FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

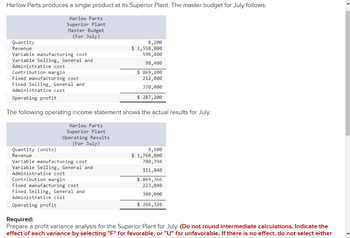

Transcribed Image Text:Harlow Parts produces a single product at its Superior Plant. The master budget for July follows:

Harlow Parts

Superior Plant

Master Budget

(For July)

Quantity

Revenue

Variable manufacturing cost

Variable Selling, General and

Administrative cost

Contribution margin

Fixed manufacturing cost

Fixed Selling, General and

Administrative cost

Operating profit

8,200

$ 1,558,000

590,400

98,400

$ 869,200

212,000

370,000

$ 287,200

The following operating income statement shows the actual results for July:

Harlow Parts

Superior Plant

Operating Results

(For July)

Quantity (units)

Revenue

Variable manufacturing cost

Variable Selling, General and

Administrative cost

Contribution margin

Fixed manufacturing cost

Fixed Selling, General and

Administrative cost

Operating profit

Required:

9,600

$ 1,760,800

780,394

111,040

$ 869,366

223,040

380,000

$ 266,326

Prepare a profit variance analysis for the Superior Plant for July. (Do not round intermediate calculations. Indicate the

effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider Derek's budget information: materials to be used totals $63,800; direct labor totals $201,700; factory overhead totals $395,600; work in process inventory January 1, $189,900; and work in progress inventory on December 31, $191,300. What is the budgeted cost of goods manufactured for the year?arrow_forwardBrown Inc.'s production budget for Product X for the year ended December 31 is as follows: Product X Sales 640,000 units Plus desired ending inventory 85,000 Total 725,000 Less estimated beginning inventory, Jan. 1 90,000 Total production 635,000 In Brown's production operations, Materials A, B, and C are required to make Product X. The quantities of direct materials expected to be used for each unit of product are as follows: Product X Material A .50 pound per unit Material B 1.00 pound per unit Material C 1.20 pound per unit The prices of direct materials are as follows: Material A $0.60 per pound Material B $1.70 per pound Material C $1.50 per pound Prepare a direct materials purchases budget for Product X. Enter all answers as positive amounts. Brown Inc. Direct Materials Purchases Budget A B Total Units required for production of Product X (Ibs) 317,500 635,000 762,000 V Unit price 0.60 1.70 X Total direct materials purchases 190,500 1,079,500arrow_forwardThe following information relates to Steele Manufacturing's overhead costs for the month: Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units $35,600 $15,200 14,300 hours 5,500 units Steele allocates variable manufacturing overhead to production based on standard direct labor hours. Steele reported the following actual results for last month: actual variable overhead, $35,100; actual fixed overhead, $15,000; actual production of 5,400 units at 2.2 direct labor hours per unit. The standard direct labor time is 2.6 direct labor hours per unit. Compute the variable overhead efficiency variance. (Round the answer to the nearest dollar.) OA. $4,831 U B. $5,378 F C. $5,378 U OD. $4,831 Farrow_forward

- ( Robinwood Fixtures manufactures two products, K4 and X7. The company prepares its master budget on the basis of standard costs. The following data are for September: Standards Direct materials Direct labor Variable overhead (per direct labor-hour) Fixed overhead (per month) Expected activity (direct labor-hours) Actual results Direct material (purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) Direct materials Direct labor Variable overhead Fixed overhead Price Variance $ 20.60 $415,680 17,320 0.75 pounds at $7.40 per pound. 1.25 hours at $25.40 per hour $ 319,060 $ 383,740 K4 10,000 pounds at $6.80 per pound 14,770 hours at $25.70 per hour K4 12,140 units Required: a. Prepare a variance analysis for each variable cost for each product. b. Prepare a fixed overhead variance analysis for each product. Note: For all requirements, Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for…arrow_forwardCrystal Glassware Company has the following standards and flexible - budget data. Standard variable - overhead rate $ 6.00 per direct - labor hour Standard quantity of direct labor 2 hours per unit of output Budgeted fixed overhead $ 100,000 Budgeted output 25,000 units Actual results for April are as follows: Actual output 20,000 units Actual variable overhead $ 320,000 Actual fixed overhead $ 97,000 Actual direct labor 50,000 hours Required: Prepare journal entries for the following transactions. Note: If no entry is required for a transaction /event, select "No journal entry required" in the first account field. Record the incurrence of actual variable overhead and actual fixed overhead. Add variable and fixed overhead to Work-in-Process Inventory. Close underapplied or overapplied overhead into Cost of Goods Sold.arrow_forwardAnthon Corporation has provided the following information regarding last month's activities. Units produced (actual) 10,920 Master production budget Direct materials. Direct labor $ 240,372 203,952 278,613 Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead Direct materials Direct labor Variable overhead Fixed overhead $ 3.96 per liter x 5 liters per unit of output $ 33.60 per hour x 0.50 hour per unit $ 29.90 per direct labor-hour Variable overhead is applied on the basis of direct labor-hours. Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Price Variance $ 234,780 (60,200 liters) 181,260 (5,300 hours)…arrow_forward

- Tat Manufacturing Corporation uses a standard cost system with machine-hours as the activity base for overhead. The following information relates to production for last year. Variable Fixed Total budgeted overhead (at the denominator level of activity) Total applied overhead $ 432,000 $ 684,000 $ 410,400 $ 649,800 $ 456,000 $ 655,500 Total actual overhead The standard machine-hours allowed for the actual output during the year were 7,600. The actual machine-hours incurred were 7,500. 11 What was Taft's variable overhead efficiency variance? A. 2$ 21,600 Favorable B. $ 51,000 Unfavorable 6998 2$ 2$ $ 45,600 Unfavorable С. 5,400 Favorable D. E. None of the above 750 12 Hoover Corporation uses a standard cost system in which it applies manufacturing overhead to units of product on the basis of standard direct labor-hours (DLHS). Hoover's total applied factory overhead was $315,000 last year when the standard DLHS for the actual output were 30,000 hours. The standard variable factory…arrow_forwardBeech Company produced and sold 113,000 units in May. For the level of production in May, budgeted amounts were sales, $1,390,000; variable costs, $841,000; and fixed costs, $250,000. The following actual results are available for May Actual Results Sales (113,000 units) Variable costs Fixed costs $ 1,372,000 811,500 250,000 Prepare a flexible budget performance report for May. Indicate whether each variance is favorable or unfavorable (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) BEECH COMPANY Flexible Budget Performance Report For Month Ended May 31 Favorable/ Unfavorable Flexible Budget Actual Results Variances Contribution marginarrow_forwardAnthon Corporation has provided the following information regarding last month's activities. Units produced (actual) Master production budget Direct materials Direct labor Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead 10,500 $ 237,600 201,600 267,000 $ 3.96 per liter x 5 liters per unit of output $ 33.60 per hour x 0.5 hour per unit $ 28.50 per direct labor-hour $ 207,480 (53,200 liters) 176,472 (5,160 hours) 272,000 (58% is variable) Variable overhead is applied on the basis of direct labor-hours Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variance- Note: Do not round intermediate calculations. Indicate the effect of each veriance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.arrow_forward

- The following data relate to a year's budgeted activity for Coronado Limited, a company that manufactures one product: Beginning inventory Production Available for sale Sales Ending inventory Units 40,480 (a) 141,680 Selling price Variable manufacturing costs Variable selling, general, and administrative expenses Fixed manufacturing costs (based on 100,000 units) Fixed selling, general, and administrative expenses (based on 100,000 units) 182,160 131,560 50,600 Break-even sales Per unit $9.00 units 2.00 3.00 Total fixed costs and expenses remain unchanged within the relevant range of 25,000 units to a total capacity of 160,000 units. 0.50 0.80 Calculate the projected annual break-even sales in units. (Round answer to O decimal places, e.g. 5,275.)arrow_forwardPlease help mearrow_forwardHarlow Parts produces a single product at its Superior Plant. The master budget for July follows: Harlow Parts Superior Plant Master Budget (For July) Quantity Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit The following operating income statement shows the actual results for July: Harlow Parts Superior Plant Operating Results (For July) Quantity (units) Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin 8,800 $ 1,560,000 721,600 97,600 $ 740,800 211, 200 334,000 $ 195,600 Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit 10,200 $ 1,726,800 879,954 110,640 $ 736,206 220,320 344,000 $ 171,886 < Prev 10 of 10 ‒‒‒ Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education