Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

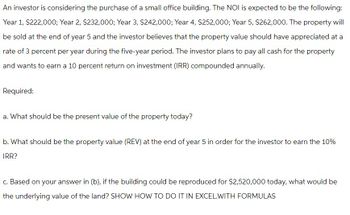

Transcribed Image Text:An investor is considering the purchase of a small office building. The NOI is expected to be the following:

Year 1, $222,000; Year 2, $232,000; Year 3, $242,000; Year 4, $252,000; Year 5, $262,000. The property will

be sold at the end of year 5 and the investor believes that the property value should have appreciated at a

rate of 3 percent per year during the five-year period. The investor plans to pay all cash for the property

and wants to earn a 10 percent return on investment (IRR) compounded annually.

Required:

a. What should be the present value of the property today?

b. What should be the property value (REV) at the end of year 5 in order for the investor to earn the 10%

IRR?

c. Based on your answer in (b), if the building could be reproduced for $2,520,000 today, what would be

the underlying value of the land? SHOW HOW TO DO IT IN EXCEL.WITH FORMULAS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 11 images

Knowledge Booster

Similar questions

- An investor is considering the purchase of a small office building. The NOI is expected to be the following: year 1, $200,000; year 2, $210,000; year 3, $220,000; year 4, $230,000; year 5, $240,000. The property will be sold at the end of year 5 and the investor believes that the property value should have appreciated at a rate of 3 percent per year during the five-year period. The investor plans to pay all cash for the property and wants to earn a 10 percent return on investment (IRR) compounded annually. a. What should be the property value (REV) at the end of year 5 in order for the investor to earn the 10% IRR? b. What should be the present value of the property today? c. Based on your answer in (b), if the building could be reproduced for $2,300,000 today, what would be the underlying value of the land? O $3,420,843; $2,950,850; $650,850 O $3,528,887; $2,590,850; $725.250 O $3,720.786; $2,476,180; $665.450arrow_forwardAn Investor is considering the purchase of a small office building. The NO/is expected to be the following: Year 1. $234,000; Year 2 $244,000; Year 3. $254,000; Year 4, $264,000; Year 5, $274,000. The property will be sold at the end of year 5 and the Investor believes that the property value should have appreciated at a rate of 3 percent per year during the five-year period. The Investor plans to pay all cash for the property and wants to earn a 10 percent return on investment (IRR) compounded annually. Required: a. What should be the present value of the property today? b. What should be the property value (REV) at the end of year 5 In order for the Investor to earn the 10% IRR? c. Based on your answer in (b). If the building could be reproduced for $2,640,000 today, what would be the underlying value of the land? Complete this question by entering your answers in the tabs below. Required A Required B Required C What should be the present value of the property today? Note: Do not…arrow_forwardA client has requested advice on a potential investment opportunity involving an income-producing property. She would like you to determine the internal rate of return of the investment opportunity based on the following information: expected holding period: years; end of first year NOI estimate: $113,900; NOI estimates in subsequent years will grow by 5 % per year; price at which the property is expected to be sold at the end of year 5: $1,615,205.22; current market price of the property: $1,475,667.71. A. 8.6% B. 9.86% C. 10% D -15.3%arrow_forward

- Assume that you are planning to buy a property producing natural resources. You think you will keep the property for the next 23 years. You plan to spend $700 per acre. You will have incurred costs of $11 per acre for the 23 years prior to selling the property. You believe that you will receive $26/acre/year in revenue during the investment period. What price (at time of the future sale) will you need to get for the property under 2 MAR scenarios. (using both 5.8% and 8% as MAR).arrow_forward3. You have been asked to evaluate investment of purchasing a parking lot under the following conditions: - The proposal is for a parking lot costing $4,000,000. The deck has an expected useful life of 15 years and a net salvage value of $625,000 (after tax adjustment). - The tenants have recently signed long-term leases, which leads you to believe that the current rental income of $250,000 per year will remain constant for the first five years, then the rental income will increase by 10% for every five-year interval over the remaining asset life. The estimated operating expenses, including income taxes, will be $65,000 for the first year and will increase by $6,000 each year thereafter. Considering an annual interest rate of 15%, what is the net present worth (NPW)? O $4M A = $250k $65k 5 A = $275k G=$6k S = $625k A = $302.5k 10 15 4. Would you accept the investment of the previous question? In other words, is it profitable?arrow_forwardElena's Café is investing in a new commercial refrigeration unit that will cost $40,000. They estimate that the unit will produce annual revenues of $12,000 for each of the next 6 years. The refrigeration unit will have negligible salvage value at the end of the next 6 years. Assuming a tax rate of 24%, a MACRS 5-year property class, 50% bonus depreciation, and an after-tax MARR of 8%, compute the present worth of the refrigeration unit and determine whether or not Elena's Café should invest in the refrigeration unit.arrow_forward

- XYZ is evaluating a project that would require the purchase of a piece of equipment for $440,000 today. During year 1, the project is expected to have relevant revenue of $786,000, relevant costs of $201,000, and relevant depreciation of $132,000. XYZ would need to borrow $440,000 today to pay for the equipment and would need to make an interest payment of $33,000 to the bank in 1 year. Relevant net income for the project in year 1 is expected to be $337,000. What is the tax rate expected to be in year 1? A rate equal to or greater than 21.96% but less than 26.61% A rate less than 21.96% or a rate greater than 46.34% A rate equal to or greater than 31.02% but less than 38.39% A rate equal to or greater than 38.39% but less than 46.34% A rate equal to or greater than 26.61% but less than 31.02%arrow_forwardAthena Investment Company is considering the purchase of an office property. After a careful review of the market and the leases that are in place, Athena believes that next year’s cash flow will be $100,000. It also believes that the cash flow will rise in the amount of $5,000 each year for the foreseeable future. It plans to own the property for at least 10 years. Athena believes that it should earn a return (r) of at least 11 percent. Athena estimates the value of the property today to be $1,224,808. What is the current, or going-in, cap rate for this property? A. 11.05% B. 10.49% C. 8.57% D. 8.16%arrow_forwardKartman Corporation is evaluating four different real estate investments. Management plans to buy the properties today and sell them three years from today. The annual discount rate for these investments is 12%. The following table summarizes the initial cost and the sale price in three years for each property: Cost Today Sale Price in Year 3 $520,000 $1,020,000 Parkside Acres 870,000 1,470,000 Real Property Estates Lost Lake Properties 910,000 510,000 220,000 Overlook 20,000 Kartman has a total capital budget of $540,000 to invest in properties. Which properties should it choose? ... The profitability index for Parkside Acres is (Round to two decimal places.)arrow_forward

- Kaimalino Properties (KP) is evaluating six real estate investments. Management plans to buy the properties today and sell them five years from today. The following table summarizes the initial cost and the expected sale price for each property, as well as the appropriate discount rate based on the risk of each venture. Expected Sale Cost Today Discount Rate (%) Price in Year 5 $18,000,000 Project $3,000,000 Mountain Ridge 15 75,500,000 50,000,000 35,500,000 10,000,000 Ocean Park Estates 15,000,000 9,000,000 6,000,000 3,000,000 15 Lakeview 15 Seabreeze 8 Green Hills 8. West Ranch 9,000,000 46,500,000 KP has a total capital budget of $18,000,000 to invest in properties. a. What is the IRR of each investment? b. What is the NPV of each investment? c. Given its budget of $18,000,000, which properties should KP choose? d. Explain why the profitability index method could not be used if KP's budget were $12,000,000 instead. Which properties should KP choose in this case? Fill in the IRR of…arrow_forwardA contractor is considering the following two alternatives: Purchase a new computer system for $45,000. The system is expected to last 6 years with a salvage value of $7,000. Lease a new computer system for $9,000 per year, payable in advance (at the start of the year). The system should last for 6 years. If a MARR of 6% is used, which alternative should be selected using a net present worth analysis? Which alternative would you select using an annualized cost method of analysis?arrow_forwardArmor Investment Company is considering the acquisition of a heavily depreciated building on 10 acres of land. It expects to rent the building as a storage facility and expects to collect cash flows equal to $100,000 next year. However, because depreciation is expected to increase, Armor expects cash flows to decline at a rate of 4 percent per year indefinitely. Armor expects to earn an IRR on investment return () at 13 percent. Required: a. What is the value of this property? b. Assume that after five years the building could be demolished and the land could be redeveloped with a strip retail improvement. The latter would produce NOI of $200,000 per year, grow at 3 percent per year, and cost $1 million to build. Investors currently earn a 10 percent IRR on such investments. What is the profit to be earned? Complete this question by entering your answers in the tabs below. Required A Required B What is the value of this property? Note: Round your final answer to the nearest dollar…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT