FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Answer all the requirement

answer in text form please (without image)

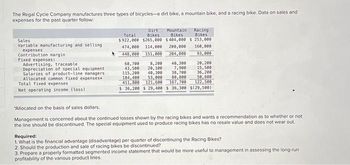

Transcribed Image Text:The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and

expenses for the past quarter follow:

Sales

Variable manufacturing and selling

expenses

Contribution margini

Fixed expenses:

Advertising, traceable.

Depreciation of special equipment

Salaries of product-line managers.

Allocated common fixed expenses.

Total fixed expenses

Net operating income (loss)

Dirt Mountain Racing

Total Bikes. Bikes Bikes

$922,000 $265,000 $484,000 s 253,000

474,000 114,000 200,000

448,000 151,000 204,000

160,000

93,000

20,200

15,500

68,700 8,200 40,300

43,500 20,100

7,900

115,200 40,300 38,700 36,200

184,400 53,000 80,800

167,700

411,800 121,600

50,600

122,500

$ 36,200 $ 29,400 $ 36,300 $(29,500)

"Allocated on the basis of sales dollars.

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not

the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run

profitability of the various product lines.

Transcribed Image Text:ok

nt

int

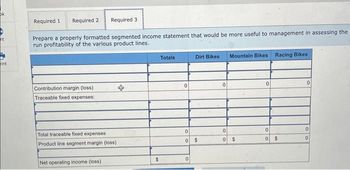

Required 1 Required 2

Prepare a properly formatted segmented income statement that would be more useful to management in assessing the

run profitability of the various product lines.

Contribution margin (loss).

Traceable fixed expenses:

Required 3

Total traceable fixed expenses

Product line segment margin (loss)

Net operating income (loss)

$

Totals

0

Dirt Bikes

0

0 $

0

0

Mountain Bikes Racing Bikes

0

0 $

0

0

0

$

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- / List the system defaults account in Quick Books and explain the purpose of any FOUR default accounts (hint- there are many such accounts in Quick Books)arrow_forwardCan you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?arrow_forwardCan someone check and tell me if my answer is correct?arrow_forward

- Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (2 x ACC101 (4726) × Account x Account X M Question x iConnect x Content xM SmartBox →> C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwebapps%252Fb Saved Help Chapter 7 Quiz 2 QS 7-2 (Algo) Accounting information system principles LO C1 Match each description with the system principle it best reflects. 7.58 points esc Ask Mc Graw Hill Description 1. The benefits from an activity in an accounting information system outweigh the costs. 2. The accounting information system adapts to changes in the needs of decision makers. 3. The accounting information system reports useful information to decision makers. 4. The accounting information system conforms to the company's structure. 5. The accounting information system helps managers monitor business activities. 0 18 < Prev 2 of 10 tv G Search or type URL ☆ Principle VA Aa 3 5 6 8 O Carrow_forwardAutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forwardne File Edit View History Bookmarks Profiles Tab Window Help M Inbox (2 x MACC101 x (4726) || X Account x| Account X WiConnec× M Question X Content c ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 7 Quiz i 7 7.58 points Ask Mc Graw Hill Saved QS 7-13 (Algo) Indicating journals used for posting LO P1, P2, P3, P4 The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory Debit (d) 700 Credit (e) Debit 340 (b) 1,700 Credit (d) Debit Credit 700 (a) 1,520 (c) 1,040 Accounts Payable Sales Debit (e) 340 Credit (a) Debit 1,520 Credit (b) Cost of Goods Sold Credit Debit 1,700 (c) 1,040 Transaction a. b. C. d. e. Journal 12.020 ANE 18 tv Aarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardHelp Save & Exit ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252... 3-RA1 - Princi x M Question 2 - CV 12.5 - Conne x + Fube Maps Translate News 2.5 i 2 Required information Saved t2 of 3 ts Knowledge Check 01 J. Morgan and M. Halsted are partners who share income and loss in a 3:1 ratio. After several unprofitable periods, the two partners decided to liquidate their partnership. The current period's income or loss is closed to the partners' capital accounts according to the sharing agreement. Immediately before liquidation, the partnership balance sheet shows: land, $100,000; accounts payable, $80,000; J. Morgan, Capital, $15,000; and M. Halsted, Capital, $5,000. On January 15, the land was sold for $110,000 cash. On January 16, the partnership settled its liabilities. On January 31, the remaining cash was distributed to the partners. Prepare the January 15 journal entry for the partnership to…arrow_forwardHow can you display or print a batch or group of reports quickly? A. Create a memorized group of reports. B. Click Batch Reports from the Home Page C. Click Reports > Process multiple reports D. You cannot do this in Quickbooksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education