FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Do not use Ai

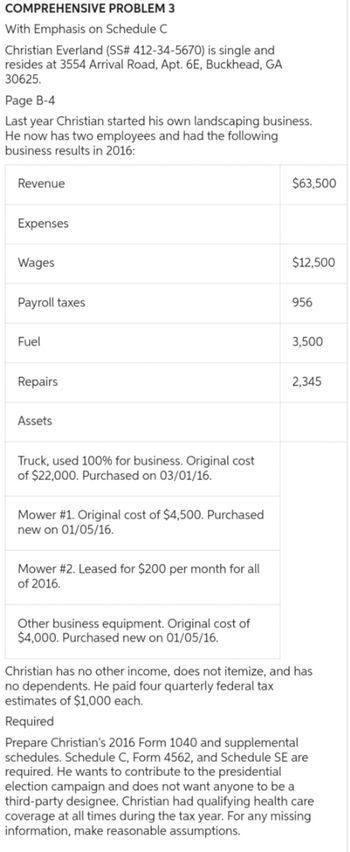

Transcribed Image Text:COMPREHENSIVE PROBLEM 3

With Emphasis on Schedule C

Christian Everland (SS# 412-34-5670) is single and

resides at 3554 Arrival Road, Apt. 6E, Buckhead, GA

30625.

Page B-4

Last year Christian started his own landscaping business.

He now has two employees and had the following

business results in 2016:

Revenue

$63,500

Expenses

Wages

$12,500

Payroll taxes

956

Fuel

Repairs

Assets

Truck, used 100% for business. Original cost

of $22,000. Purchased on 03/01/16.

Mower #1. Original cost of $4,500. Purchased

new on 01/05/16.

Mower #2. Leased for $200 per month for all

of 2016.

3,500

2,345

Other business equipment. Original cost of

$4,000. Purchased new on 01/05/16.

Christian has no other income, does not itemize, and has

no dependents. He paid four quarterly federal tax

estimates of $1,000 each.

Required

Prepare Christian's 2016 Form 1040 and supplemental

schedules. Schedule C, Form 4562, and Schedule SE are

required. He wants to contribute to the presidential

election campaign and does not want anyone to be a

third-party designee. Christian had qualifying health care

coverage at all times during the tax year. For any missing

information, make reasonable assumptions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 41 marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in 2018: “picture attached with the i formation and two questions.arrow_forwardAssignment 6.1: Session 6 Comprehensive Problem (Chapter 8) Instructions In this session, we have a 6-part comprehensive problem. Download the Session 6 Comprehensive Problem Templates below to complete the 6 required parts of the problem. You will need your Bergevin and MacQueen book for reference. Rancho Cucamonga Inc. began business on January 1, 2020. The firm earned $100 from sales in its first year of business. Rancho Cucamonga collected $90 of revenue earned in cash during 2020 and reported a $10 account receivable on its 2020 balance sheet. The firm paid $70 cash for operating expenses in 2020 and reported a $5 account payable for unpaid operating expenses on its 2020 balance sheet. Income tax laws only recognize cash collected from sales and cash paid for expenses as taxable items in the year collected or paid. Rancho Cucamonga also reported a $10 fine, paid in cash, to the federal government for unfair business practices. Generally accepted accounting principles allow firms…arrow_forwardHi I’m confused about these questions can you help me please?arrow_forward

- 1.arrow_forwardO Page view A R You are employed as the office manager at Clover Point Pediatrics. Your job requires you to take on many responsibilities. One of these is to arrange for the annual employee party. This year, you have been given permission to rent a banquet room at a local hotel, hire a caterer, and hire a disc jockey for entertainment. There are 23 employees and each will be bringing one guest (46 total). Answer the following (all pricing includes tax and tip): 10. The caterer is charging $29.95 per person for a sit-down dinner. What will be the total cost for food? 11. Beer and wine will be served at a cost of $12.00 per person. What is the total cost for beverages? 12. The entertainment costs $100.00 an hour, and entertainment will be held from 7:00 p.m. to midnight. What will this cost? The banquet rental is $1,200.00 for the evening and this includes all set ups. What will the entire evening cost (food, beverages, entertainment, and rental)? 13.arrow_forwardGraw 6:33 connect® 3. Award: 9.09 points Problem 8-35 (LO 8-2) cancel print In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Mortgage interest Depreciation Repairs and maintenance Required: $ 15,000 2,000 1,500 3,800 7,200 1,300 What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Rental income Real estate taxes Utilities Mortgage interest Repairs and maintenance Depreciation Net rental income References Problem Schedule E Schedule A $ 0 Difficulty: 3 Hard Problem 8-35 (LO 8-2) Learning Objective: 08-02 AA Understand how to report personal use of a rental property (vacation home). © 2024 McGraw-Hill Education. All rights…arrow_forward

- Calibri (Body) 2 Wrap Text v te В I U v Merge & Center v XV fx A B C E F G Q5: Solve the following 3 problems related to GST, HST, PST, CLR 1- Obj. 5 L2 Marks a. Meredith owns a flower shop in Ontario (Assume GST of 5%). Over a 3 month period her revenues from sales was $84900. i. How much GST did she collect? ii, If she purchased products and services costing her $25750. How much GST did she pay? iii. What amount is she required to remit to the government for the period? b. Astore located in British Columbia sold a desk top computer for $1688 plus GST (5%) and PST 7%). i. What is the total price the consumer must pay for this computer? ii. What would the consumer in Ontario (HST 13%) have to pay for the same computer? iii. What is the difference in paid by the resident of BC and of Ontario? Atown has a total residential property assessment of $985550000. It initially estimated that $57565000 must be raised i. C. What tax rate (in %) per $1000 must be set to raise the $57565000? ii.…arrow_forwardHome Insert Draw Page Layout Formulas Data Review View Tell me Arial 10 A A° Wrap Text v General A $ v % 9 Paste В U Merge & Center v 13 fx A В C E F J 1 2 Name: KhanGhulam IIII II || 3 Amortization Schedule 4 Instruction: Develop and amortization table for the payment of a loan on a house. Payments are monthly for 10 years. Loan on the house is $179,000. 5 6. PMT formula 7 Interest is 5.3% annual. 8 PV formula 9 Payment: 10 11 Payment Payment Number Month |Рayment Amount Beginning Ending Toward Toward 12 Balance Balance Principal Interest Apr-02 May-02 13 1 179,000.00 14 15 3 16 4 17 18 19 7 20 8 21 9. 22 10 23 11 24 12 25 13 26 14 27 15 28 16 29 17 30 18 31 19 32 20 liliarrow_forwardart 2 of 2 pints eBook Ask Print References Mc Graw Hill 124,011 30³ F1 @ 2 W S * mand Required information Problem 6-4A & 6-5A (Algo) [The following information applies to the questions displayed below.] Gerald Utsey earned $48,700 in 2021 for a company in Kentucky. He is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2021 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked. Problem 6-5A (Algo) Required: Compute the employer's share of the taxes. (Do not round intermediate calculation. Round your final answer to 2 decimal places.) Federal income tax withholding Social Security tax Medicare tax F2 FUTA tax SUTA tax State income tax withholding # 3 E D M 15 8.0 F3 $ 4 R F Q X C V F4 % 5 T A alı DII F8 N M 1 ( 9 K DD F9 A O 1 ) 0 L A F10 P I : ; L O A…arrow_forward

- - Chapter X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q apter 15, 16, and 17 i Saved Help Save & E The following information is for Hulk Gym's first year of operations. Amounts are in millions of dollars. The enacted tax rate is 25%. Accounting income Temporary difference: Prepaid insurance Taxable income Required: Year 2024 $ 220 Future Taxable Amounts Future Amounts 2025 2026 2027 2028 Total (52) $ 13 $ 13 $13 $ 13 $ 52 $ 168 Prepare a compound journal entry to record the income tax expense for the year 2024. in millions (i.e., 10,000,000 should be entered as 10.) Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers View transaction list Journal entry worksheet Record the income taxes. to search 車 10:0 73°F Partly cloudy 4/14 F3 F4 F5 F6 F7 F8 F9 F10 F11 F12 PrtScr Insert Delete Calc E R * Backspacearrow_forwardCan someone help me solve thisarrow_forwardACTION - CH 08 Quiz i 3 8.5 points eBook References Problem 8-34 (LO 8-1, 8-2) Kelvin owns and lives in a duplex. He rents the other unit for $730 per month. He incurs the following expenses during the current year for the entire property: Mortgage interest Property taxes Utilities Fixed light fixture in rental unit Fixed dishwasher in personal unit Painted entire exterior Insurance Depreciation (entire structure) Required: How are the above income and expenses reported on Kelvin's tax return? Note: Enter Schedule E expense as a negative number. Income Mortgage interest Property taxes Utilities Fix light (rental) Fix dishwasher Paint exterior Insurance Depreciation Personal $ 7,400 1,920 1,480 90 230 1,040 1,800 6,300 Schedule A Saved Schedule Earrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education