Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

hello! can someone answer and explain the solution to me. i badly needed this for my report tomorrow (August 24, 2024)

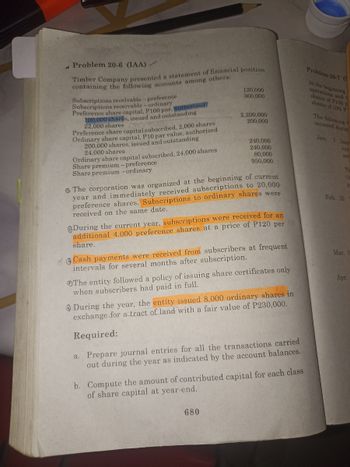

Transcribed Image Text:Problem 20-6 (IAA)-

Timber Company presented a statement of financial position

containing the following accounts among others:

Subscriptions receivable-preference

Subscriptions receivable-ordinary

Preference share capital, P100 par, authorized

100,000 shares, issued and outstanding

22,000 shares C

Preference share capital subscribed, 2,000 shares

Ordinary share capital, P10 par value, authorized

200,000 shares, issued and outstanding

24,000 shares

Share premium - preference

Share premium - ordinary

120,000

360,000

2,200,000

200,000

Problem 20-70

At the beginning

operations and

shares of P100 p

shares of 10% P

The following

occurred durin

240,000

Jan. 1 Issu

240,000

exc

80,000

ser

950,000

ΤΗ

th

Ordinary share capital subscribed, 24,000 shares

6 The corporation was organized at the beginning of current

year and immediately received subscriptions to 20,000

preference shares. Subscriptions to ordinary shares were

received on the same date.

During the current year, subscriptions were received for an

additional 4,000 preference shares at a price of P120 per

share.

Cash payments were received from subscribers at frequent

intervals for several months after subscription.

The entity followed a policy of issuing share certificates only

when subscribers had paid in full.

During the year, the entity issued 8,000 ordinary shares in

exchange for a tract of land with a fair value of P230,000.

Required:

a. Prepare journal entries for all the transactions carried

out during the year as indicated by the account balances.

b. Compute the amount of contributed capital for each class

of share capital at year-end.

680

Feb. 20

Mar. 1

Apr.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Problem 6arrow_forwardTimber Company presented a statement of financial position containing the following accounts among others: Subscriptions receivable- preference 120,000 Subscriptions receivable- ordinary 360,000 Preference share capital, P100 par, authorized 100,000 shares, issued and outstanding 22,000 shares 2,200,000 Preference share capital subscribed, 2,000 shares 200,000 Ordinary share capital, P10 par value, authorized 200,000 shares, issued and outstanding 24,000 shares 240,000 Ordinary share capital subscribed, 24,000 shares 240,000 Share premium- preference 80,000 Share premium- ordinary 950,000 The corporation was organized at the beginning of current year and immediately received subscriptions to 20,000 preference…arrow_forwardSs.227.arrow_forward

- Hh1. Accountarrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.arrow_forwardRequired information [The following information applies to the questions displayed below.] The financial statements for Highland Corporation included the following selected information: Common stock Retained earnings Net income Shares issued Shares outstanding Dividends declared and paid The common stock was sold at a price of $36 per share. Required: 1. What is the amount of additional paid-in capital? $ 515,000 $ 890,000. Additional paid-in capital $ 1,110,000 103,000 64,000 $ 770,000arrow_forward

- Contributed capital: Western Grass, Inc. Equity Section of Balance Sheet December 31, 2823 Preferred shares, $3 cumulative, 10,000 shares authorized, issued and outstanding Common shares, 100,000 shares authorized; 65,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 75,000 552,500 627 500 581 000 $1,208,500 Required: Using the Information provided, calculate book value per common share assuming: (Round the final answers to 2 decimal places.) a. There are no dividends in arrears. b. There are three years of dividends in arrears. Book Value of Common Sharesarrow_forwardAnswer with computation and explanation If the total authorized share capital is P1,000,000 at P10 par, the unissued share capital is 25,000 shares, and all the issued shares were sold at P15, then the total shareholders' equity before any operation activities is a 2 750,000. b P1,125,000 c. P375,000. d. P250,000.arrow_forwardAnswer no. 4 to 6arrow_forward

- Silver Company provided the following information at 8-8 gido Problem 5-8 (IAA) year-end: Share premium Accounts payable Preference share capital, at par Ordinary share capital, at par Sales 1,000,000 1,100,000 2,000,000 3,000,000 10,000,000 7,800,000 500,000 700,000 1,000,000 Total expenses Treasury shares – ordinary Dividends Retained earnings - beginning What is the shareholders' equity at year-end? a. 8,000,000 b. 8,500,000 c. 5,800,000 d. 8,700,000 000000arrow_forwardFinancial Accounting and Reporting Equityarrow_forward1. An abstract of the shareholders’ equity of the Camia Co. on December 31,200A appears as follows:Preference Share, Php35 par value, 150,000 shares issued and outstanding Php5,250,000Ordinary Shares, Php25 par value, 300,000 shares issued and Outstanding 7,500,000Premium on Preference Share 450,000Premium on Ordinary Share 600,000Retained Earnings 1,200,000Treasury Share – Ordinary 60,000 The Board of Directors decided to establish a reserve of Php230,000 for contingencies and Php380,000 for plant expansion. Required:1. Record…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning