FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Help

Save & Exit

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252...

3-RA1 - Princi x

M Question 2 - CV 12.5 - Conne x

+

Fube Maps

Translate

News

2.5 i

2

Required information

Saved

t2 of 3

ts

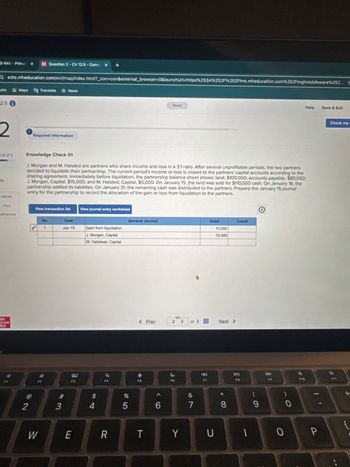

Knowledge Check 01

J. Morgan and M. Halsted are partners who share income and loss in a 3:1 ratio. After several unprofitable periods, the two partners

decided to liquidate their partnership. The current period's income or loss is closed to the partners' capital accounts according to the

sharing agreement. Immediately before liquidation, the partnership balance sheet shows: land, $100,000; accounts payable, $80,000;

J. Morgan, Capital, $15,000; and M. Halsted, Capital, $5,000. On January 15, the land was sold for $110,000 cash. On January 16, the

partnership settled its liabilities. On January 31, the remaining cash was distributed to the partners. Prepare the January 15 journal

entry for the partnership to record the allocation of the gain or loss from liquidation to the partners.

eBook

Print

View transaction list

View journal entry worksheet

eferences

No

Date

General Journal

1

Jan 15

Gain from liquidation

J. Morgan, Capital

M. Halstead, Capital

Mc

Graw

HALF

2

*

W

80

Q

F3

Debit

Credit

10,000

15,000

< Prev

2 3

of 3

95

%

54

#3

6

27

&

Next >

Check my

F7

114

FB

DD

F9

F10

E

R

T

Y

U

כ

8

9

0

0

P

F11

GE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ces - Cor X nheducation.com/ext/map/index.html?_con=con&external_ browser%=D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-g.. PTC Pathway | Login S The GOAT. Let's gra. @ Encrypted Messages O Cisco Webex Meeti. Sign In in Connect Connect Math - T'.. Deborah meeting r. ses i Saved Help Save & Exit Submit Check my work On a given day a stock dealer maintains a bid price of $1,006.50 for a bond and an ask price of $1,009.75. The dealer made 19 trades that totaled 950 bonds traded that day. What was the dealer's gross trading profit for this security? Multiple Choice $950.00 $1,173.25 $3,087.50arrow_forwardChatGi X Gincome X > DeepL X zto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mhe Questi X ssignment i Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below.] On December 31, Hawkin's records show the following accounts. $ 5,900 1,000 3,600 14,800 Cash Accounts Receivable Supplies Equipment Accounts Payable Hawkin, Capital, December 1 Hawkin, Withdrawals Services Revenue Wages Expense Rent Expense Utilities Expense HAWKIN Statement of Owner's Equity For Month Ended December 31 Hawkin, Capital, December 1 Add: Investments by owner Hawkin, Capital, December 31 6,400 15,300 1,800 $ 16,400 8,000 1,900 1,100 QS 1-16 (Algo) Preparing a statement of owner's equity LO P2 Use the above information to prepare a statement of owner's equity for Hawkin for the month ended December 31. Hint: Owner investments are $0 for the period. 0 Copia d X 0 0 chat.op X Log…arrow_forwardomework x ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co.. Q E User Management,. H https://outlook.offi. FES Protection Plan System 7 - North C... ework Exercises Saved Help Bushard Company (buyer) and Schmidt, Inc. (seller), engaged in the following transactions during February 20X1: Bushard Company DATE TRANSACTIONS 20X1 Feb. 10 Purchased merchandise for $6,800 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $380 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 20X1 Feb. 10 Sold merchandise for $6,800 on account to Bushard Company, Invoice 1980, terms 1/10, n/30. The cost of merchandise sold was $3,900. 13 Issued…arrow_forward

- 1V Prin Accou X 1... -40 d ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheduca WP WileyPLUS Login B Bloomberg for Edu... Frontline - Sign In R myRutgers Portal R My Services on Rut... Mc Graw Mill 1 FI Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory Q A A process manufacturer that uses the weighted-average method reports the following. Compute the total equivalent units of production for conversion. Multiple Choice O McGraw-Hill Education Campus X J F2 2 806,000. 868,000, S 684,000 W F3 # 3 E D DII F4 4 R F Units 304,000 624,000 684,000 244,000 Question 16 - Exam II - Connect FS % 5 Conversion Percent Complete F6 T 80% U W] * 8 F9 1 prt sc ( F10 9 K home F11 ScarletApp 0 end Parrow_forwardheducation.com/ext/map/index.htmi?_con=con&ex nacbrowser30&launchuri%=Dnttps%253A %252Fbbhosted.cuny.edu%252Fwebapps%252Fportal%252Fframes. ooks Login H Module 5 Chap 1 8 H Office templates & t.. Il - Chapter 8 Saved Help Save & Exit Subr Northwest Fur Co. started 2021 with $105,000 of merchandise inventory on hand. During 2021, $540,000 in merchandise was purchased on account with credit terms of 2/15, n/45. All discounts were taken. Purchases were all made f.o.b. shipping point. Northwest paid freight charges of $8,500. Merchandise with an invoice amount of $3,400 was returned for credit. Cost of goods sold for the year was $378,000. Northwest uses a perpetual inventory system. Assuming Northwest uses the gross method to record purchases, what is the cost of goods available for sale? Multiple Choice $650,100. $639,368.arrow_forward102arrow_forward

- z- Conr x ezto.mheducation.com/ext/map/index.html?_con% con&external browser-0&daunchUrt-https%253A%252F%252Ffaytechccblackboard.com/%2 7User Management,. https:/foutlook.off. FES Protection Plan System 7- North C. Seved Help Seve &Ext Subm During the year, a firm purchased $144,000 of merchandise and paid freight charges of $12,600. If the total purchases returns and allowances were $9,200 and purchases discounts were $3,300 for the year, what is the net delivered cost of purchases? Multiple Cholce $118,900 $143,900 $144,100 $169.100arrow_forward- Conne X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fmybsc.bryantstratton.edu%252Fwebapps%252Fportal... = T-Connect Assignment 1 Saved Help Save & Exit Subm Check my work Required information [The following information applies to the questions displayed below.] Following are the transactions of a new company called Pose-for-Pics. August 1 M. Harris, the owner, invested $14,500 cash and $62,350 of photography equipment in the company. August 2 The company paid $4,000 cash for an insurance policy covering the next 24 months. August 5 The company purchased supplies for $2,755 cash. August 20 The company received $2,950 cash from taking photos for customers. August 31 The company paid $885 cash for August utilities. k Required: 1. Post the above transactions to the T-accounts. t 2. Use the amounts from the T-accounts in Requirement (1) to prepare an August 31 trial balance for Pose-for-Pics. nces Complete this question by entering your…arrow_forwardlare X 2021taxtables.pd x 2021taxtables.pd x https://ezto-cf-m x uons: ducation.com/ext/map/index.html?_con3Dcon&external_browser%3D08&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q. ulos 1, 2, 3 y 4 O Saved Help Save CI In 2016, Anna borrowed $11,500. In 2021, the debt was forgiven. Anna does not believe she should report the forgiveness of debt as income because she received nothing at the time the debt was forgiven in 2021. Required: What amount of income should Anna record in her tax return in relation to debt forgone? Income to be recorded < Prev 8 of 15arrow_forward

- ducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Fbbhosted.cuny.edu%252Fwebapps%252Fportal% ks Login - Hh Module 5- Chap 1 &.. H Office templates & . - Chapter 5 G Help Save & Saved FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 o.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 1.19405 0.83748 7 1.22987 0.81309 6. 6.4684 5.41719 6.6625 5.57971 7.6625 6.23028 7.8923 6.41719 1.26677 O.78941 1.30477 0.76642 10 1.34392 0.74409 8. 8.8923 7.01969 9.1591 7.23028 9. 10.1591 7.78611 10.4639 8.01969 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12 1.42576 0.70138 12.8078 9.25262 13.1920 9.53020 14.6178 10.25262 16.0863 10.95400 14.1920 9.95400 15.6178 10.63496 17.0863 11.29607 18.5989 11.93794 13 1.46853 0.68095 14 1.51259 0.66112 17.5989 11.63496 19.1569 12.29607 20.7616…arrow_forwardmatsApp. File Edit View Chat Call Window Help MInbox (229) - abigailo XM Gmail xiConnect - Home x M Question 11 - Mid-Tern x Connect Getting to k × wiL47 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam i 11 Skipped Saved The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31. 1. Use the following information about the company's adjustments to complete a 10-column work sheet. a. Unrecorded depreciation on the trucks at the end of the year is $5,761. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $1,800. Help Ask 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 2b. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $295,929 on December 31 of the prior year.…arrow_forwardIROKOTV x M Inbox (2,1 x G Gmall NNetfilx Indoor Cla X Public Hor x Mail - Pati x b Login | ba x (1) AFROE A ezto.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Fblackboard.american.ec HOMEWORK Chp. 11 Saved 2 Problem 11-15 Using CAPM A stock has an expected return of 10 percent, its beta is 1.50, and the expected return on the market is 8 percent. What must the risk-free rate be? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 14.28 polnts eBook Risk-free rate Referencesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education