Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

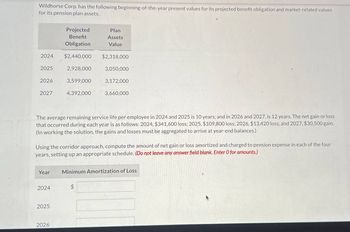

Transcribed Image Text:Wildhorse Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values

for its pension plan assets.

Projected

Benefit

Obligation

Plan

Assets

Value

2024

$2,440,000 $2,318,000

2025

2,928,000

3,050,000

2026

3,599,000

3,172,000

2027

4,392,000

3,660,000

The average remaining service life per employee in 2024 and 2025 is 10 years; and in 2026 and 2027, is 12 years. The net gain or loss

that occurred during each year is as follows: 2024, $341,600 loss; 2025, $109,800 loss; 2026, $13,420 loss; and 2027, $30,500 gain.

(In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)

Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four

years, setting up an appropriate schedule. (Do not leave any answer field blank. Enter O for amounts.)

Year

Minimum Amortization of Loss

2024

$

2025

2026

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Flounder Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. ProjectedBenefitObligation PlanAssetsValue 2019 $2,140,000 $2,033,000 2020 2,568,000 2,675,000 2021 3,156,500 2,782,000 2022 3,852,000 3,210,000 The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows: 2019, $299,600 loss; 2020, $96,300 loss; 2021, $11,770 loss; and 2022, $26,750 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule.arrow_forwardSandhill Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. ProjectedBenefitObligation PlanAssetsValue 2019 $2,420,000 $2,299,000 2020 2,904,000 3,025,000 2021 3,569,500 3,146,000 2022 4,356,000 3,630,000 The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows: 2019, $338,800 loss; 2020, $108,900 loss; 2021, $13,310 loss; and 2022, $30,250 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule. Year Minimum Amortization of Loss 2019 2020 2021 2022arrow_forwardBridgeport Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. ProjectedBenefitObligation PlanAssetsValue 2019 $2,480,000 $2,356,000 2020 2,976,000 3,100,000 2021 3,658,000 3,224,000 2022 4,464,000 3,720,000 The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows: 2019, $347,200 loss; 2020, $111,600 loss; 2021, $13,640 loss; and 2022, $31,000 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule. Year Minimum Amortization of Loss 2019 $enter a dollar amount 2020 $enter a…arrow_forward

- Crane Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. Projected Plan Benefit Assets Obligation Value 2024 $2,040,000 $1,938,000 2025 2,448,000 2,550,000 2026 3,009,000 2,652,000 2027 3,672,000 3,060,000 The average remaining service life per employee in 2024 and 2025 is 10 years; and in 2026 and 2027, is 12 years. The net gain or loss that occurred during each year is as follows: 2024, $285,600 loss; 2025, $91,800 loss; 2026, $11,220 loss; and 2027, $25,500 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.) Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule. (Do not leave any answer field blank. Enter O for amounts.)arrow_forwardhdk.6arrow_forwardKenseth Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. ProjectedBenefitObligation PlanAssetsValue 2019 $2,000,000 $1,900,000 2020 2,400,000 2,500,000 2021 2,950,000 2,600,000 2022 3,600,000 3,000,000 The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows: 2019, $280,000 loss; 2020, $90,000 loss; 2021, $11,000 loss; and 2022, $25,000 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.) Instructions Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule.arrow_forward

- 11. Cullumber Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. ProjectedBenefitObligation PlanAssetsValue 2019 $2,040,000 $1,938,000 2020 2,448,000 2,550,000 2021 3,009,000 2,652,000 2022 3,672,000 3,060,000 The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows: 2019, $285,600 loss; 2020, $91,800 loss; 2021, $11,220 loss; and 2022, $25,500 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule. Year Minimum Amortization of Loss 2019 $enter a dollar amount 2020 $enter a…arrow_forwardThe following information relates to the pension plan for the employees of Cullumber Company: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) The corridor for 2026 is 1/1/25 $1102000. $1073600. $1410700. $1212200. $9340000 9865000 9025000 0 12/31/25 $9760000 10558000 11020000 (1522000) 11% 8% 12/31/26 $12700000 14107000 12154000 (1690000) 11% Cullumber estimates that the average remaining service life is 16 years. Cullumber's contribution was $1323000 in 2026 and benefits paid were $987000. 7%arrow_forwardThe following information relates to the defined benefit pension plan of Nelson, Inc. Projected benefit obligation Fair value of plan assets Accumulated OCI-net actuarial gain Settlement rate (for year) Expected rate of return (for year) The interest cost for 2020 is $158,640 $211,520 12/31/19 2,644,000 3,118,000 432,000 O $240,120 O $280,140 O None of the above 6% 8% 12/31/20 4,002,000 3,328,000 480,000 For 2020, Nelson estimates that the average remaining service life of its current employees is 8 years. Nelson's contribution to the plan was $364,000 in 2020 and benefits paid to retirees were $276,000, 6% 7%arrow_forward

- On January 1, 2026, Pharoah Co. has the following balances: Projected benefit obligation Fair value of plan assets Service cost The settlement rate is 11%. Other data related to the pension plan for 2026 are: $3650000 Amortization of prior service costs Contributions Benefits paid Actual return on plan assets Amortization of net gain 2350000 $3173000. $988000. O $1650000. O $3010000. $ 340000 90000 465000 190000 385000 18000 The fair value of plan assets disclosed in the notes at December 31, 2026 isarrow_forwardVaughn Enterprises provides the following information relative to its defined benefit pension plan. Balances or Values at December 31, 2020Projected benefit obligation $2,726,600Accumulated benefit obligation 1,982,100Fair value of plan assets 2,293,300Accumulated OCI (PSC) 208,700Accumulated OCI—Net loss (1/1/20 balance, 0) 45,700Pension liability 433,300Other pension plan data for 2020: Service cost $94,700Prior service cost amortization 42,100Actual return on plan assets 129,100Expected return on plan assets 174,800Interest on January 1, 2020, projected benefit obligation 252,800Contributions to plan 93,100Benefits paid 138,800 Collapse question part(a)Prepare the note disclosing the components of pension expense for the year 2020. (Enter amounts that reduce pension expense with either a negative sign preceding the number e.g. -45 or parenthesis e.g. (45).) Components of Pension ExpenseService Cost$94700Interest Cost252800Expected Return on Plan Assets(174800)Prior Service Cost…arrow_forwardVaughn Enterprises provides the following information relative to its defined benefit pension plan. Balances or Values at December 31, 2020Projected benefit obligation $2,726,600Accumulated benefit obligation 1,982,100Fair value of plan assets 2,293,300Accumulated OCI (PSC) 208,700Accumulated OCI—Net loss (1/1/20 balance, 0) 45,700Pension liability 433,300Other pension plan data for 2020: Service cost $94,700Prior service cost amortization 42,100Actual return on plan assets 129,100Expected return on plan assets 174,800Interest on January 1, 2020, projected benefit obligation 252,800Contributions to plan 93,100Benefits paid 138,800 Collapse question part(a) Prepare the note disclosing the components of pension expense for the year 2020. (Enter amounts that reduce pension expense with either a negative sign preceding the number e.g. -45 or parenthesis e.g. (45).) Components of Pension ExpenseService Cost$94700Interest Cost252800Expected Return on Plan Assets(174800)Prior Service Cost…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning