FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

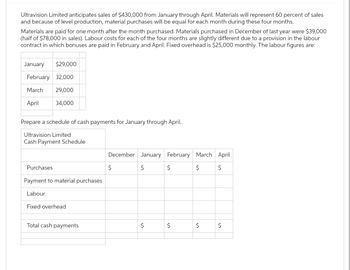

Transcribed Image Text:Ultravision Limited anticipates sales of $430,000 from January through April. Materials will represent 60 percent of sales

and because of level production, material purchases will be equal for each month during these four months.

Materials are paid for one month after the month purchased. Materials purchased in December of last year were $39,000

(half of $78,000 in sales). Labour costs for each of the four months are slightly different due to a provision in the labour

contract in which bonuses are paid in February and April. Fixed overhead is $25,000 monthly. The labour figures are:

January $29,000

February 32,000

March 29,000

April

34,000

Prepare a schedule of cash payments for January through April.

Ultravision Limited

Cash Payment Schedule

Purchases

Payment to material purchases

Labour

Fixed overhead

Total cash payments

December January February March April

$

$

$

$

$

$

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- rever Ready Company expects to operate at 85% of productive capacity during May. The total manufacturing costs for May for the production of 3,900 batteries are budgeted as follows: Direct materials Direct labor Variable factory overhead Fixed factory overhead Total manufacturing costs The company has an opportunity to submit a bid for 2,000 batteries to be delivered by May 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during May or increase the selling or administrative expenses. $324,300 119,200 33,350 67,000 $543,850 What is the unit cost below which Forever Ready Company should not go in bidding on the government contract? Round your answer to two decimal places. per unitarrow_forwardBirch Company normally produces and sells 49,000 units of RG-6 each month. The selling price is $20 per unit, variable costs are $10 per unit, fixed manufacturing overhead costs total $155,000 per month, and fixed selling costs total $50,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company’s sales to temporarily drop to only 12,000 units per month. Birch Company estimates the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing its own plant during the strike, which would reduce fixed manufacturing overhead costs by $49,000 per month and fixed selling costs by 10%. Start-up costs at the end of the shutdown would total $12,000. Because Birch Company uses Lean Production methods, no inventories are on hand. Required: What is the financial advantage (disadvantage) if Birch closes its own plant for two…arrow_forwardProduction workers for Benson Manufacturing Company provided 380 hours of labor in January and 660 hours in February. Benson expects to use 4,000 hours of labor during the year. The rental fee for the manufacturing facility is $16,000 per month. Required Based on this information, how much of the rental cost should be allocated to the products made in January and to those made in February? (Do not round intermediate calculations.) Month Allocated Cost January Februaryarrow_forward

- Birch Company normally produces and sells 47,000 units of RG-6 each month. The selling price is $20 per unit, variable costs are $10 per unit, fixed manufacturing overhead costs total $200,000 per month, and fixed selling costs total $40,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company’s sales to temporarily drop to only 9,000 units per month. Birch Company estimates that the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing down its own plant during the strike, which would reduce its fixed manufacturing overhead costs by $41,000 per month and its fixed selling costs by 10%. Start-up costs at the end of the shutdown period would total $13,000. Because Birch Company uses Lean Production methods, no inventories are on hand. Required: 1. What is the financial advantage (disadvantage) if…arrow_forwardBirch Company normally produces and sells 49,000 units of RG-6 each month. The selling price is $30 per unit, variable costs are $10 per unit, fixed manufacturing overhead costs total $190,000 per month, and fixed selling costs total $36,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company’s sales to temporarily drop to only 9,000 units per month. Birch Company estimates that the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing down its own plant during the strike, which would reduce its fixed manufacturing overhead costs by $43,000 per month and its fixed selling costs by 10%. Start-up costs at the end of the shutdown period would total $13,000. Because Birch Company uses Lean Production methods, no inventories are on hand. Required: 1. What is the financial advantage (disadvantage) if…arrow_forwardPam-Tees Company plans to sell 11,000 T-shirts at $15 each in the coming year. Product costs include: Direct materials per T-shirt $4.75 Direct labour per T—shirt $2.25 Variable overhead per T- shirt $0.50 Total fixed factory overhead $32,000 Variable selling expense is the redemption of a coupon, which averages $0.70 per T-shirt; fixed selling and administrative expenses total $17,000. Required: Calculate the: 1. Variable product cost per unit 2. Contribution margin ratio (rounded to four significant digits) 3. Total fixed expense for the year 4. Break Even point in quantity (Q) 5. Margin of Safety in Quantity (Q)arrow_forward

- Trago Company manufactures a single product and has a JIT policy that ending inventory must equal 10% of the next month's sales. It estimates that May's ending inventory will consist of 29,600 units. June and July sales are estimated to be 296,000 and 306,000 units, respectively. Trago assigns variable overhead at a rate of $3.40 per unit of production. Fixed overhead equals $416,000 per month. Compute the budgeted total factory overhead for June.arrow_forwardAB Company produces two Products: A and B. Product A has a contribution margin of $30 per unit. Product B has a contribution margin of $5 per unit. The sales mix is three units of product A for each two units of product B. The company total monthly fixed cost is $480,000. During the month, how many units should the company sell of each ?product to achieve a target operating income of $150,000 .units of product A and 10,600 units of product B 15,900 a O .units of product A and 5,000 units of product B 30,000 b O .18,900units of product A and 12,600 units of product B .c O None of the choices given d O .units of product A and 11,600 units of product B 17,400 .e Oarrow_forwardCeder Company has compiled the following data for the upcoming year: Sales are expected to be 16,000 units at $52 each. Each unit requires 4 pounds of direct materials at $2.40 per pound. Each unit requires 2.1 hours of direct labor at $13 per hour. Manufacturing overhead is $4.90 per unit. Beginning direct materials inventory is $5,400. Ending direct materials inventory is $6,950. Selling and administrative costs totaled $138,720. Determine Ceder's budgeted cost of goods sold. Complete Ceder's budgeted income statement.arrow_forward

- Becker Bikes manufactures tricycles. The company expects to sell 360 units in May and 490 units in June. Beginning and ending finished goods for May are expected to be 100 and 65 units, respectively. June's ending finished goods are expected to be 75 units. Each unit requires 3 wheels at a cost of $6 per wheel. Becker requires 20 percent of next month's material production needs on hand each month. July's production units are expected to be 460 units. Compute Becker's direct materials purchases budget with respect to wheels for May and June. Budgeted cost of wheels purchased May Junearrow_forwardThe Xenopeltis Company estimates its requirement, which is 39,000 units semiannually at a price of $4 per unit. The carrying cost at 15% of the price and its ordering cost at $90 per order. On a 360-day basis, determine the following: To determine the number of orders to be place in a year? A. Total demand per year must be multiplied by the economic order quantity B. Economic order quantity must be divided by the Total demand per year C. Economic order quantity must added to the Total demand per year D. Total demand per year must be divided by the economic order quantity E. Economic order quantity must be subtracted from the Total demand per yeararrow_forwardBirch Company normally produces and sells 48,000 units of RG-6 each month. The selling price is $20 per unit, variable costs are $10 per unit, fixed manufacturing overhead costs total $180,000 per month, and fixed selling costs total $34,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company’s sales to temporarily drop to only 8,000 units per month. Birch Company estimates that the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing down its own plant during the strike, which would reduce its fixed manufacturing overhead costs by $47,000 per month and its fixed selling costs by 10%. Start-up costs at the end of the shutdown period would total $13,000. Because Birch Company uses Lean Production methods, no inventories are on hand. Required: 1. What is the financial advantage (disadvantage) if…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education