FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

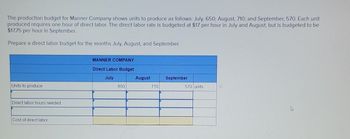

Transcribed Image Text:The production budget for Manner Company shows units to produce as follows: July, 650; August, 710; and September, 570. Each unit produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be $17.75 per hour in September.

Prepare a direct labor budget for the months July, August, and September.

**Table: Manner Company - Direct Labor Budget**

| | July | August | September |

|----------------|------|--------|-----------|

| Units to produce | 650 | 710 | 570 |

| Direct labor hours needed | | | |

| Cost of direct labor | | | |

- **Units to produce**: This row indicates the number of units that Manner Company plans to produce each month.

- **Direct labor hours needed**: This row will be filled with the same numbers as units to produce, since each unit requires one hour of direct labor.

- **Cost of direct labor**: This row is calculated by multiplying direct labor hours by the hourly wage for each month. For July and August, the rate is $17, while in September, it is $17.75.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Addison Company budgets production of 2,760 units during the second quarter. Information on its direct labor and its variable and fixed overhead is as follows: Direct labor Variable overhead Fixed overhead 1. Prepare a direct labor budget. 2. Prepare a factory overhead budget. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Each finished unit requires 5 direct labor hours, at a cost of $8 per hour. Budgeted at the rate of $10 per direct labor hour. Budgeted at $550,000 per quarter. Prepare a direct labor budget. Units to produce Direct labor hours needed Cost of direct labor ADDISON COMPANY Direct Labor Budget Second Quarter 2,760 unitsarrow_forwardFind the direct labor budget, and manufacturing overhead budget for the yeararrow_forwardThe direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Budgeted direct labor-hours 9,000 8,700 9,000 8,400 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $3.25 per direct labor-hour and its total fixed manufacturing overhead is $58,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $14,500 per quarter. Required: Prepare the company’s manufacturing overhead budget for the upcoming fiscal year. Compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.arrow_forward

- Yuvwell Corporation's direct labor budget for next year contained the following information: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 8,600 8,500 8,200 8,800 Budgeted direct labor-hours The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $2.75 per direct labor-hour and its total fixed manufacturing overhead is $54,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation of $13,500 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for next year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for next year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's manufacturing overhead budget for next year. Note: Round "Variable manufacturing overhead rate" answers to 2 decimal places. Variable manufacturing…arrow_forwardBlack Company expects to produce 2,100 finished goods units in January and 2,010 finished goods units in February. Black budgets 7 direct labor hours per finished good unit. Direct labor costs averages $11 per hour. Black's budgeted cost of Direct Labor for February is O $124,300 O $142,630 O $154,770 O $139,200 O $161,420arrow_forwardHarlow Parts produces a single product at its Superior Plant. The master budget for July follows: Harlow Parts Superior Plant Master Budget (For July) Quantity Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit 8,200 $ 1,558,000 590,400 98,400 $ 869,200 212,000 370,000 $ 287,200 The following operating income statement shows the actual results for July: Harlow Parts Superior Plant Operating Results (For July) Quantity (units) Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit Required: 9,600 $ 1,760,800 780,394 111,040 $ 869,366 223,040 380,000 $ 266,326 Prepare a profit variance analysis for the Superior Plant for July. (Do not round intermediate calculations. Indicate the effect of each variance by…arrow_forward

- Static budget versus flexible budget The production supervisor of the Machining Department for Hagerstown Company agreed to the following monthly static budget for the upcoming year: Hagerstown Company Machining Department Monthly Production Budget Wages Utilities Depreciation Total $1,090,000 49,000 82,000 $1,221,000 The actual amount spent and the actual units produced in the first three months in the Machining Department were as follows: Amount Spent Units Produced 100,000 91,000 82,000 May June July The Machining Department supervisor has been very pleased with this performance because actual expenditures for May-July have been significantly less than the monthly static budget of 1,221,000. However, the plant manager believes that the budget should not remain fixed for every month but should "flex" or adjust to the volume of work that is produced in the Machining Department. Additional budget information for the Machining Department is as follows: $1,150,000 1,095,000 1,042,000…arrow_forwardStarts Inc. using production levels of 62,000, 67,200, and 69,300 units produced. The following additional information is necessary to complete the budget. Prepare a flexible production budget for the year ending December 31 for :Variable costs: Direct labor ($18.00 per unit) Direct materials ($5.00 per unit) Variable manufacturing costs ($8.00 per unit) Fixed costs: Supervisor’s salaries $27,000 Rent 18,000 Depreciation on equipment 82,000arrow_forwardThe production budget for Manner Company shows units to produce as follows: July, 700; August, 760; and September, 620. Each unit produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be $17.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July 700 August 760 September 620 unitsarrow_forward

- The production budget for Manner Company shows units to produce as follows: July, 630; August, 690; and September, 550. Each un produced requires three hours of direct labor. The direct labor rate is budgeted at $16 per hour in July and August, but is budgeted to be $16.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July August 630 690 September 550 unitsarrow_forwardRamos Company provides the following (partial) production budget for the next three months. Each finished unit requires 0.50 hour of direct labor at the rate of $16 per hour. The company budgets variable overhead at the rate of $20 per direct labor hour and budgets fixed overhead of $8,000 per month. Production Budget Units to produce Required 1 Required 2 1. Prepare a direct labor budget for April, May, and June. 2. Prepare a factory overhead budget for April, May, and June. April 442 Complete this question by entering your answers in the tabs below. Units to produce May 570 Direct labor hours needed June 544 Prepare a direct labor budget for April, May, and June. (Enter your direct labor hours (hours) per unit in two decimal places.) Cost of direct labor RAMOS COMPANY Direct Labor Budget April 544 unitsarrow_forwardHarper Manufacturing determines allocation rates as part of its annual budgeting process, which takes place 1 month before the beginning of the year. The company reports the following manufacturing overhead information as part of its budgeting process: Budgeted MOH Budgeted production (units) Budgeted direct labor hours Cost Pool Cost Pool 1 Cost Pool 2 Total Total Cost $ 6,000,000 $ 9,000,000 $ 15,000,000 $ 15,000,000 25,000,000 40,000 Allocation Base Unit Direct labor hour Question a. Assuming that Harper uses a traditional job costing system with a single allocation base (units), what is the predetermined overhead rate for the upcoming year? Note: Round your answer to 2 decimals. b. Assume Job 189 comprises 36 units and 2 direct labor hours. If Harper uses a traditional job costing system with a single allocation base (units), what is the total manufacturing overhead allocated to the job? Note: Round your answer to 2 decimals. c1. Now assume that Harper uses a two-stage job costing…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education