year. direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. $ per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. Night lights $ Desk lamps $ per unit per unitarrow_forward

- The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000 divided into two departments: Fabrication, $420,000, and Assembly, $180,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require 8 direct labor hours in Fabrication and 4 direct labor hours in Assembly. The bass boats require 4 direct labor hours in Fabrication and 8 direct labor hours in Assembly. Each product is budgeted for 250 units of production for the year. If required, round all per unit answers to the nearest cent. a. Determine the total number of budgeted direct labor hours for the year in each department. Fabrication _______direct labor hours Assembly _______direct labor hours b. Determine the departmental factory overhead rates for both departments. Fabrication Department rate $______per dlh Assembly Department rate $______per dlh c. Determine the factory overhead allocated per unit for each product using the department…arrow_forwardGarden Yeti manufactures garden sculptures. Each sculpture requires 8 pounds of direct materials at a cost of $2 per pound and 0.4 direct labor hour at a rate of $18 per hour. Varlable overhead is budgeted at a rate of $3 per direct labor hour. Budgeted fixed overhead is $4,500 per month. The company's policy is to maintain direct materials Inventory equal to 30% of the next month's direct materials requirement. At the end of February the company had 7,440 pounds of direct materials in Inventory. The company's production budget reports the following. Production Budget Units to produce March April 3,100 4,400 (1) Prepare direct materials budgets for March and April. (2) Prepare direct labor budgets for March and April. (3) Prepare factory overhead budgets for March and April. Complete this question by entering your answers in the tabs below. Units to produce Required 1 Required 2 Required 3 Prepare direct materials budgets for March and April. GARDEN YETI Direct Materials Budget…arrow_forwardWater Sports Company budgets overhead cost of $840,000 for the year. The company manufactures two types of boats: Pontoons and Speedboats. Budgeted direct labor hours per unit are 16 for the Pontoon model and 24 for the Speedboat model. The company budgets production of 200 units of the Pontoon model and 200 units of the Speedboat model for the year. What is the total number of budgeted direct labor hours for the year? Multiple Choice O O 400 direct labor hours. 1,600 direct labor hours. 3,200 direct labor hours. 8,000 direct labor hours. 4,800 direct labor hours.arrow_forward

- You are given financial statements and a Dupont analysis for Tesco and Ahold. What do you conclude about the two companies’ performances based on these numbers?arrow_forwardBonita Sleep Systems manufactures nylon mesh hammocks for a chain of retail outlets located throughout the southeast. The company plans to manufacture and sell 28,000 hammocks during the fourth quarter. Overhead costs are expected to include: Variable indirect materials $ 4.75 per hammock Variable indirect labor $ 11.25 per hammock Other variable overhead $ 3.25 per hammock Salaries $ 50,000 per quarter Insurance $ 6,000 per quarter Depreciation $ 25,000 per quarter Prepare Bonita's manufacturing overhead budget for the fourth quarter.arrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $1,703,240. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 17,300 units. Each night light requires 3 hours of direct labor. Desk lamps are budgeted for 17,500 units. Each desk lamp requires 2 hours of direct labor. a Determine the total number of budgeted direct labor hours for the year. direct labor hours b Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. per direct labor hour c Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. per unit per unit Night Lights Desk Lampsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education