FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

The direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours:

|

|

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

|

Budgeted direct labor-hours |

9,000 |

8,700 |

9,000 |

8,400 |

The company uses direct labor-hours as its

Required:

- Prepare the company’s manufacturing overhead budget for the upcoming fiscal year.

- Compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Transcribed Image Text:Required 1 Required 2

Prepare the company's manufacturing overhead budget for the upcoming fiscal year. (Round "Variable manufacturing overhead rate"

answers to 2 decimal places.)

Yuvwell Corporation

Manufacturing Overhead Budget

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Year

Variable manufacturing overhead rate

Variable manufacturing overhead

Fixed manufacturing overhead

Total manufacturing overhead

Cash disbursements for manufacturing overhead

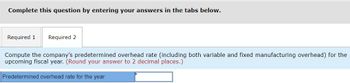

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the

upcoming fiscal year. (Round your answer to 2 decimal places.)

Predetermined overhead rate for the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The manufacturing overhead budget at Foshay Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 5,800 direct labor-hours will be required in May. The variable overhead rate is $9.10 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $104,400 per month, which includes depreciation of $8,120. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. What should be the predetermined overhead rate for May?arrow_forwardA company's budgeted varlable manufacturing overhead cost Is $1.05 per machine-hour and Its budgeted fixed manufacturing overhead Is $27,094 per month. The following information is avallable for a recent month: a. The denominator activity of 8,740 machine-hours is used to compute the predetermined overhead rate. b. At a denominator activity of 8.740 machine-hours, the company should produce 3,800 unlts of product. C. The company's actual operating results were: Number of units produced Actual machine-hours Actual variable manufacturing overhead cost Actual fixed manufacturing overhead cost 4,220 10,050 $12,060.00 $26,400.00 Required: 1. Compute the predetermined overhead rate and break It down Into varlable and fixed cost elements. (Round your answers to 2 declmal places.) 2. Compute the standard hours allowed for the actual production. 3. Compute the varlable overhead rate and efficlency varlances and the fixed overhead budget and volume varlances. (Indicate the effect of each…arrow_forwardAssume the following five facts: • budgeted fixed manufacturing overhead for the coming period of $308,750 • budgeted variable manufacturing overhead of $4.00 per direct labor hour, • actual direct labor hours worked of 64,000 hours, and • budgeted direct labor-hours to be worked in the coming period of 65,000 hours. The company allocates MOH based on direct-labor hours. The predetermined plantwide overhead rate for the period is closest to:A. $8.50 per dlh B. $8.82 per dlh C. $$8.75 per dlh D. $8.63 per dlharrow_forward

- The manufacturing overhead budget at Franklyn Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 2,500 direct labor-hours will be required in January. The variable overhead rate is $5 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $43,010 per month, which includes depreciation of $3,750. All other fixed manufacturing overhead costs represent current cash flows. The January cash disbursements for manufacturing overhead on the manufacturing overhead budget should be: Group of answer choices $55,510 $12,500 $51,760 $39,260arrow_forwardYuvwell Corporation's direct labor budget for next year contained the following information: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 8,600 8,500 8,200 8,800 Budgeted direct labor-hours The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $2.75 per direct labor-hour and its total fixed manufacturing overhead is $54,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation of $13,500 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for next year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for next year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's manufacturing overhead budget for next year. Note: Round "Variable manufacturing overhead rate" answers to 2 decimal places. Variable manufacturing…arrow_forwardSubject: accountingarrow_forward

- Yuvwell Corporation's direct labor budget for next year contained the following Information: Budgeted direct labor-hours 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 8,000 8,200 8,500 7,800 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $3.25 per direct labor-hour and its total fixed manufacturing overhead is $48,000 per quarter. The only noncash Item Included in fixed manufacturing overhead is depreciation of $16,000 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for next year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for next year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's manufacturing overhead budget for next year. Note: Round "Variable manufacturing overhead rate" answers to 2 decimal places. Yuvwell Corporation…arrow_forwardABC Corporation has prepared the following overhead budget for next month. Activity level Variable overhead costs: Supplies Indirect labor Fixed overhead costs: Supervision Utilities Depreciation Total overhead cost 3,700 machine-hours $ 21,090 35,520 18,100 7,100 8,100 $ 89,910 The company's variable overhead costs are driven by machine-hours. What would be the total budgeted overhead cost for next month if the activity level is 3,600 machine-hours rather than 3,700 machine-hours? (Round your intermediate calculations to 2 decimal places.)arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for esch deportment. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor Indirect labor Utilitics Supplies Equipment depreciation Factory rent Ргopсrty tакеs Factory adninistration $15.88g $8, 280 + $1.68g $6,400 + $e.seg $1,180 + $e.48g $23,0ee + $3.78g $8,400 $2,100 $11,700 + $1.9eg The Production Department planned to work 8,000 lebor-hours in March; however, it octually worked 8,400 lobor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March $134,738 $ 19,860 $ 14,578 $ 4,988 $ 54, 88e $ 8,700 $ 2,100 $ 26,470 Direct labor Indirect labor lities Supplies Equipment depreciation Factory rent Property taxes Factory administration Required: 1. Prepare the Production…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education