Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Stock price

$57.00

Shares outstanding

11,656,000

Market cap

$664,392,000

Excess Cash

$106,560,000

Dividend per share

$9.14

Transcribed Image Text:Dividend Policy and Retained Earnings

The year is 2002 and you are an investor in a company called

"Amazon." You are attending an annual shareholder meeting, where

their founder Jeff is talking about building warehouses all around the

country. The meeting progresses to the Q&A section and it's clear the

shareholders are not pleased with the lack of dividends so far. Listen

to their concerns and offer advice on Amazon's dividend policy.

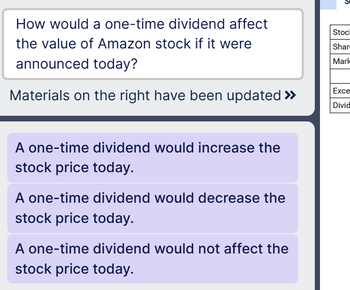

Transcribed Image Text:How would a one-time dividend affect

the value of Amazon stock if it were

announced today?

Materials on the right have been updated >>>

A one-time dividend would increase the

stock price today.

A one-time dividend would decrease the

stock price today.

A one-time dividend would not affect the

stock price today.

Stocl

Shar

Mark

Exce

Divid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are a consultant working with various companies that are considering incorporating and listing shares on a stock exchange. One of your clients asks you about the various acronyms she has been hearing in conjunction with financial analysis. Explain the following acronyms and how they measure different things but may complement each other: EPS (earnings per share), EBITDA (earnings before interest, taxes, depreciation, and amortization), and NOPAT (net operating profit after taxes).arrow_forwardYou are a consultant for several emerging, high-growth technology firms that were started locally and have been a part of a business incubator in your area. These firms start out as sole proprietorships but quickly realize the need for more capital and often incorporate. One of the common questions you are asked is about stockholders equity. Explain the characteristics and functions of the retained earnings account and how the account is different from contributed capital.arrow_forwardUse the internet to find a publicly-held companys annual report. Locate the section reporting Stockholders Equity. Assume that you work for a consulting firm that has recently taken on this firm as a client, and it is your job to brief your boss on the financial health of the company. Write a short memo noting what insights you gather by looking at the Stockholders Equity section of the financial reports.arrow_forward

- Use the internet to find a publicly-held companys annual report. Locate the section that comments on the Stockholders Equity section of the financial reports. What additional insights are you able to learn by looking further into the commentary? Is there anything that surprised you or that you think is missing and could help you if you were deciding whether to invest $100,000 of your savings in this companys stock?arrow_forwardAssume that you are consulting the board of directors for a start-up firm. The firm is expecting small profits and possible losses in the next couple of years, but significant growth over the next 10 years. They have asked your opinion on a dividend policy for the firm. In your initial post, provide your opinion on a dividend policy along with reasoning using terminology and business factors discussed in this module.arrow_forwardDo all companies pay dividends? What is another way stockholders can get a return on their investment? Did Microsoft always pay dividends, and if not why would they start?arrow_forward

- Need answer the financial accounting question not use aiarrow_forwardSolve the following problem with complete solution.1. List five large publicly held companies that you know or whose products and services you enjoy. Then use the web to find the most recent closing stock price. Ignoring commissions, estimate the cost if you purchased ten shares of each of the five companies.arrow_forwardYou are an accounting student at your local university. Your brother has recently managed to save $5,000, and he would like to invest some of this money in the stock market, so hes researching various global corporations that are listed on the stock exchange. He is reviewing a company that has Goodwill as an item on the balance sheet. He is quite perplexed about what this means, so he asks you for help, knowing that you are taking accounting classes. How would you explain the concept of goodwill to him by comparing it to other types of resources the company has available?arrow_forward

- Joy wants to invest his funds in shares in one of the two existing manufacturing companies. The following information about the dividend paid during the seven years of the Year Brown Company Avel Company 2000 500 300 2001 600 557 2002 665 615 2003 675 640 2004 785 790 2005 800 815 2006 815 795 If you as an investment consultant who is conducting an analysis of the two companies, with Using trend analysis, which company would you recommend to Joy for his investment in 2010? (work with complete procedure)arrow_forwardThanks to who helped me earlier. All my values were off because I started to answer this on January 1. My values just needed to be shifted down into the perspective cells. I am reposting the question to find out what I'm missing for December 31. The cells are highlighted in yellow (See attached Image) that I need assistance with. The scenario is in the image.arrow_forwardIdentify information used in an investment decision Look forward to the daywhen you will have accumulated $5,000, and assume that you have decided to investthat hard-earned money in the common stock of a publicly owned corporation. Whatdata about that company will you be most interested in, and how will you arrangethose data so they are most meaningful to you? What information about the company will you want on a weekly basis, on a quarterly basis, and on an annual basis?How will you decide whether to sell, hold, or buy some more of the firm’s stock?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,