FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The production manager of Rordan Corporation has submitted the following quarterly production

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | |

| Units to be produced | 10,600 | 8,000 | 8,300 | 10,600 |

Each unit requires 0.25 direct labor-hours, and direct laborers are paid $16.00 per hour.

Transcribed Image Text:Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not

adjusted each quarter. Instead, assume that the company's direct labor workforce consists of permanent employees who are

guaranteed to be paid for at least 2,400 hours of work each quarter. If the number of required direct labor-hours is less than

this number, the workers are paid for 2,400 hours anyway. Any hours worked in excess of 2,400 hours in a quarter are paid

at the rate of 1.5 times the normal hourly rate for direct labor. (Round "Direct labor time per unit (hours)" answers to 2

decimal places.)

Show less A

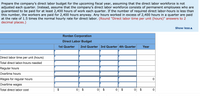

Rordan Corporation

Direct Labor Budget

1st Quarter

2nd Quarter 3rd Quarter 4th Quarter

Year

Direct labor time per unit (hours)

Total direct labor-hours needed

Regular hours

Overtime hours

Wages for regular hours

Overtime wages

Total direct labor cost

%24

%24

%24

Transcribed Image Text:Prepare the company's direct labor budget for the upcoming fiscal year. Assume that the direct labor workforce is adjusted

each quarter to match the number of hours required to produce the forecasted number of units produced. (Round "Direct

labor time per unit (hours)" answers to 2 decimal places.)

Rordan Corporation

Direct Labor Budget

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Year

Direct labor time per unit (hours)

Total direct labor-hours needed

Direct labor cost per hour

Total direct labor cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dhapaarrow_forwardrever Ready Company expects to operate at 85% of productive capacity during May. The total manufacturing costs for May for the production of 3,900 batteries are budgeted as follows: Direct materials Direct labor Variable factory overhead Fixed factory overhead Total manufacturing costs The company has an opportunity to submit a bid for 2,000 batteries to be delivered by May 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during May or increase the selling or administrative expenses. $324,300 119,200 33,350 67,000 $543,850 What is the unit cost below which Forever Ready Company should not go in bidding on the government contract? Round your answer to two decimal places. per unitarrow_forwardThe annual demand for a certain product is 11,340 units. The company informs you that every time an order is placed for this product the cost per order incurred is £100. You are also told that the cost of holding one unit fora year is £0.7. What is the economic order quantity of the product?arrow_forward

- The production department of Zan Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: Units to be produced 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 16,000 19,000 18,000 17,000 In addition, 16,000 grams of raw materials inventory is on hand at the start of the 1st Quarter and the beginning accounts payable for the 1st Quarter is $7,000. Each unit requires 4 grams of raw material that costs $1.80 per gram. Management desires to end each quarter with an inventory of raw materials equal to 25% of the following quarter's production needs. The desired ending inventory for the 4th Quarter is 5,000 grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.40 direct labor-hours and direct laborers are paid $12.50 per hour. Required: 1. and 2. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material…arrow_forwardProduction workers for Benson Manufacturing Company provided 380 hours of labor in January and 660 hours in February. Benson expects to use 4,000 hours of labor during the year. The rental fee for the manufacturing facility is $16,000 per month. Required Based on this information, how much of the rental cost should be allocated to the products made in January and to those made in February? (Do not round intermediate calculations.) Month Allocated Cost January Februaryarrow_forwardCulver, Inc. is a company that manufactures and sells a single product. Unit sales for each of the four quarters of 2025 are projected as follows. Quarter First Second Third Fourth Annual total 100,800 189,000 Units 693,000 151,200 Culver incurs variable manufacturing costs of $0.40 per unit and variable nonmanufacturing costs of $0.35 per unit. Culver will incur fixed manufacturing costs of $907,200 and fixed nonmanufacturing costs of $1,360,800. Culver will sell its product for $4 per unit. 1,134,000 Show Transcribed Text $ Income before taxes (Integral Approach) $ Income before taxes (Discrete Approach) Determine the amount of net income Culver will report in each of the four quarters of 2025, assuming actual sales are as projected and employing the integral approach to interim financial reporting. (Ignore income taxes.) Repeat the analysis under the discrete approach. (Round answers to O decimal places, e.g. 5,125. Enter negative amounts using either a negative sign preceding the…arrow_forward

- Coe Aggregates Ltd has scheduled the production and sale of 35,700 tonnes of aggregates for the Month of April, 2021. Given the following information: Selling prices: $23.15 / tonne Tax rate 30% (of net income) Operating costs Direct material cost: $5.75 /tonne Direct labour cost: $8.05/ tonne Variable overhead costs: $1.56/tonne Fixed overhead cost: $115,820 Selling and Administrative costs Variable: $1.27/tonne Fixed: $28,000 1)Calculate the expected monthly net income after tax (profit) for the month of April 2021 2)Calculate the scheduled production tonnage and sale required to attain a desired net income after tax (profit) of $78,500 for the month of April 2021. PLEASE type or print clearlyarrow_forwardThe PILLOW Co. manufactures two products, AA and BB. The following are projections for the coming month: AA BBSales P100,000 P150,000Costs: Variable 60,000 40,000 Fixed cost for the period is P45,000. 1. Compute for the total breakeven sales.2. Determine the sales requirement for each product to breakeven.arrow_forwardA manufacturer has a production facility that requires 19,111 units of component JY21 per year. Following a long-term contract, the manufacturer purchases component JY21 from a supplier with a lead time of 6 days. The unit purchase cost is $12.8 per unit. The cost to place and process an order from the supplier is $113 per order. The unit inventory carrying cost per year is 20 percent of the unit purchase cost. The manufacturer operates 250 days a year. Assume EOQ model is appropriate. What is the optimal total annual inventory and purchase cost for the manufacturer? Use at least 4 decimal places.arrow_forward

- AB Company produces two Products: A and B. Product A has a contribution margin of $30 per unit. Product B has a contribution margin of $5 per unit. The sales mix is three units of product A for each two units of product B. The company total monthly fixed cost is $480,000. During the month, how many units should the company sell of each ?product to achieve a target operating income of $150,000 .units of product A and 10,600 units of product B 15,900 a O .units of product A and 5,000 units of product B 30,000 b O .18,900units of product A and 12,600 units of product B .c O None of the choices given d O .units of product A and 11,600 units of product B 17,400 .e Oarrow_forwardThe Xenopeltis Company estimates its requirement, which is 39,000 units semiannually at a price of $4 per unit. The carrying cost at 15% of the price and its ordering cost at $90 per order. On a 360-day basis, determine the following: To determine the number of orders to be place in a year? A. Total demand per year must be multiplied by the economic order quantity B. Economic order quantity must be divided by the Total demand per year C. Economic order quantity must added to the Total demand per year D. Total demand per year must be divided by the economic order quantity E. Economic order quantity must be subtracted from the Total demand per yeararrow_forwardHansabenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education