Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

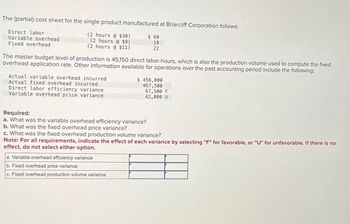

Transcribed Image Text:The (partial) cost sheet for the single product manufactured at Briarcliff Corporation follows:

Direct labor

Variable overhead

Fixed overhead

(2 hours @ $30)

$ 60

(2 hours @ $9)

(2 hours @ $11)

18

22

The master budget level of production is 45,150 direct labor-hours, which is also the production volume used to compute the fixed

overhead application rate. Other information available for operations over the past accounting period include the following:

Actual variable overhead incurred

Actual fixed overhead incurred

Direct labor efficiency variance

Variable overhead price variance

$ 456,000

467,500

67,500 F

42,000 U

Required:

a. What was the variable overhead efficiency variance?

b. What was the fixed overhead price variance?

c. What was the fixed overhead production volume variance?

Note: For all requirements, indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no

effect, do not select either option.

a. Variable overhead efficiency variance

b. Fixed overhead price variance

c. Fixed overhead production volume variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardPlease help mearrow_forwardPlease provide answer this accounting questionarrow_forward

- Webber fabricating estimated the following solve this question ❓arrow_forwardPrimara Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator level of activity) Actual direct labor-hours. Standard direct labor-hours allowed for the actual output $ 481,600 $ 472,000 56,000 57,000 54,000 Required: 1. Compute the fixed portion of the predetermined overhead rate for the year. (Round Fixed portion of the predetermined overhead rate to 2 decimal places.) 2. Compute the fixed overhead budget variance and volume variance. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.). Input all amounts as positive values.)arrow_forwardGadubhaiarrow_forward

- Primara Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator level of activity) Actual direct labor-hours Standard direct labor-hours allowed for the actual output $ 426,4e0 $ 420,400 52,ee0 53,000 50,000 Requlred: 1. Compute the fixed portion of the predetermined overhead rate for the year. (Round Flxed portion of the predetermIned overhead rate to 2 declmal places.) 2 Compute the fixed overhead budget variance and volume variance.. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (1.e., zero varlance.). Input ell amounts as positlve values.) 1. Fixed portion of the predetermined overhead rate per DLH 2. Budget variance Volume…arrow_forwardA Company establishes the following standards for the costs of one unit of its product. The standard production overhead costs per unit are bascd on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty 3.00 kg | Direct Material Direct Labor Variable Overhead Fixed Overhead* |Total *based on practical capacity of 20,000 direct-labor hour per month Std Price/Rate $ 8.25 per kg $ 10.00 per hour $ 10.00 per hour $ 7.50 per hour 24.75 $ 20.00 2.00 hour $ 20.00 2.00 hour 15.00 2.00 hour 79.75 During December 2020, the Company purchased 30,000 kg of direct material at a total cost of $246,000. The total wages for December were $260,000, 75% of which were for direct labor. The Company manufactured 9,500 units of product during December 2020, using 28,400 kg of the direct material purchased in December and 18,900 direct-labor hours. Actual variable and fixed overhead cost were $200,000 and $150,000, respectively. The scheduled production for the month was…arrow_forwardWildhorse Company accumulated the following standard cost data concerning product I-Tal. Direct materials per unit: 2.50 pounds at $4.40 per pound Direct labor per unit: 0.40 hours at $16.00 per hour Manufacturing overhead: Allocated based on direct labor hours at a predetermined rate of $20.00 per direct labor hour Compute the standard cost of one unit of product I-Tal. (Round answer to two decimal places (e.g., 2.75).) Standard cost $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning