FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

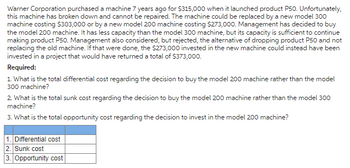

Transcribed Image Text:Warner Corporation purchased a machine 7 years ago for $315,000 when it launched product P50. Unfortunately,

this machine has broken down and cannot be repaired. The machine could be replaced by a new model 300

machine costing $303,000 or by a new model 200 machine costing $273,000. Management has decided to buy

the model 200 machine. It has less capacity than the model 300 machine, but its capacity is sufficient to continue

making product P50. Management also considered, but rejected, the alternative of dropping product P50 and not

replacing the old machine. If that were done, the $273,000 invested in the new machine could instead have been

invested in a project that would have returned a total of $373,000.

Required:

1. What is the total differential cost regarding the decision to buy the model 200 machine rather than the model

300 machine?

2. What is the total sunk cost regarding the decision to buy the model 200 machine rather than the model 300

machine?

3. What is the total opportunity cost regarding the decision to invest in the model 200 machine?

1. Differential cost

2. Sunk cost

3. Opportunity cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Warner Corporation purchased a machine 7 years ago for $350,000 when it launched product P50. Unfortunately, this machine has broken down and cannot be repaired. The machine could be replaced by a new model 300 machine costing $342,450 or by a new model 200 machine costing $290,800. Management has decided to buy the model 200 machine. It has less capacity than the model 300 machine, but its capacity is sufficient to continue making product P50. Management also considered, but rejected, the alternative of dropping product P50 and not replacing the old machine. If that were done, the $290,800 invested in the new machine could instead have been invested in a project that would have returned a total of $400,400. Required: 1. What is the total differential cost regarding the decision to buy the model 200 machine rather than the model 300 machine? 2. What is the total sunk cost regarding the decision to buy the model 200 machine rather than the model 300 machine? 3. What is the total…arrow_forwardsarrow_forwardManagement of Plascencia Corporation is considering whether to purchase a new model 370 machine costing $502,000 or a new model 220 machine costing $443,000 to replace a machine that was purchased 11 years ago for $470,000. The old machine was used to make product I43L until it broke down last week. Unfortunately, the old machine cannot be repaired.Management has decided to buy the new model 220 machine. It has less capacity than the new model 370 machine, but its capacity is sufficient to continue making product I43L.Management also considered, but rejected, the alternative of simply dropping product I43L. If that were done, instead of investing $443,000 in the new machine, the money could be invested in a project that would return a total of $487,000.In making the decision to buy the model 220 machine rather than the model 370 machine, the differential cost was: A: 59,000 B: 27,000 C: 32,000 D: 17,000arrow_forward

- Management of Plascencia Corporation is considering whether to purchase a new model 370 machine costing $511,000 or a new model 220 machine costing $471,000 to replace a machine that was purchased 7 years ago for $503,000. The old machine was used to make product I43L until it broke down last week. Unfortunately, the old machine cannot be repaired. Management has decided to buy the new model 220 machine. It has less capacity than the new model 370 machine, but its capacity is sufficient to continue making product I43L. Management also considered, but rejected, the alternative of simply dropping product I43L. If that were done, instead of investing $471,000 in the new machine, the money could be invested in a project that would return a total of $479,000. In making the decision to invest in the model 220 machine, the opportunity cost was: Multiple Choice $503,000 $471,000 $511,000 $479,000arrow_forwardManagement of Plascencia Corporation is considering whether to purchase a new model 370 machine costing $536,000 or a new model 220 machine costing $463,000 to replace a machine that was purchased 9 years ago for $484,000. The old machine was used to make product 143L until it broke down last week. Unfortunately, the old machine cannot be repaired. Management has decided to buy the new model 220 machine. It has less capacity than the new model 370 machine, but its capacity is sufficient to continue making product 143L. Management also considered, but rejected, the alternative of simply dropping product 143L. If that were done, instead of investing $463,000 in the new machine, the money could be invested in a project that would return a total of $488,000. In making the decision to buy the model 220 machine rather than the model 370 machine, the sunk cost was: Multiple Choice $484,000 $463,000 $536,000 $488,000arrow_forwardPlease solve this MCQs Management of Plascencia Corporation is considering whether to purchase a new model 370 machine costing $464,000 or a new model 220 machine costing $405,000 to replace a machine that was purchased 10 years ago for $439,000. The old machine was used to make product I43L until it broke down last week. Unfortunately, the old machine cannot be repaired.Management has decided to buy the new model 220 machine. It has less capacity than the new model 370 machine, but its capacity is sufficient to continue making product I43L.Management also considered, but rejected, the alternative of simply dropping product I43L. If that were done, instead of investing $340,000 in the new machine, the money could be invested in a project that would return a total of $456,000.In making the decision to buy the model 220 machine rather than the model 370 machine, the sunk cost was: $456,000 $464,000 $439,000 $405,000arrow_forward

- Denny Corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine. The new machine would cost $290,000 and have a tenericals controll nortunately, the new machine would have no salvage value. The new machine would cost $48,000 per year to operate and maintain but would save $89,000 per year in labor and other costs. The old machine can be sold now for scrap for $29,000. The simple rate of return on the new machine is closest to (Ignore income taxes.):arrow_forward"That old equipment for producing oil drums is worn out,” said Jillian Rafuse, president of Hondrich Company. "We need to make a decision quickly." The company is trying to decide whether it should rent new equipment and continue to make its oil drums internally or whether it should discontinue production and purchase them from an outside supplier. The alternatives follow: Alternative 1: Rent new equipment for producing the oil drums for $100,000 per year. Alternative 2: Purchase oil drums from an outside supplier for $17.40 each. Hondrich Company's costs per unit of producing the oil drums internally (with the old equipment) are given below. These costs are based on a current activity level of 40,000 units per year: Direct materials Direct labour Variable overhead Fixed overhead ($1.25 supervision, $1.80 depreciation, and $4.00 general company overhead) Total cost per unit $ 6.00 8.00 3.20 7.05 $24.25 The new equipment would be more efficient and, according to the manufacturer, would…arrow_forward"That old equipment for producing oil drums is worn out," said Jillian Rafuse, president of Hondrich Company. "We need to make a decision quickly." The company is trying to decide whether it should rent new equipment and continue to make its oil drums internally or whether it should discontinue production and purchase them from an outside supplier. The alternatives follow: Alternative 1: Rent new equipment for producing the oil drums for $96,000 per year. Alternative 2: Purchase oil drums from an outside supplier for $17.15 each. Hondrich Company's costs per unit of producing the oil drums internally (with the old equipment) are given below. These costs are based on a current activity level of 30,000 units per year: Direct materials $ 5.00 Direct labour 9.00 Variable overhead 3.20 Fixed overhead ($1.60 supervision, $1.80 depreciation, and $4.00 general company overhead) Total cost per unit 7.40 $24.60 The new equipment would be more efficient and, according to the manufacturer, would…arrow_forward

- Difend Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $170,000. The new machine will cost $360,000 and an additional cash investment in working capital of $170,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $130,000 in additional cash inflows during the first year of acquisition and $290,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life. What is the net present value of the investment, assuming the required rate of…arrow_forwardYour company has been approached to bid on a contract to sell 21,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $4,200,000 and will be depreciated on a straight-line basis to a zero salvage value. Production will require an investment in net working capital of $150,000 to be returned at the end of the project, and the equipment can be sold for $270,000 at the end of production. Fixed costs are $805,000 per year and variable costs are $45 per unit. In addition to the contract, you feel your company can sell 4,800, 12,400, 14,400, and 7,700 additional units to companies in other countries over the next four years, respectively, at a price of $130. This price is fixed. The tax rate is 25 percent, and the required return is 11 percent. Additionally, the president of the company will undertake the project only…arrow_forwardYour company has been approached to bid on a contract to sell 19,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $4,000,000 and will be depreciated on a straight- line basis to a zero salvage value. Production will require an investment in net working capital of $140,000 to be returned at the end of the project, and the equipment can be sold for $260,000 at the end of production. Fixed costs are $795,000 per year and variable costs are $43 per unit. In addition to the contract, you feel your company can sell 4,600, 12,200, 14,200, and 7,500 additional units to companies in other countries over the next four years, respectively, at a price of $140. This price is fixed. The tax rate is 23 percent, and the required return is 12 percent. Additionally, the president of the company will undertake the project only…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education