FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

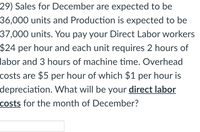

Transcribed Image Text:29) Sales for December are expected to be

36,000 units and Production is expected to be

37,000 units. You pay your Direct Labor workers

$24 per hour and each unit requires 2 hours of

labor and 3 hours of machine time. Overhead

costs are $5 per hour of which $1 per hour is

depreciation. What will be your direct labor

costs for the month of December?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 6. Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitri’s normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitri’s other operations. PLEASE NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). If Dimitri accepts the offer, what will be the impact on profits of accepting the order. Incremental dollar amount = ? . Increase or Decrease? . Please note: Your answer is either "Increase" or "Decrease" - capital first letters and no quotes.arrow_forwardAshland Company manufactures and sells a single product. The company's sales and expenses for a recent month are as follows: (a) What is the monthly break-even point in units sold and in sales dollars?(b) How many units would have to be sold each month to earn a minimum target net income of $50,000?arrow_forwardThe production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year:arrow_forward

- 1.what is the cost pf lobor required to operate the production line per month 2.If you require astorage area of 600 sq.ft and with an average rent $12 per sq.ft/month what is the estimated cost of rent per month for the production line including the storage area.(Rounded to the nearest $1000). 3.how many operators do you need for the production line. 4. what is the cost of buying and installing the production line.arrow_forwardMaple Enterprises sells a single product with a selling price of $70 and variable costs per unit of $21. The company's monthly fixed expenses are $29,400. A. What is the company's break-even point in units? Break-even units 600 units B. What is the company's break-even point in dollars? Break-even dollars $49.00 C. Construct a contribution margin income statement for the month of September when they will sell 800 units. Use a minus sign for a net loss if present. Income Statement Sales $56,000 Variable Costs -16,800 Contribution Margin $39,200 Fixed Costs -29,400 Net Income $9,800 D. How many units will Maple need to sell in order to reach a target profit of $44,100? New break-even units _____ units E. What dollar sales will Maple need in order to reach a target profit of $44,100? New break-even dollars $_____ F. Construct a contribution margin income statement for Maple that reflects $140,000 in sales volume. Income Statementarrow_forwardTo make a product it costs $24 per liter. The importation cost is a fixed cost of $ 150 additional of the unit costs. The time that takes from placing the order to receiving it is 5 weeks. During this time the average consumed is 80 liters with a std dev. of 4 liters. If the products ends the costs is $45 per liter. They work 52 weeks a year. The anual interest is 20% What is the order size and reorder point if we want to accomplish 90% of demand in the cycles? What is the order size and reorder point if we want to minimize average costs? what would be service level type 2?arrow_forward

- : If the monthly labor cost for security staff is $33,000, and 50 security workers are each working 40 hours per month, what is the hourly pay per worker?arrow_forwardA company sells one of its products for $13.80 per unit. Its fixed costs are $1,080.00 per month, and the variable cost per unit is $4.80. The production capacity is 625 units per month. (a) The break-even volume, i.e., the level of output at break-even, is per month. (If necessary, round up to the next whole number of units.) (b) The break-even volume as a percent of capacity is your answer to two decimal places.) units (d) The net income at the break-even level of output is $ %. (If necessary, round (c) The break-even revenue, i.e., the total revenue at the break-even level of output, is $ per month.arrow_forwardA local toolmaker makes the best hammers on the market. The head of the hammer costs $15.56 and the handle costs $4.24. It takes 1.4 minutes to assemble the hammer and the hourly cost is $91 for assembly time. The company has fixed operating costs of $26348 per month. They sell the hammers for three times their total variable cost. The company wants to make a monthly profit of $8619. How many hammers must they sell? Round to the nearest whole number Answer:arrow_forward

- Blossom Company makes radios that sell for $40 each. For the coming year, management expects fixed costs to total $126,380 and variable costs to be $32 per unit. Compute the sales dollars required to earn net income of $153,620.arrow_forwardA local toolmaker makes the best hammers on the market. The head of the hammer costs $19.75 and the handle costs $3.52. It takes 1.4 minutes to assemble the hammer and the hourly cost is $73 for assembly time. The company has fixed operating costs of $27746 per month. They sell the hammers for three times their total variable cost. The company wants to make a monthly profit of $14085. How many hammers must they sell? Round to the nearest whole number Answer:arrow_forwardrally synthesis inc. manufactures and sells 100 bottles per day. fixed costs are $22,000 and the variable costs for manufacturing 100 bottles are $30,000. Each bottle is sold for $1,200. how would the daily profit be affected if the daily volume of sales drop by 10%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education