Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

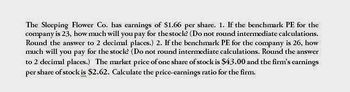

Transcribed Image Text:The Sleeping Flower Co. has earnings of $1.66 per share. 1. If the benchmark PE for the

company is 23, how much will you pay for the stock? (Do not round intermediate calculations.

Round the answer to 2 decimal places.) 2. If the benchmark PE for the company is 26, how

much will you pay for the stock? (Do not round intermediate calculations. Round the answer

to 2 decimal places.) The market price of one share of stock is $43.00 and the firm's earnings

per share of stock is $2.62. Calculate the price-earnings ratio for the firm.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Dahlia Flower Company has earnings of $1.48 per share. a. If the benchmark PE for the company is 15, how much will you pay for the stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. If the benchmark PE for the company is 18, how much will you pay for the stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. Stock price b. Stock pricearrow_forwardThe Dahlia Flower Company has earnings of $1.44 per share. If the benchmark PE for the company is 13, how much will you pay for the stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. If the benchmark PE for the company is 16, how much will you pay for the stock?arrow_forwardThe Perfect Rose Co. has earnings of $2.10 per share. The benchmark PE for the company is 10. a. What stock price would you consider appropriate? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What if the benchmark PE were 13? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) stock price for pe of 10 stock price for pe of 13arrow_forward

- The Blooming Flower Co. has earnings of $1.63 per share. a. If the benchmark PE for the company is 22, how much will you pay for the stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the benchmark PE for the company is 25, how much will you pay for the stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Stock price b. Stock pricearrow_forwardPlease give me answerarrow_forwardNeed answerarrow_forward

- Want accurateanswerarrow_forwardQuestion: The Perfect Rose Co. has earnings of $2.00 per share. The benchmark PE for the company is 13. What stock price would you consider appropriate? (Do not round intermediate calculations) What is the stock price if the benchmark PE was16? (Do not round intermediate calculations)arrow_forwardDetermine the cost of common stock (equity). The T-Bill rate is 5.2%. The Market Return is 12.7%. What is the company's cost of equity capital if the company has a beta of 1.27? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity %arrow_forward

- The preference share of Acme International is selling currently at $107.4. If your required rate of return is 8.7 per cent, what is the dividend paid by this share? Round your answer to 2 decimal places. E.g. if the final value is $12345.8342, please type 12345.83 in the answer box (do not type the dollar sign).arrow_forwardThe Beautiful Flower Company. has earnings of $1.44 per sharee. a. If the benchmark PE for the company is 13, how much will you pay for the stock? b. If the benchmark PE for the company is 16, how much will you pay for the stock?arrow_forwardJersey Medical earns $12.50 a share, sells for $100, and pays a $6 per share dividend. The stock is split two for one and a $3 per share cash dividend is declared. a. What will be the new price of the stock? Round your answer to the nearest dollar. $ b. If the firm's total earnings do not change, what is the payout ratio before and after the stock split? Round your answers to one decimal place. Payout ratio before the split: Payout ratio after the split: % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning