Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Finance Question Solution Please with calculation

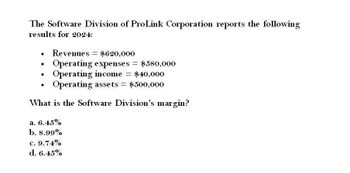

Transcribed Image Text:The Software Division of ProLink Corporation reports the following

results for 2024:

•

Revenues $620,000

=

.

Operating expenses = $580,000

•

Operating income = $40,000

•

Operating assets = $500,000

What is the Software Division's margin?

a. 6.45%

b. 8.99%

c. 9.74%

d. 6.45%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please give me answer financial accounting questionarrow_forwardThe following are selected data for the division for the consumer products of ABC Corp for 2019: Sales 50,000,000 Average invested capital (assets) 20,000,000 Net income 2,000,000 Cost of capital 8% What is the return on sales for the division? 1.4% 2. 8% 3.10% 4. 20% О1 O 2 O 4 3.arrow_forwardGiven answer accounting questionsarrow_forward

- I want to correct answer general accountingarrow_forwardBelow is given the data for the assembly division of Charles Corporation: Sales Cost of Sales Operating Expenses $10,000,000 $15,000,000 Average Operating Assets $250,000,000 $310,000,000 2020 2021 $100,000,000 $165,000,000 $22,000,000 $28,000,000 Minimum Required Rate of Return Actual Cost of Capital Income Tax Rate Instructions 1. Compute the margin and turnover ratios for each year 2. Compute the ROI for each year 3. Compute the residual income for each year 4. Compute EVA for Charles Corporation for each year (Note: Round to 2 decimal) MacBook Air 9% 6% 30%arrow_forwardI need answer of this accounting questions solutionarrow_forward

- Provide this question solution general accountingarrow_forward• The following are selected data for the division for the consumer products of ABC Corp for 2019: Sales 50,000,000 Average invested capital (assets) 20,000,000 Net income 2,000,000 Cost of capital 8% What is the return on investment for the division? 1. 2% 2. 4% 3. 8% 4. 10% О1 O 2 3 O 4arrow_forwardINCOME STATEMENT Hermann Industries is forecasting the following income statement:Sales $8,000,000Operating costs excluding depr. & amort. 4,400,000EBITDA $3,600,000Depreciation & amortization 800,000EBIT $2,800,000Interest 600,000EBT $2,200,000Taxes (40%) 880,000Net income $1,320,000The CEO would like to see higher sales and a forecasted net income of $2,500,000. Assumethat operating costs (excluding depreciation and amortization) are 55% of sales and thatdepreciation and amortization and interest expenses will increase by 10%. The tax rate, whichis 40%, will remain the same. What level of sales would generate $2,500,000 in net income?arrow_forward

- Assume the Residential Division of Kipper Faucets had the following results last year: What is the division’s RI? a. $(140,000) b. $104,000 c. $140,000 d. $(104,000)arrow_forwardThe following are selected data for the division for the consumer products of ABC Corp for 2020: Sales P 10,000,000 Average invested capital 4,000,000 Net Income 400,000 Cost of Capital 8% What is the return on sales for the division? 1. 4% 2. 8% 3. 10% 4. 20% O 1 O 2 O 3 O 4arrow_forwardAssume that Major Manuscripts, Inc. is currently operating at 95 percent of capacity and that sales are projected to increase to $20,000. What is the projected addition to fixed assets? O a. $1,529 O b. $0 O c. $1,493 d. $1,546arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning