FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

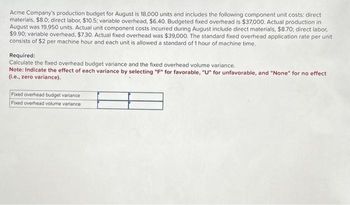

Transcribed Image Text:Acme Company's production budget for August is 18,000 units and includes the following component unit costs: direct

materials, $8.0; direct labor, $10.5; variable overhead, $6.40. Budgeted fixed overhead is $37,000. Actual production in

August was 19,950 units. Actual unit component costs incurred during August include direct materials, $8.70; direct labor,

$9.90; variable overhead, $7.30. Actual fixed overhead was $39,000. The standard fixed overhead application rate per unit

consists of $2 per machine hour and each unit is allowed a standard of 1 hour of machine time.

Required:

Calculate the fixed overhead budget variance and the fixed overhead volume variance.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect

(i.e., zero variance).

Fixed overhead budget variance

Fixed overhead volume variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- NuArt Company's budgeted production for November is 5,500 units. Budgeted component unit costs include: direct materials, $24; direct labor, $30; variable overhead, $18. Budgeted fixed overhead is $100,000. NuArt's actual production for November was 6,000 units. Actual component unit costs include: direct materials, $24.50; direct labor, $29; variable overhead, $18.40. Actual fixed overhead was $94,000. NuArt's flexible budget amount for direct labor in November would be: Multiple Choice A)$100,000 B)$156,000 C)$174,000 D)$180,000.arrow_forwardThe following information relates to Steele Manufacturing's overhead costs for the month: Static budget variable overhead $35,900 Static budget fixed overhead $15,600 Static budget direct labor hours 15,400 hours Static budget number of units 5,500 units Steele allocates variable manufacturing overhead to production based on standard direct labor hours. Steele reported the following actual results for last month: actual variable overhead, $35,400;actual fixed overhead, $15,400; actual production of 5,400 units at 2.4 direct labor hours per unit. The standard direct labor time is 2.8 direct labor hours per unit. Compute the variable overhead efficiency variance. (Round the answer to the nearest dollar.) A. $4,474 U B. $5,033 U C. $4,474 F D. $5,033 Farrow_forwardThe production budget for Manner Company shows units to produce as follows: July, 650; August, 710; and September, 570. Each unit produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be $17.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July 650 August 710 September 570 units hsarrow_forward

- Cholla Company’s standard fixed overhead rate is based on budgeted fixed manufacturing overhead of $10,800 and budgeted production of 36,000 units. Actual results for the month of October reveal that Cholla produced 31,000 units and spent $10,500 on fixed manufacturing overhead costs.arrow_forwardThe following data pertains to the month of October for Elm. Co. when production was budgeted to be 5,000 units of P90. P90 has standard costs per unit of: 3 lbs of Direct Materials at a cost of $7.00 per lb; .20 hours of Direct Labor at $18.00 per hour, and variable overhead assigned on the basis of 0.05 machine hours at a rate of $50 per machine hour. In October the productio of P90 was 4,600 units, using 15,100 lbs of material costing a total of $107,778. A.Determine the direct materials price variance. (negative numbers indicate a favorable variance)arrow_forwardStarts Inc. using production levels of 62,000, 67,200, and 69,300 units produced. The following additional information is necessary to complete the budget. Prepare a flexible production budget for the year ending December 31 for :Variable costs: Direct labor ($18.00 per unit) Direct materials ($5.00 per unit) Variable manufacturing costs ($8.00 per unit) Fixed costs: Supervisor’s salaries $27,000 Rent 18,000 Depreciation on equipment 82,000arrow_forward

- The production budget for Manner Company shows units to produce as follows: July, 700; August, 760; and September, 620. Each unit produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be $17.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July 700 August 760 September 620 unitsarrow_forwardThe production budget for Manner Company shows units to produce as follows: July, 630; August, 690; and September, 550. Each un produced requires three hours of direct labor. The direct labor rate is budgeted at $16 per hour in July and August, but is budgeted to be $16.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July August 630 690 September 550 unitsarrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $1,163,800. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 17,900 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 21,800 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year. direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. $ per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. Night lights $ Desk lamps $ per unit per unitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education