FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

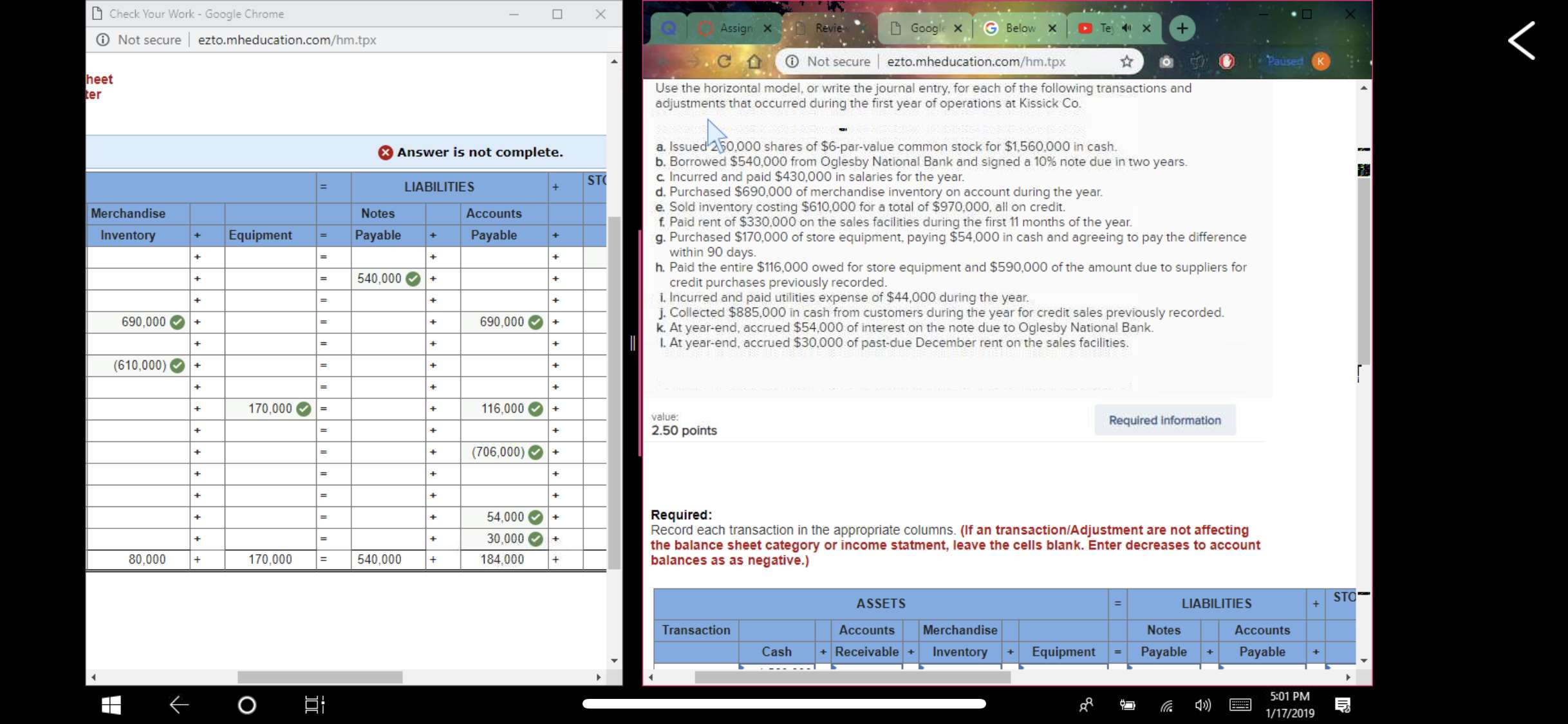

Can you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?

Transcribed Image Text:Check Your Work-Google Chrome

ⓘ Not secure l ezto.mheducation.com/hm.tpx

Assign ×

С

Not secure l ezto.mheducation.com/hm.tpx

heet

er

Use the horizontal model, or write the journal entry, for each of the following transactions and

adjustments that occurred during the first year of operations at Kissick Co.

a. Issued 250,000 shares of $6-par-value common stock for $1,560,000 in cash.

b. Borrowed $540,000 from Oglesby National Bank and signed a 10% note due in two years

C Incurred and paid $430,000 in salaries for the year.

d. Purchased $690,000 of merchandise inventory on account during the year

e. Sold inventory costing $610,000 for a total of $970,000, all on credit.

f Paid rent of $330,000 on the sales facilities during the first 11 months of the year

g. Purchased $170,000 of store equipment, paying $54,000 in cash and agreeing to pay the difference

Answer is not complete.

隨

ST

LIABILITIES

Merchandise

Notes

Accounts

Inventory

EquipmentPa

Payable

within 90 days

h. Paid the entire $116,000 owed for store equipment and $590,000 of the amount due to suppliers for

-540,000+

credit purchases previously recorded

i. Incurred and paid utilities expense of $44,000 during the year

j. Collected $885,000 in cash from customers during the year for credit sales previously recorded.

k. At year-end, accrued $54,000 of interest on the note due to Oglesby National Bank

L. At year-end, accrued $30,000 of past-due December rent on the sales facilities

690,000+

690,000+

610,000)+

70,000

116,000

value:

2.50 points

Required information

(706,000)

54,000+

30,000+

184,000

Required:

Record each transaction in the appropriate columns. (If an transaction/Adjustment are not affecting

the balance sheet category or income statment, leave the cells blank. Enter decreases to account

balances as as negative.)

80,000 +

170,000

540,000 +

STO

ASSETS

LIABILITIES

Transaction

Accounts Merchandise

Notes

Accounts

Cash ReceivableInventoryEquipmentPayablePayable

5:01 PM

1/17/2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 10 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The answer is marked as incorrect, i don't know what's wrong I've tried everythingarrow_forwardThe solution provided was incorrect. Can you re work it?arrow_forwardKaren finds that many claim forms were rejected because important information was omitted. How might Karen suggest corrections for these omissions?arrow_forward

- For the last entries I am having difficulties understanding, could I have more clarification?arrow_forwardNeed urgent answer please. (1) Is COSO relevant for internal control? This is a full question and not any essay question. Need brief and plagirism free answer. Answer should not be too short.arrow_forwardWhat happened to the solutions to part C and D? It seems they are not available.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education