FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

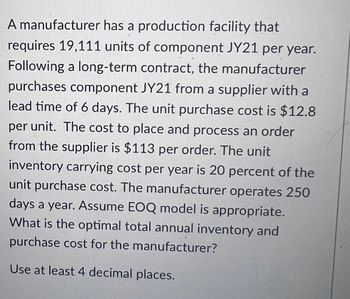

Transcribed Image Text:A manufacturer has a production facility that

requires 19,111 units of component JY21 per year.

Following a long-term contract, the manufacturer

purchases component JY21 from a supplier with a

lead time of 6 days. The unit purchase cost is $12.8

per unit. The cost to place and process an order

from the supplier is $113 per order. The unit

inventory carrying cost per year is 20 percent of the

unit purchase cost. The manufacturer operates 250

days a year. Assume EOQ model is appropriate.

What is the optimal total annual inventory and

purchase cost for the manufacturer?

Use at least 4 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A firm orders on average 400 wheels each month. Demand is normally distributed with standard deviation of the monthly demand being 20 wheels. The ordering cost is $8 per order. The cost to buy one wheel is $4 per wheel. Annual carrying costs are 50% of unit cost. The supplier lead time is 2 operating days. The firm operates 240 days per year, in other word, the firm operates 20 days each month. Each order is received from the supplier in a single delivery. There are no quantity discounts. Write your answer and then Round your answer up to the nearest number for future calculation. (e.g 9.6 => 10). Please clearly write down the formulation and calculation for your answers. Note: Here I make the time measures bolded for you to make you pay the attention to their differences. Please notice the difference in times measure units, so that you do not make mistake by doing calculations with different time measures. You need to convert the data to the same time measures before doing any…arrow_forwardCeder Company has compiled the following data for the upcoming year: Sales are expected to be 16,000 units at $52 each. Each unit requires 4 pounds of direct materials at $2.40 per pound. Each unit requires 2.1 hours of direct labor at $13 per hour. Manufacturing overhead is $4.90 per unit. Beginning direct materials inventory is $5,400. Ending direct materials inventory is $6,950. Selling and administrative costs totaled $138,720. Determine Ceder's budgeted cost of goods sold. Complete Ceder's budgeted income statement.arrow_forwardChimneySweep provides cleaning services for residential chimneys and fireplaces. The cleaning service requires $35 in variable costs for cleaning materials. The fixed costs of labor, the company’s truck, and administrative support are $165,000 per year. ChimneySweep averages 100 service calls per month. What is the average cost per cleaning service call? Round your answer to 2 decimal places.arrow_forward

- Western Jeans Co. has an annual plant capacity of 2,000,000 units, and current production is 1,920,000 units. Monthly fixed costs are $400,000, and variable costs are $9 per unit. The present selling price is $15 per unit. On July 6 of the current year, the company received an offer from Childs Company for 50,000 units of the product at $13 each. Childs Company will market the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of sales of Western Jeans Co. Question Content Area a. Prepare a differential analysis dated July 6 on whether to reject (Alternative 1) or accept (Alternative 2) the Childs order. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential AnalysisReject (Alt. 1) or Accept (Alt. 2) OrderJuly 6 Line Item Description Reject Order(Alternative 1) Accept Order(Alternative 2) Differential Effects(Alternative 2) Revenues $Revenues…arrow_forwardSheridan Ranch Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 66% of direct labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively. Normal production is 34,300 curtain rods per year. A supplier offers to make a pair of finials at a price of $13.05 per unit. If Sheridan Ranch accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $45,700 of fixed manufacturing overhead currently being charged to the finials will have to be absorbed by other products. (a) Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Direct materials. Direct labor Variable overhead costs Fixed manufacturing costs Purchase price Total…arrow_forwardSheridan Inc. has been manufacturing its own shades for its table lamps. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 50% of direct labour costs. The direct materials and direct labour costs per unit to make the lampshades are $4.50 and $5.50, respectively. Normal production is 48,000 table lamps per year. A supplier offers to make the lampshades at a price of $13.20 per unit. If Sheridan Inc. accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $40,000 of fixed manufacturing overhead currently being charged to the lampshades will have to be absorbed by other products. Prepare the incremental analysis for the decision to make or buy the lampshades. (Round answers to O decimal places, e.g. 5,275. If an amount reduces the net income then enter with a negative sign preceding the number e.g. -15,000 or parenthesis, e.g. (15,000). While alternate approaches are…arrow_forward

- Gustavo Fring approached Walt & Jessie Pharmaceutical Co. to buy 50 pounds of product for $50,000 a pound. Regular customers are charged $84,000 for a pound of product. Walt and Jessie Pharmaceutical Co. has the capacity to make 1000 pounds of product per month. The following costs are associated with the company's normal monthly production of the sale of 970 pounds of product: Direct Material per Pound of Product $9,000 Direct Labor per Pound of Product $2,000 Variable MOH per Pound of Product $3,000 Fixed MOH per Pound of Product $3,000 What is the minimum price Walt and Jessie Pharmaceutical Co. would be willing to accept per pound of product for the order? Round your answer to the nearest dollar. Hint: You can solve this problem using the formula for minimum transfer price. Transfer price >= incremental variable costs per unit + (Sacrificed regular contribution margin/ # units transferred) Minimum price = incremental variable costs per unit + ((# units…arrow_forwardIvanhoe Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 61% of direct labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively. Normal production is 32,300 curtain rods per year. A supplier offers to make a pair of finials at a price of $12.90 per unit. If Ivanhoe accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $46,500 of fixed manufacturing overhead currently being charged to the finials will have to be absorbed by other products. (a) Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45)) Direct materials Direct labor Variable overhead costs Fixed manufacturing costs Purchase price Total annual cost (c) (b)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education